Hey, MFG!

Tonight, I’m excited to bring you 10 exclusive Trade of the Week updates—a special breakdown of each trade we’ve covered, complete with fresh insights and actionable strategies. These updates are crafted to give you the edge you need in today’s market.

For those on the free subscription, now is the perfect time to upgrade and gain full access to these premium insights. Don’t miss out on the details that could be game-changers for your trades.

Let’s dive in and make this week one to remember!! LFG!!

-GP a.k.a Fullauto11 🧙🐼

The Peters Report - Stock & Crypto Trader’s Resource

Always remain bullish and follow The Money Flow.

10 Exclusive Trade of The Week Updates!!

1. 2X Leveraged Trade on AMD (AMDL)

AMDL AMDL 0.00%↑ is a 2X leveraged Advanced Micro Devices, Inc. AMD ETF. AMD AMD 0.00%↑ dropped 10% due to investor’s disappointment with its earnings report. I have a “3-day rule” when a stock drops more than 10% in one day, I don’t touch it. I give it three days before I do anything.

AMD is a leading player in the semiconductor and AI space. There’s nothing wrong with the company— just an overreaction to earnings. Let’s see if price comes back into the box. I’m still in the trade here and will be looking to add more shares once it sets up again. If I was trading AMDL on margin, I might exit the trade and reenter once its time.

2. Adobe Systems, Inc (ADBE)

Adobe Systems, Inc. ADBE 0.00%↑ is back in a stage one buy zone! You got your stage one trigger move— price getting above the 5-day EMA! I added shares here. This is a beautiful opportunity. According to analyst Dan from Morningstar, ADBE has a fair value of $635 and is currently trading undervalued.

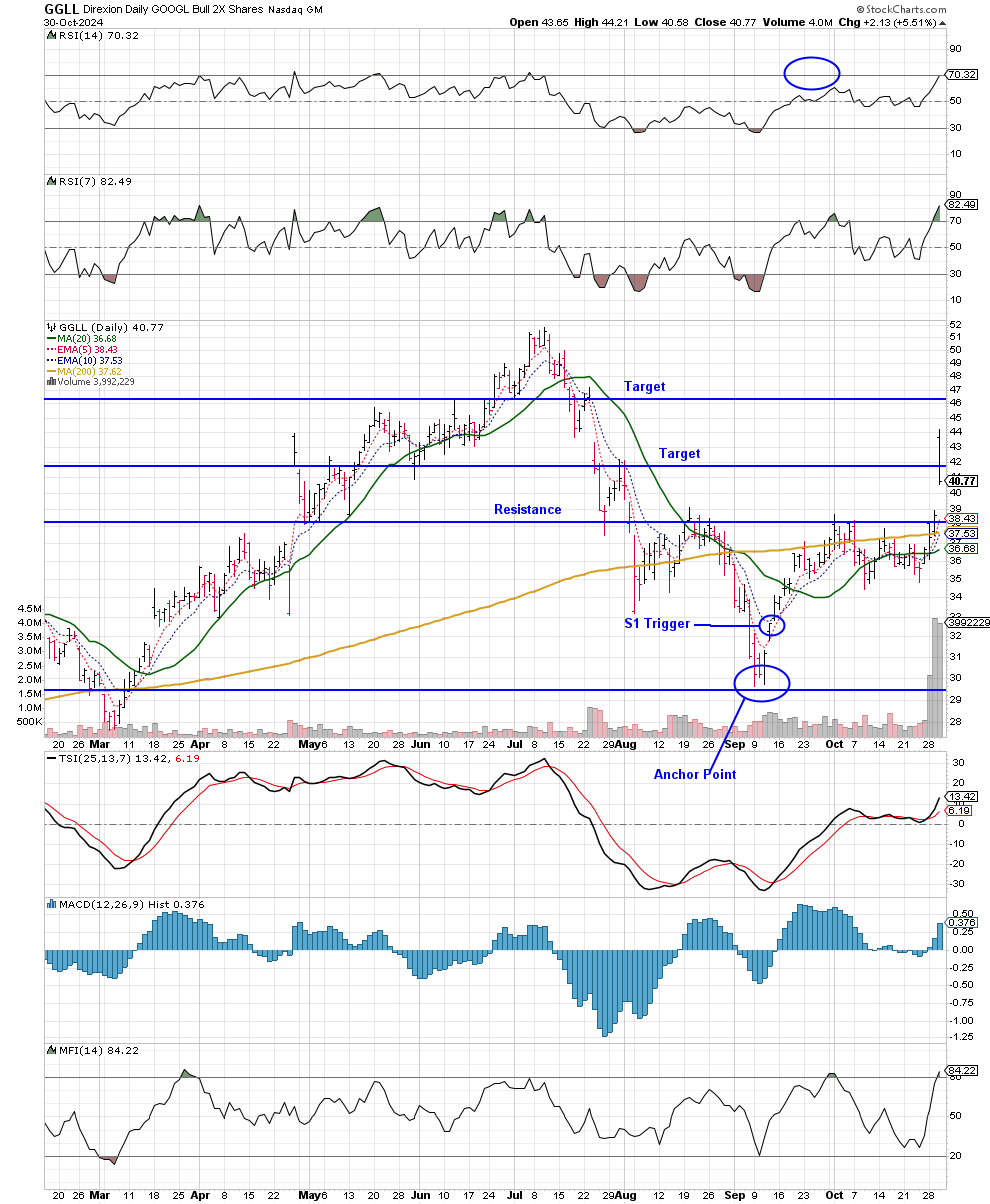

3. 2X Leveraged Trade on Google (GGLL)

GGLL GGLL 0.00%↑ is a 2X leveraged GOOGL ETF. Alphabet, Inc, a.k.a. Google GOOGL 0.00%↑ crushed earnings and the stock popped, blew through its first target and banged an extreme-high RSI reading! I trimmed some shares of GGLL today for a nice gain and I’m letting the rest of my position run.

4. 2X Leveraged Trade on Super Micro Computer, Inc (SMCX)

SMCX SMCX 0.00%↑ is a 2X leveraged Super Micro Computer, Inc. SMCI ETF. SMCI SMCI 0.00%↑ is another top player in the AI space. Shares dropped 32% after the company’s accounting firm Ernst and Young quit due to no longer wanting to be associated with SMCI’s financial statements.

SMCX was down 65% due to the leverage. If this trade is on margin, I would get out. I stayed in here. Like I mentioned before, I give stocks that fall more than 10% three days before I make a move. That gives me ample time to dig into more research regarding what happened.