10 Premium Trade of The Week Updates

GP’s latest exclusive moves with chart annotations and technical analyses.🐼

Hey, MFG!🤘

YES! YES! YES! 👏👏👏

I hope you and your family are doing well and consistently working on your financial wealth.

Come Friday, you should have more shares than you did on Monday and your dividend income should have increased.

I can’t stress enough the importance of consistency in your pursuit of building wealth and achieving financial freedom.

Let’s dig into these premium trade updates.🤘

Let me know in the comments if you like these updates. I appreciate you.🙌

Always remember, whatever you think about comes about, whatever you focus on grows. - G 🐼

10 Premium Trade of The Week Updates

1. Occidental Petroleum Corp. (OXY)

Occidental Petroleum Corp. OXY 0.00%↑ has entered a confirmed stage 1 accumulation zone below its 200-day SMA.

Price tagged an extreme-low RSI reading and dropped an anchor point. The TSI has curled and the MACD histogram has been ticking upwards indicating momentum is to the upside.

Price has now gotten above its 5-day EMA giving me my trigger to enter the trade. There’s confluence of the Money Flow indicators here.

OXY is a leading American energy company engaged in the exploration and production of oil and natural gas. Founded in 1920 and headquartered in Houston, Texas, OXY operates primarily in the United States, the Middle East, and North Africa.

OXY is not just an oil and gas company; it's also a leader in carbon management. Through its subsidiary, 1PointFive, OXY is constructing Stratos, the world's largest Direct Air Capture (DAC) facility in Texas, aiming to remove up to 500,000 metric tons of CO₂ annually.

In a notable collaboration, Microsoft MSFT 0.00%↑ signed a deal with OXY to purchase 500,000 carbon credits over six years, helping offset the tech giant's emissions amid its AI expansion.

This partnership underscores OXY’s role in providing climate solutions to major corporations

According to analyst Joshua from Morningstar, OXY has a fair value of $59 and is currently trading undervalued.

OXY is part of the Energy sector XLE 0.00%↑ and the Exploration & Production sub-sector.

I like OXY here for a swing trade and a buy & hold position.

2. Ferrari NV (RACE)

Ferrari NV RACE 1.30%↑ is in a stage 2 buy zone below its 200-day SMA.

The MACD histogram is ticking upwards on the bullish side, the TSI has crossed, and price broke above its 20-day SMA, signaling a stage 2 breakout.

The RSI is 48, so there’s still time to add shares or enter the trade.

Ferrari’s ticker, RACE, isn’t just functional- it’s a branding masterpiece. It reflects the company's core identity: speed, performance, and competition.

The company intentionally limits the number of cars it produces each year to preserve exclusivity and high demand. Even wealthy buyers may have to wait months, or even years, for certain models.

When RACE went public in 2015, the IPO was so hot it was oversubscribed several times over, highlighting how powerful the brand is even in equity markets.

RACE is part of the Consumer Discretionary sector XLY 0.00%↑ and the Automobiles sub-sector.

According to analyst Rella from Morningstar, RACE has a fair value of $433 and is currently trading fairly valued.

I added to my RACE trade on the breakout.

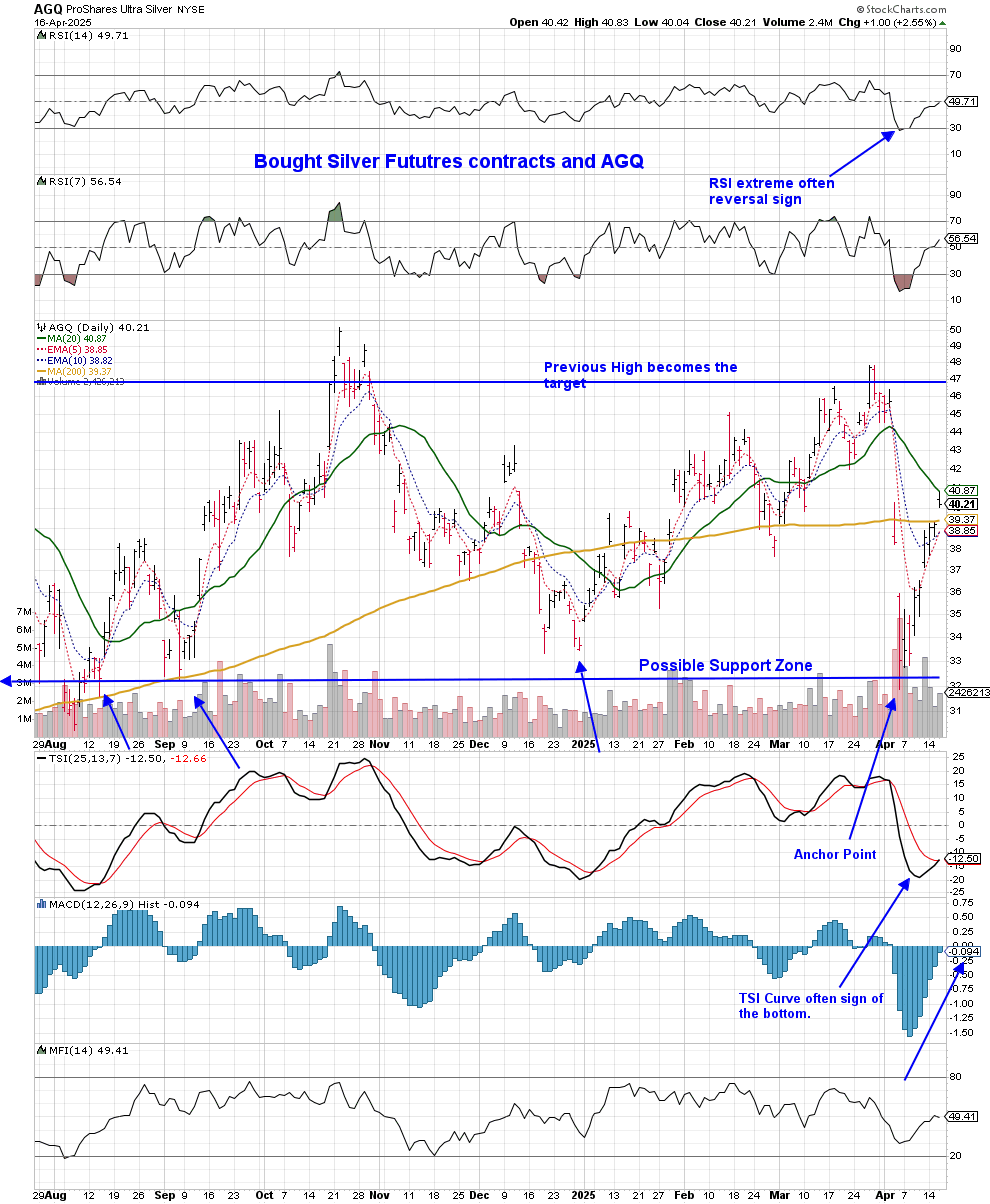

3. ProShares Ultra Silver (AGQ)

iShares Silver Trust SLV 0.00%↑ has entered a stage 2 breakout above its 200-day SMA along with the continuous daily contract $silver.

I’m adding to last week’s Trade of The Week in ProShares Ultra Silver AGQ 0.00%↑ here.

The breakout is usually the last chance to add. Once the RSI gets above 50, the trade is past a buy point.

Targets are an extreme-high RSI reading and previous high around $47.

AGQ is a double leveraged play on SLV.

Remember, while trading leveraged funds, make sure to use the un-leveraged chart for your trade analysis and plan. In this case, $silver and SLV 0.00%↑ .