6 Healthcare Stocks on My Watchlist in 2025

Plus 1 Gene-Editing Bonus Stock for Premium Subscribers

Hey, MFG!🤘

YES! YES! YES! 👏👏👏

As always, I’m on the hunt for fresh setups in the market—stocks that are showing signs of a breakout, building strong accumulation zones, or gaining momentum within their sector.

In this exclusive breakdown, I’m highlighting six healthcare stocks that have earned a spot on my radar. I’ll walk you through why I’m watching each one and how they may fit into The Money Flow Trading System.

These aren’t random tickers—each stock has a reason. Whether it’s a high-yield pharma name trading at a discount or a biotech with explosive upside potential, there’s a specific story, setup, or catalyst behind every pick on this list.

Always remember, whatever you think about comes about, whatever you focus on grows. - G 🐼

6 Healthcare Stocks on My Watchlist in 2025

Healthcare never goes out of style—especially for traders and investors who value stability, innovation, and long-term upside.

In a world of fast-moving tech stocks and speculative hype, healthcare offers something different: resilience.

Whether it’s steady dividend payers, breakthrough biotech firms, or pharmaceutical giants leading the charge in chronic disease treatment, healthcare stocks remain a cornerstone of any balanced watchlist.

Right now, I’m watching six healthcare names closely.

Some are undervalued giants with strong pipelines and cash flow. Others are high-growth biotech names riding clinical momentum or shifting medical trends.

Here’s a quick breakdown of the six healthcare stocks on my radar—and why you might want to watch them too.

1. Bristol Myers Squibb Co. (BMY)

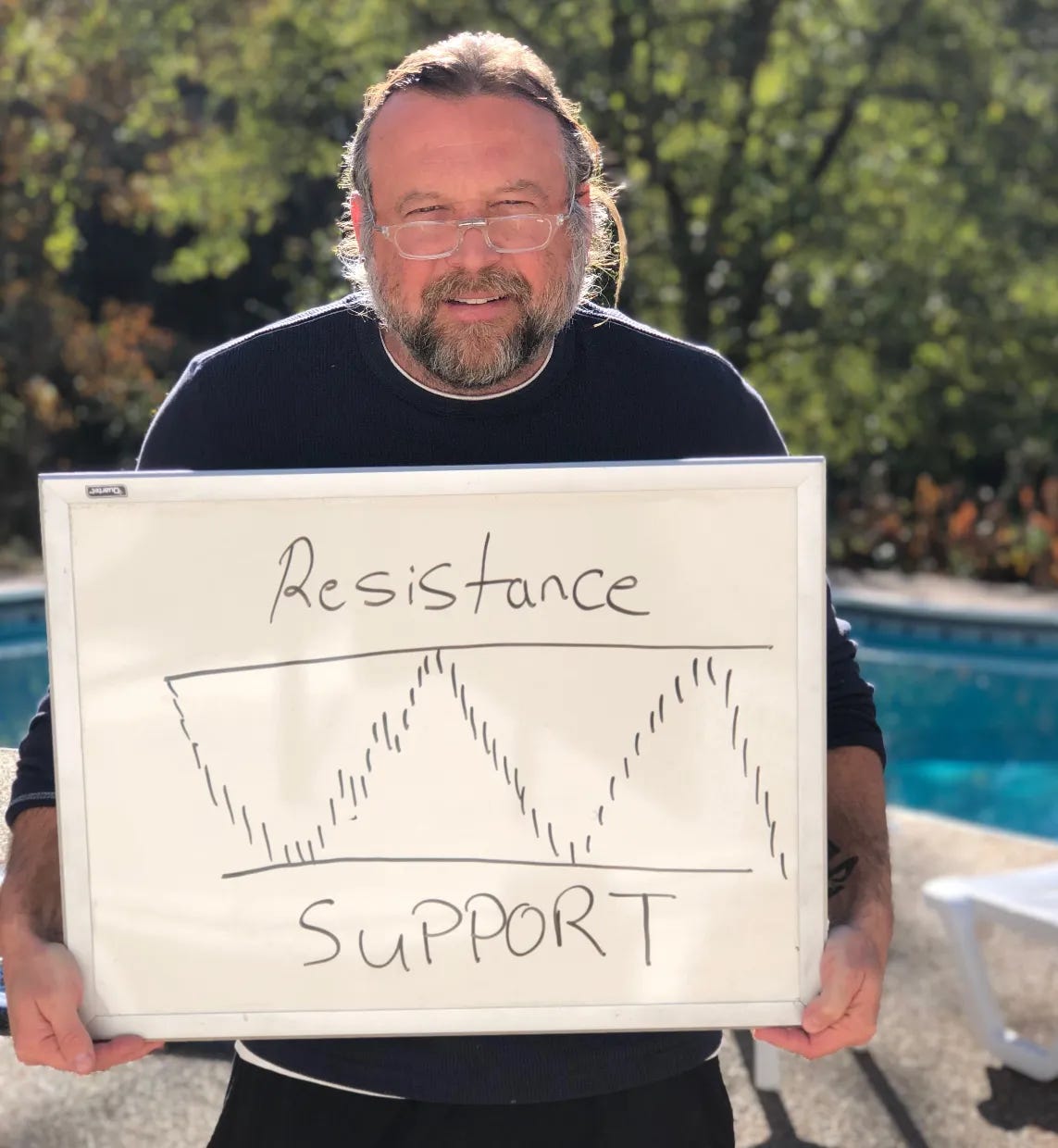

Bristol Myers Squibb Co. BMY 0.00%↑ is trading in a stage 3 zone above its 200-day SMA.

This stage 3 looks like it could be turning into a stage 1 and poised for a possible breakout.

BMY is one of the oldest and most respected pharmaceutical companies in the world, with a legacy that dates back to 1887.

It was one of the original developers of penicillin during World War II and played a major role in helping mass-produce the life-saving antibiotic.

Known for blockbuster drugs like Revlimid (cancer), Eliquis (blood thinners), and Opdivo (immunotherapy), BMY remains a cash-generating machine.

Despite its strong product lineup, the stock has been beaten down lately—making it a value opportunity in my eyes. The company sports a strong dividend yield above 4%, making it appealing to income-focused investors as well.

According to analyst Karen from Morningstar, BMY has a fair value of $66 and currently trading fairly valued.

2. Gilead Sciences, Inc. (GILD)

Gilead Sciences, Inc. GILD 0.00%↑ is in a stage 4 decline above its 200-day SMA.

The company made its name as a global leader in antiviral treatments, especially with its game-changing therapies for HIV and Hepatitis C.

GILD’s Hepatitis C cure, Sovaldi, was the first drug in history to surpass $10 billion in sales in its first full year on the market—earning it the nickname “the $1,000 pill.”

The company’s HIV portfolio remains one of the strongest in the industry, and its COVID-era antiviral, remdesivir (Veklury), brought it back into the spotlight during the pandemic.

GILD has been quietly expanding its oncology pipeline, making strategic acquisitions like Immunomedics to diversify its drug portfolio.

According to analyst David from Morningstar, GILD has a fair value of $108 and currently trading fairly valued.

3. Amgen, Inc. (AMGN)

Amgen, Inc. AMGN 0.00%↑ is trading in a stage 3 distribution zone above its 200-day SMA.

The company is a biotechnology powerhouse with a deep portfolio of treatments consisting of oncology, inflammation, cardiovascular disease, and nephrology.

Known for legacy drugs like Enbrel and Neulasta, AMGN has successfully transitioned into newer therapies like Repatha (cholesterol-lowering) and Tezspire (severe asthma).

The company also recently acquired Horizon Therapeutics, a move that significantly boosts its rare disease pipeline.

AMGN’s financials are rock solid—strong cash flow, consistent earnings, and a dividend yield near 3%—making it a blue-chip biotech with defensive qualities.

AMGN is short for Applied Molecular Genetics. It was one of the very first biotech firms to commercialize genetically engineered human proteins, helping launch the biotech era in the 1980s.

According to analyst Karen from Morningstar, AMGN has a fair value of $333 and currently trading fairly valued.

4. Eli Lilly & Co. (LLY)

Eli Lilly & Co. LLY 0.00%↑ is in a stage 1 accumulation zone right below its 200-day SMA.

It was the first company to mass-produce insulin in the 1920s—an innovation that changed the lives of millions living with diabetes. The company’s headquarters are still in Indianapolis, where it was founded in 1876.

LLY is one of the hottest names in the market right now—and for good reason. Its weight-loss drug Zepbound (tirzepatide) and diabetes blockbuster Mounjaro are transforming the company’s growth trajectory.

With obesity and metabolic disorders at the center of global health challenges, LLY has positioned itself as a leader in a multi-billion-dollar market.

The stock has seen a massive run-up, but its pipeline strength, innovative focus, and brand power continue to justify investor interest. It’s also one of the few Big Pharma companies experiencing rapid revenue acceleration.

According to analyst Karen from Morningstar, LLY has a fair value of $620 and currently trading overvalued.

5. Novo Nordisk (NVO)

Novo Nordisk NVO 0.00%↑ is still holding the anchor point, but looks to be possibly rolling over into a stage 4 decline here below its 200-day SMA. Price has also been trading in a channel.

The company was originally founded in the 1920s as two separate companies that merged in 1989. Both began by producing insulin from pigs—a far cry from today’s cutting-edge synthetic peptides!

Based in Denmark, NVO is dominating the global diabetes and obesity drug market with its blockbuster GLP-1 drugs: Ozempic, Wegovy, and Rybelsus.

These drugs have become cultural and medical phenomena, with surging demand driving record-breaking profits.

NVO is now the largest company in Europe by market cap, and it continues to expand its manufacturing capacity to keep up with global demand.

Like LLY, NVO is a pure play on one of the biggest megatrends in health—metabolic disease—and it’s become a Wall Street favorite.

According to analyst Karen from Morningstar, NVO has a fair value of $89 and currently trading fairly valued.

6. Viking Therapeutics, Inc. (VKTX)

Viking Therapeutics, Inc. VKTX 0.00%↑ is a stage 2 buy zone, but currently has been trading in a downward-sloping channel.

VKTX is a small-cap biotech with big potential, and it’s quickly gaining attention as a speculative play in the weight-loss and metabolic disease space.

Its lead candidate, VK2809, targets NASH (nonalcoholic steatohepatitis), while VK2735—an injectable GLP-1/GIP agonist—is being developed as a direct competitor to Ozempic and Mounjaro.

The company was founded in 2012 and operates with a lean team of under 30 employees—proof that in biotech, small teams can still make waves with the right science.

VKTX doesn’t have any approved drugs yet, but its promising early trial data has lit a fire under the stock.

For stock market participants willing to stomach volatility, VKTX offers high-reward potential in a red-hot therapeutic space.

VKTX has a fair value of $99.29 and currently trading undervalued.

G’s Wrap-Up🐼

Healthcare is one of the most resilient and opportunity-rich sectors in the stock market.

From established dividend-paying giants to nimble biotech innovators, this space offers something for every kind of investor or trader.

Whether you're looking for long-term holds like LLY and NVO, high-quality companies BMY and GILD, or high-upside speculation like VKTX, these six stocks are worth watching closely.

As always, do your own research, monitor the charts, and stay one step ahead of the market.

Thank you for reading, MFG!! I appreciate you.🤘🙏

Always remember, whatever you think about comes about, whatever you focus on grows. - GP 🐼

Plus 1 Gene-Editing Bonus Stock for Premium Subscribers!!

Want to unlock the final healthcare stock on my watchlist?

It’s a cutting-edge biotech company using gene-editing technology to rewrite DNA and potentially cure diseases once thought untreatable.

This stock is highly speculative—but the upside could be massive.

Upgrade to a paid subscription to access the bonus section and get full access to:

My exclusive bonus stock pick

Trade of the Week reports

Deep-dive research articles

Premium watchlists and trade updates & alerts

Join hundreds of other traders who are leveling up their investing game with The Peters Report.