Hey, MFG!

YES! YES! YES!

Merry Christmas and Happy Holidays, MFG!!

I hope you had an amazing time with your family. I’m going to be honest, I can’t wait for the stock market to open tomorrow. I’m excited to trade!

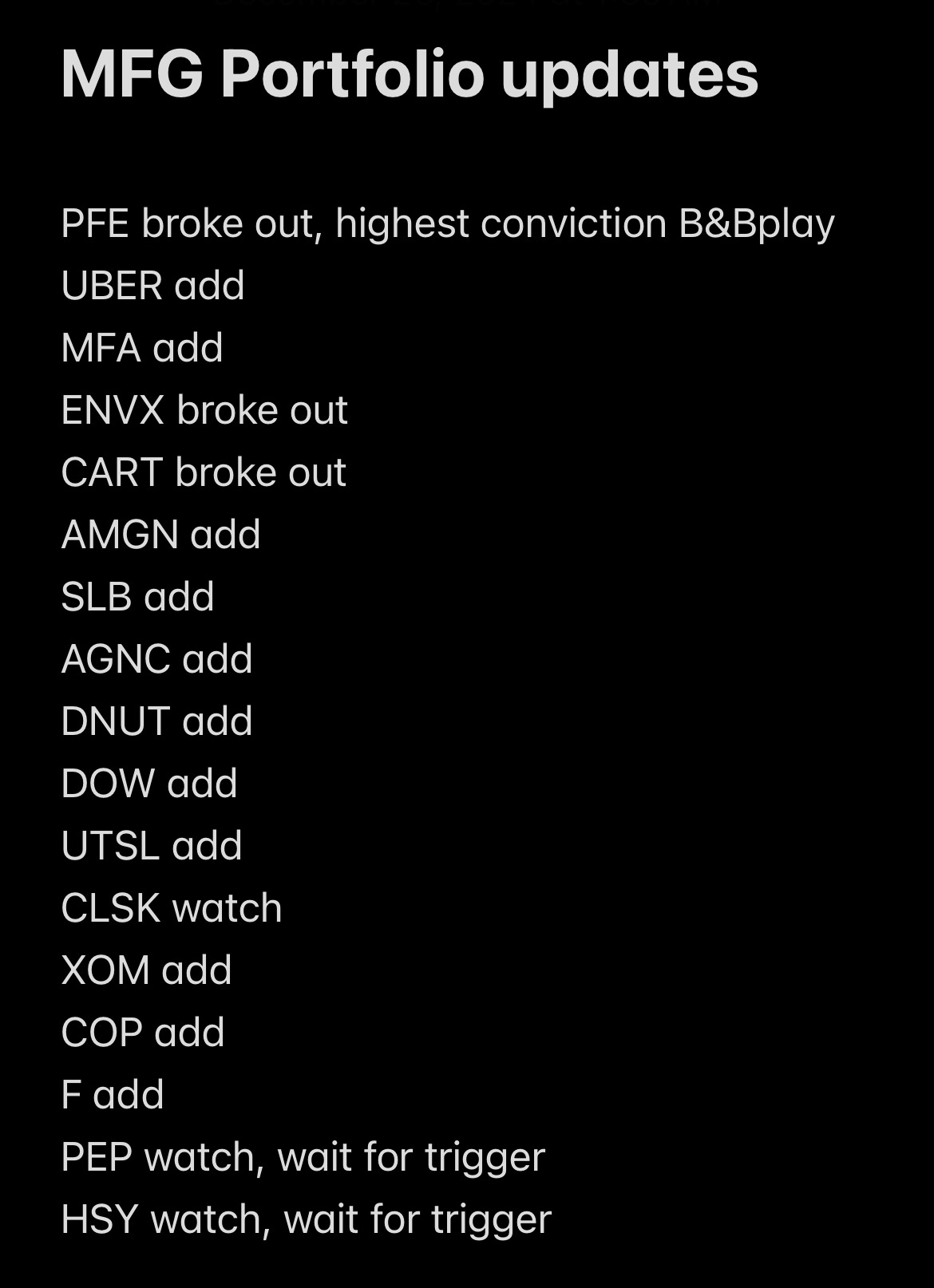

I truly appreciate you trading with me. You’re awesome so before the market opened tomorrow I wanted to give you not 10, but 12 high-quality MFG portfolio updates! The purpose of these is to help you stay one step ahead and achieve success in the markets.

Whether you’re tracking past trades or eyeing new ones, this is your chance to refine your strategy, learn from real-world scenarios, and build the wealth you and your family deserve.

👉👉The market doesn’t sleep, and neither should your ambition. 👈👈

👉👉Dive in, stay focused, and let’s make the rest of this week prosperous!!🏄♀️🏄

Let me know in the comments if you like these trade updates. I appreciate you. 👈👈

12 Trade Updates Inside the MFG Portfolio!!🐼

1. Pfizer, Inc. (PFE)

Pfizer, Inc. PFE 0.00%↑ is my highest conviction Bread & Butter (B&B) play right now. Price is currently in a stage 2 uptrend. The first target is the 200-day SMA. The second target is around $29.75. According to analyst Karen from Morningstar, PFE has a fair value of $42 and is currently trading undervalued.

2. Hershey Foods Corp. (HSY)

Hershey Foods Corp. HSY 0.00%↑ is a B&B swing trade for me. HSY shares popped over 12% on December 9th due to a takeover deal with Mondelez International MDLZ 0.00%↑ ; however, two days later the main owner of HSY rejected the preliminary takeover offer. Shares fell and price came back down below its 200-day SMA. I still have half of my position on and I’m looking to add shares once price gets back above the 5-day EMA. First target will be the 200-day SMA. According to analyst Erin from Morningstar, HSY has a fair value of $210 and is currently trading undervalued.

3. ZIM Integrated Shipping Services Ltd. (ZIM)

ZIM Integrated Shipping Services Ltd. ZIM 0.00%↑ is in a stage 2 breakout. This is picture-perfect. Price put in a doji anchor point and got above the 5-day EMA giving me the trigger to add shares. The MACD histogram flipped over to the bullish side, the TSI crossed, and price broke out above the 20-day SMA. ZIM is a long-term buy and hold for me and a swing trade. First target is $25. Other targets are previous high or an extreme-high RSI.

4. Krispy Kreme Inc. (DNUT)

Kristy Kreme, Inc. DNUT 0.00%↑ is in a nice stage 1 accumulation zone. DNUT is a buy here. The RSI hit an extreme-low, price dropped an anchor point and jumped above the 5-day EMA, while the TSI curled and the MACD histogram has been ticking upwards. There’s confluence of the Money Flow indicators here signaling a possible bottom. DNUT is has a fair value of $15.

5. Dow Holdings Inc. (DOW)

Dow Holdings Inc. DOW 0.00%↑ has gotten smashed recently after it was removed from the Dow 30 DIA 0.00%↑ . Historically, stocks perform well or even double after being removed from an index. I really like DOW here and believe it’s a great opportunity. I can’t believe the stock is this low. There’s confluence of the Money Flow indicators. The MACD histogram has rolled over to the bullish side, the TSI is about to cross, the RSI went extreme, and price is above the 5-day EMA. DOW is a long-term buy and hold position for me and I also have an open B&B trade. I’ve been dripping adding shares for the last few weeks. According to analyst Seth from Morningstar, DOW has a fair value of $70 and is currently trading undervalued.

6. Enovix Corporation (ENVX)

Enovix Corporation ENVX 0.00%↑ is in stage 2 breakout. On December 16, 2024, ENVX issued a press release announcing their CFO Farhan Ahmad has left the company and that it is searching for a new CFO. Shares fell over 17% and recovered the same day. ENVX broke out last Friday. This stock is still a hold here. This is awful news to hear about the CFO leaving. It’s not a good sign at all. This is another speculation play. I believe the stock is going much higher to around $30. I think it’s a matter of time before Samsung or Apple decides to use ENVX’s batteries.

7. Lockheed Martin Corp. (LMT)

Lockheed Martin Corp. LMT 0.00%↑ is in a stage 1 buy zone. Price falling below its 200-day SMA and the extreme-low RSI reading have my attention. This signals a potential bottom could be in. I’m looking to add shares here. According to analyst Nicolas from Morningstar, LMT has a fair value of $510 and is currently trading fairly valued.

8. Uber Technologies, Inc. (UBER)

Uber Technologies, Inc. UBER 0.00%↑ is in a stage one accumulation zone and trading undervalued. UBER has my attention here. I’m looking to add shares to my position trade in UBER and start a swing trade in UBRL. This is a nice opportunity here. According to analyst Malik from Morningstar, UBER has a fair value of $80 and is currently trading undervalued. Goldman Sachs has UBER listed as one of their top stocks for 2025 with a $96 fair value.

9. 3X Leveraged Utilities Trade (UTSL)

UTSL 0.00%↑ is a 3X leveraged play on utilities XLU 0.00%↑ and is one of the MFG’s favorite leveraged funds to trade. Utilities is one of the simplest swing trades. I’m looking to open a swing trade in UTSL here. This is a classic, textbook Money Flow stage 1 accumulation zone. The RSI went extreme, price dropped an anchor point, went sideways, and got above the 5-day EMA. This is the trigger to enter the trade. First target is previous high or an extreme-high RSI.👈

10. Ford Motor Co. (F)

Ford Motor Co. F 0.00%↑ is back on my buy list. A lot of the car companies had gotten hit. Price has been trading in a channel below the 200-day SMA. Price has gotten above the 5-day EMA. I have my trigger. I’m adding shares here. First target is the 200-day SMA. According to analyst David from Morningstar, F has a fair value of $19 and it’s currently trading undervalued.

11. AGNC Investment Corp. (AGNC)

AGNC Investment Corp. AGNC 0.00%↑ is in a stage 1 buy zone. This is a long-term hold of mine that pays a monthly dividend. I’m picking up shares of AGNC here.

12. Maplebear Inc (CART)

Instacart CART 0.00%↑ broke out this week! I had been waiting for price to get above the 5-day EMA, which it did last week giving us ample time to add to the trade before it broke out. CART is past a buy point. You could look to add on any weakness or price pullback to the 20-day SMA. First target is $48. According to analyst Noah from Morningstar, CART has a fair value of $39 and it’s currently trading fairly valued.

Get access to my “MFG Trade Ideas of The Week” chart pack CLICK HERE!!

Quick Notes✍️🏄

GP’s Wrap-Up

As we wrap up these swing trade updates, it's important to remember that each of these trades is rooted in disciplined analysis and timing. 👈👈

Whether you're already positioned in these trades or watching for new opportunities, staying informed and patient is key. 👈👈

Continue following along as we navigate waves of the markets together, keeping our focus sharp and ready for the next move. Stay in flow!! 👈🌊

Thank you, MFG!!

👉Let me know in the comments if you like these MFG portfolio trade updates. 👇

I appreciate you. 👈🙏🖤

Always remember, whatever you think about comes about, whatever you focus on grows. - GP 🐼

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

Get access to my “MFG Trade Ideas of The Week” chart pack CLICK HERE!!

Thank you so much, GP. 🙌🏼 love these trade updates 🏄♀️

🐼🐼🐼🐼💰💰💰