Discover How to Earn Monthly Income with This Options-Income Fund—No Options Knowledge Required

Learn how retail investors can gain professional-level options exposure

Hey, MFG!

If I had to pick one thing that made the most impact on my financial life is internalizing that weekends are for getting RICH! One tip to all of you MFG members and hustlers is that you must learn to leverage your earned income and make money with money.

I leverage myself through multiple ways- real estate, trading stocks, and selling books and courses. There are different ways to leverage yourself in the stock market. I’m sure you heard you could generate income through options.

I’m going to share with you a way to seek monthly income from option strategies without knowing anything about options. While trading options can be profitable make no mistake about it. It requires time and skill to be profitable at options.

Thankfully, options give you options, and now retail investors can get the same exposure as professional investors without having the knowledge and skills it takes to be successful at writing options contracts.

Let’s dig into this new unique options-income fund that seeks to generate monthly income from a portfolio of option strategies.

-GP a.k.a Fullauto11

The Peters Report - Stock & Crypto Trader’s Resource

Looking for a group of likeminded people to trade with? Text alerts and the MFGDiscord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

Discover How to Earn Monthly Income with This Options-Income Fund—No Options Knowledge Required

An options income fund is a type of investment fund that generates income through options strategies, primarily by selling call options on the underlying securities in its portfolio.

The fund collects premiums from selling these options, which can provide a steady stream of income through dividends for investors.

This approach allows investors to benefit from options trading without needing to have in-depth knowledge or expertise in trading options themselves.

Options income funds have been around for several decades. Historically, options income funds have been employed by professional investors and fund managers who utilize these strategies to enhance yield and manage risk.

These funds became more widely accessible to retail investors with the advent of exchange-traded funds (ETFs) and closed-end funds (CEFs) that focus on options income strategies

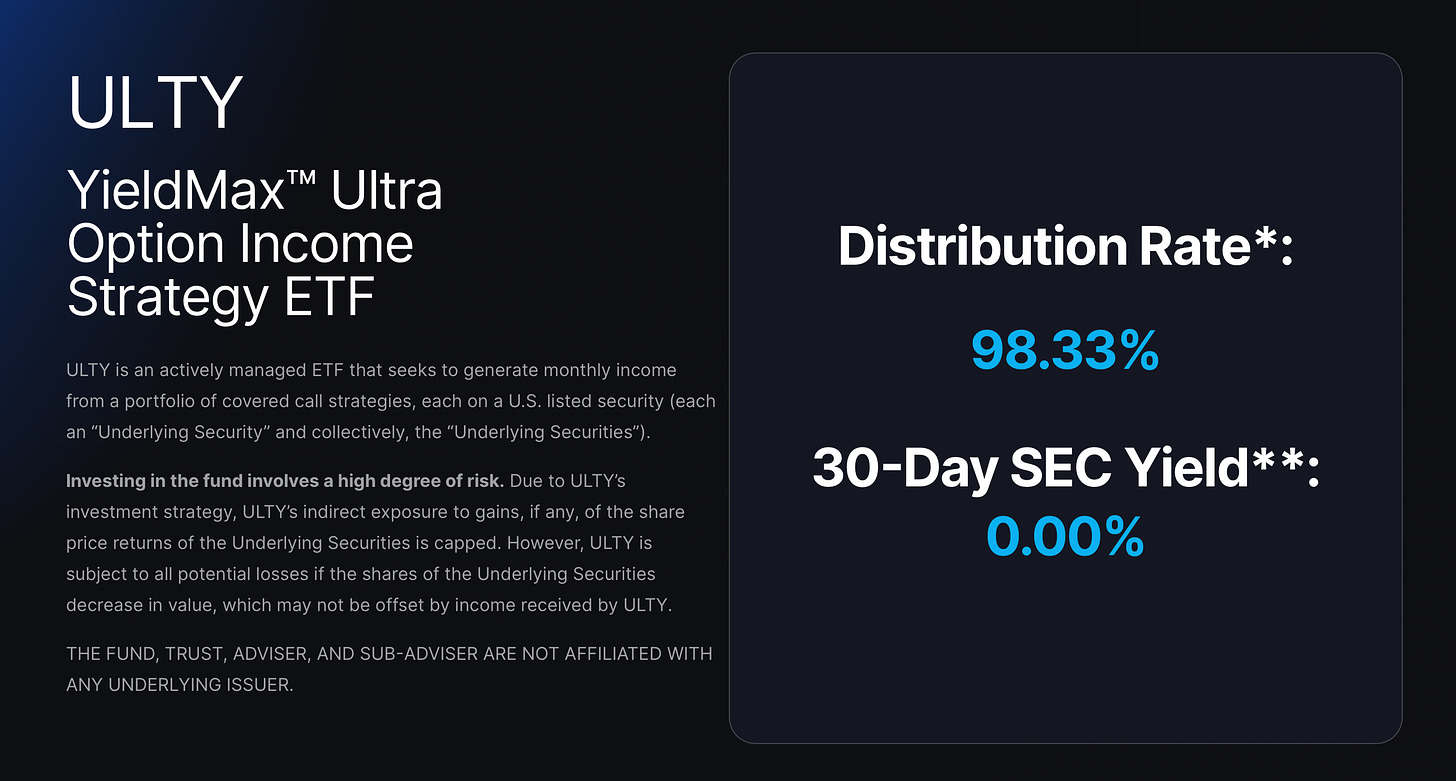

A new, unique options-income fund called YieldMax Ultra Option Income Strategy ETF (ULTY) is an actively managed ETF that seeks to generate monthly income from a portfolio of covered call strategies.

This article aims to provide a comprehensive overview of ULTY, highlighting its purpose, strategy, holdings, and key considerations for potential investors looking to make money from options without knowing anything about options.

YieldMax™ Ultra Option Income Strategy ETF (ULTY)

The YieldMax™ Ultra Option Income Strategy ETF (ULTY) is an ETF managed by YieldMax. It focuses on earning monthly income by using covered call strategies on a selected group of stocks, known as underlying securities.

ULTY’s primary investment goal is to seek current income.

ULTY’s secondary investment objective is to seek exposure to the share price returns of the underlying securities, subject to a limit on potential investment gains for each such security.

The ULTY fund manager selects 15 to 30 underlying securities, or stocks, based on their volatility and adjusts the portfolio as needed to optimize income. ULTY’s strategy involves balancing the income from options with the risks associated with the underlying stocks' price movements.

In other words, ULTY is a fund that generates monthly income through covered-call option strategies in a portfolio 15-30 stocks. YieldMax does own these securities and the investment team meets weekly to review and manage the portfolio. Strategies are adjusted and stocks are swapped in and out based on performance.

Let’s take a look at ULTY’s current holdings:

The tickers highlighted in green are part of the MFG portfolio and tracked daily.

ULTY holdings are subject to change. Depending on the underlying performance of the stocks in the fund, they are swapped in and out by the fund manager on a regular basis.

Now let’s take another look at ULTY’s distribution details since the fund’s inception in February:

ULTY has a 98.33% distribution rate and a varying 30-day SEC yield.

A distribution rate is the annual return an investor would receive if the most recently declared distribution remained the same going forward.

The 30-Day SEC Yield is the net investment income earned by the fund over the month. It’s expressed as an annual percentage rate based on the fund’s share price. This yield varies month to month.

Since February, ULTY has paid over $1.00 per share four out of the five months. This is considered a high yield and carries a high degree of risk. Distributions are variable and may vary significantly from month to month, or may be zero.

Here is a quick video covering ULTY:

G’s Wrap-Up

ULTY is designed for investors seeking monthly income through a managed strategy involving covered calls, with a focus on high yields, though it comes with certain risks and limitations.

It’s important to consider that there is no guarantee of regular distributions; the income can vary monthly and might sometimes be zero. The high yields may not always be sustainable, especially if market conditions change.

What I like about ULTY is the high-yield monthly dividends, YieldMax actually owns the stocks in the portfolio, and it’s actively managed regularly by the YieldMax fund manager, Jay.

Again, this fund is high risk!!! Do you research and understand your options and why you’re investing in what you’re buying.

👉👉 Link to ULTY fund CLICK HERE!!

“WHATEVER may be said in praise of poverty, the fact remains that it is not possible to live a really complete or successful life unless one is rich.” - Wallace Wattles, The Science of Getting Rich

Always remember, whatever you think about comes about, whatever you focus on grows. - G

Thank you, GP

I’ve enjoyed outsourcing options and still reaping the benefits while I continue to learn in grow as an investor and trader.