11 Swing Trades I Took Profits In!!

See how I applied the Money Flow Trading System to secure profits on these 11 trades.

Hey, MFG!

Successful trading isn’t just about catching market highs—it’s about having the discipline to stick to your strategy, day in and day out.

The key pillars of profitable trading lie in stock selection, proper position sizing, and tracking your trades consistently.

By making sure you choose the right stocks, deploy your cash wisely, manage risk, and track your positions every day, you set yourself up for success.

In this article, I’m breaking down 11 swing trades where I took profits by following the Money Flow Trading System—a strategy that emphasizes well-timed entries and exits based on price movements and technical indicators like the RSI.

If you stay disciplined and commit to these principles, you can achieve your goals and become a profitable trader.

Remember, successful trading is a journey. The more you learn, track, and refine your process, the closer you’ll get to consistently achieving gains. Stay committed, and the results will follow.

Congratulations to those of you who are in these winning trades with me!!

-GP a.k.a Fullauto11 🧙🐼

The Peters Report - Stock & Crypto Trader’s Resource

Always remain bullish and follow The Money Flow.

👉JOIN THE MFG DISCORD!!

Looking for a group of likeminded people to trade with? Text alerts and the MFGDiscord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

11 Swing Trades I Took Profits In!!

Here’s a quick video of GP breaking down the trades.

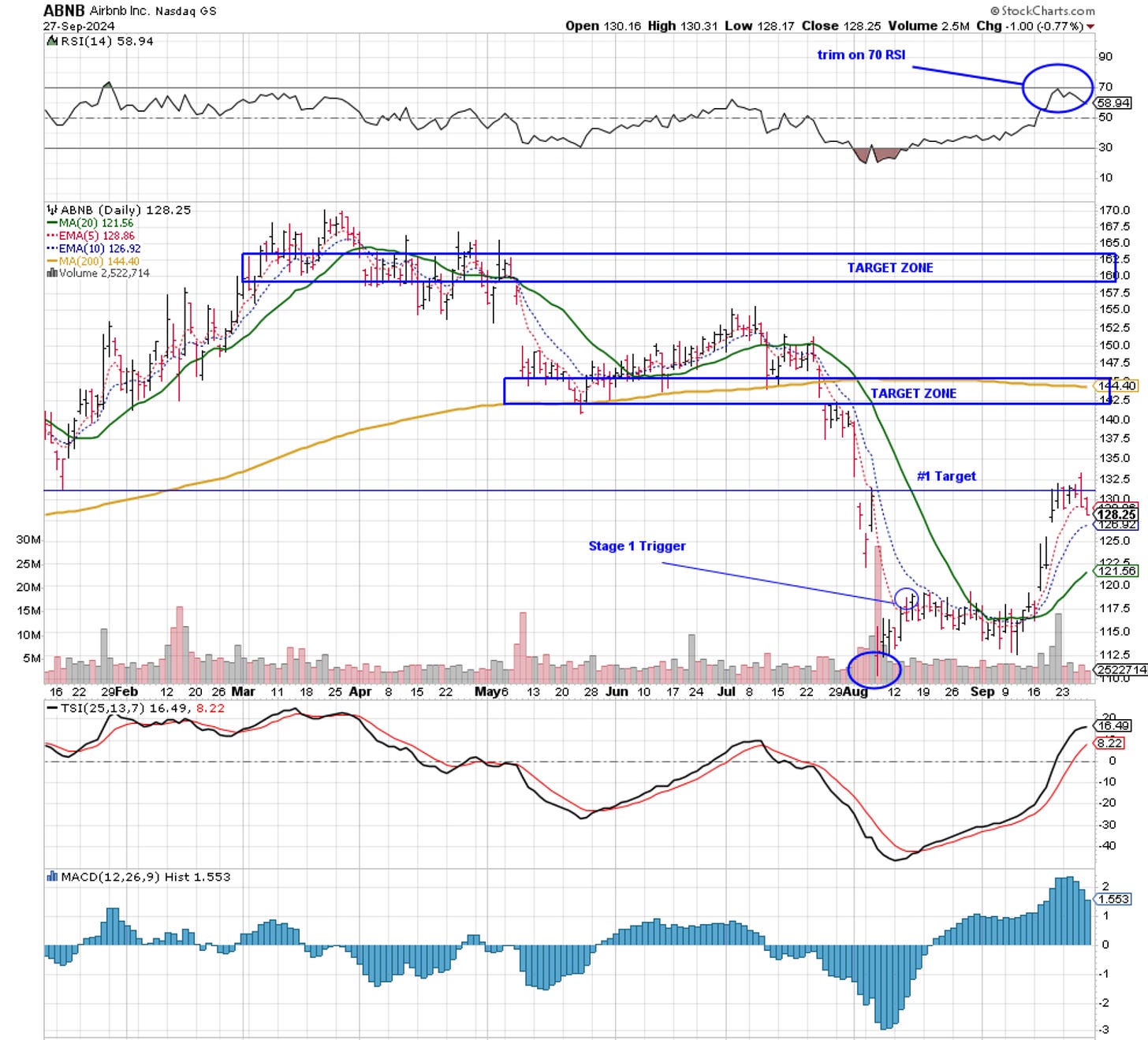

1. Airbnb Inc. (ABNB)

ABNB 0.00%↑hit its first target and true value of $130. The RSI just tagged 70. I trimmed down some shares here and I’m looking for price to hit its second target $144. If this stage 3 rolls over, you’ll have to decide how far you’re willing to ride it down.

2. Freeport-McMoRan (FCX)

FCX 0.00%↑exploded and blew through its first target. It was the best performing stock of the S&P 500 SPY 0.00%↑on Tuesday thanks to China’s massive stimulus package. Copper CPER 0.00%↑ jumped over 8%. Copper is classified as an industrial metal. These metals are used primarily for manufacturing and construction purposes due to their physical properties like strength, ductility, and conductivity. I only trimmed odd lot shares here. FCX is one of my favorite stocks and I believe price can go much higher.

3. 2X Leveraged Trade on AMD (AMDL)

AMDL 0.00%↑ is how I’m playing the leveraged semiconductor trade. I took profits here again in AMDL. AMD 0.00%↑blew through its 200-day SMA and hit its first target zone. Price also banged an extreme-high RSI reading on the 7-day RSI and almost hit it on the 14-day. Remember, to use the un-leveraged chart for your trade analysis and plan while trading leveraged funds.

4. Starbucks Corp. (SBUX)

SBUX 0.00%↑blew through its 200-day SMA and hit true value. SBUX has a fair value of $95 and is currently trading fairly valued according to Morningstar. Some analysts, mentioned a price upgrade, but nothing definite yet. I trimmed down to a core position.

5. US Steel Group, Inc (X)

X 0.00%↑is a social sentiment trade. On September 5th, the President said— he wasn’t going to let a merger deal go through with a Japanese steel company. I immediately opened a trade with a target of right back to where it was before the big drop. These type of deals with the government take time and the stock dropping was a result of the initial shock of the news. Price hit its target and tagged an extreme-high RSI on the 7-day. This week, I took gains on half of my position and I’m letting the rest run. If price comes back down, I’ll look to add back onto the trade.

6. Delta Air Lines Inc. (DAL)

This is a classic, perfect Money Flow swing trade— price goes from one extreme RSI to another in DAL 0.00%↑. Price tagged an extreme-low RSI, put in a doji reversal bar, went sideways 3 days, and jumped above the 5-day EMA to build a stage 1 buy zone. This is called confluence of the Money Flow indicators. After price broke out, it blew through its 200-day SMA and has been on a run since. DAL is currently banging an extreme-high RSI and trading overvalued. It’s time to lock in profits. According to analyst Nicolas from Moringstar, DAL has a fair value of $40.

7. 2X Leveraged Trade on Bitcoin (BITX)

BITX 0.00%↑is a 2X leveraged play on Bitcoin in the stock market. Price dropped an anchor point and jumped above the 5-day EMA to give us the stage 1 trigger buy along with a stage 2 breakout. Price ran up to its 200-day SMA, went sideways, and tagged an extreme-high RSI reading on the 7-day. I took profits in BITX and closed my futures contracts on Coinbase for a gain. Price recently broke through resistance, so I picked up 5 Bitcoin futures contracts for 10/25/24.

8. 2X Leveraged Trade on Silver (AGQ)

AGQ 0.00%↑is a 2X leveraged play on silver. Price hit its previous high target zone. I trimmed some shares and I’m letting the rest run. I use the silver SLV 0.00%↑chart for my trade analysis and plan.

9. 3X Leveraged Trade of The XLU (UTSL)

UTSL 0.00%↑ is a 3X leveraged utilities trade. Utilities have performed so well this year and have been running hot on an extreme-high RSI. Price is on the bullish side of the 5-day EMA and the moving averages are in numerical alignment. I’ve taken profits three times already. I’m letting the rest ride. This has been an amazing trade.

10. 2X Leveraged Trade on TSLA (TSLL)

TSLL 0.00%↑is a 2X leveraged play on TSLA part of the EV trade. I took some profits here to lock in gains and I’m letting the rest of the position run. Notice the 7-day RSI went extreme, but the 14-day did not. This signals to us that price still has room to climb higher.

11. Lyft Inc. (LYFT)

LYFT 0.00%↑hit its first target and an extreme-high RSI reading on the 7-day RSI. I locked in some gains. I also hold LYFT in my buy and hold account for a potential buy out target. According to analyst Malik from Morningstar, LYFT has a fair value of $15 and is currently trading fairly valued.

GP’s Wrap-Up

These 11 swing trades are a testament to the power of strategic stock selection and well-timed entries and exits.

By sticking to core principles like position sizing, monitoring trades daily, and utilizing the Money Flow Trading System, profitable outcomes become achievable.

As you refine your trading approach, remember that consistency is key.

Success in trading isn’t just about making the right moves—it's about staying committed to your strategy, learning from each trade, and continuously improving.

Always remember, whatever you think about comes about, whatever you focus on grows. - GP 🐼

Unlock Even More Value!👇👇

Upgrade to a paid membership today and gain access to our exclusive dividend list—carefully curated to help you generate steady, long-term returns. Don’t miss out on these premium insights designed to enhance your portfolio and maximize your income potential.

Get access to my “MFG Trade Ideas of The Week” chart pack CLICK HERE!!

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

Purchase GP’s Trading Book The Money Flow Trading System CLICK HERE!

Grab a free copy of Gerald’s life-changing ebook “You Don’t Have To Die Broke!” CLICK HERE!

FINANCIAL DISCLAIMER

This is not financial advice, but education to increase awareness. Before making investment decisions, always do thorough research and possibly consult with a financial advisor. The above descriptions are a broad overview and may not capture all nuances associated with each asset.

💎

GP the GOAT!! X was probably the simplest swing trade. Easy money. 🤑🤑🤑