Gain an Emotional Advantage in the Stock Market: The Power of Understanding Crowd Psychology

Leveraging Emotional Cycles to Enhance Your Trading Edge

Investing in the stock market can be as much an emotional journey as it is a financial one.

The highs and lows of market fluctuations often reflect the collective emotions of its participants.

Understanding crowd psychology in the stock market can provide an individual investor with a significant emotional advantage.

By recognizing and managing the common biases and emotional reactions that drive the behavior of the average participant, an investor can make more rational, informed decisions.

Gaining an Emotional Advantage in the Stock Market: The Power of Understanding Crowd Psychology

Crowd Psychology Explained

Crowd psychology, also known as herd behavior, refers to the collective behavior and emotional responses of a group of investors.

It examines how individuals in a group can influence each other and make decisions that they might not make individually.

In the stock market, this phenomenon often leads to trends where large numbers of investors act in similar ways, driven by shared emotions and perceptions rather than independent analysis.

Recognizing and Managing Common Biases

Herd Behavior: One of the most prominent aspects of crowd psychology is herd behavior, where investors follow the majority without independent analysis. By recognizing this tendency, an individual can avoid impulsive decisions driven by the fear of missing out (FOMO) and instead focus on sound investment strategies.

Fear and Greed: Fear can lead to panic selling during market downturns, while greed can result in buying into speculative bubbles. Understanding these emotions can help an investor maintain discipline, stick to their investment plan, and avoid the pitfalls of emotional trading.

Overreaction and Underreaction: Markets often overreact to news, leading to significant price swings. Conversely, underreaction can cause slow adjustments to new information. Recognizing these patterns can help investors take advantage of temporary mispricings caused by emotional crowd behavior.

Confirmation Bias: Investors tend to seek information that confirms their existing beliefs, ignoring contradictory evidence. Being aware of this bias allows an individual to make more balanced decisions by considering diverse perspectives and data points.

Sentiment Indicators: Tools such as the Volatility Index (VIX) or put/call ratios reflect the market's overall mood. An informed investor can use these indicators to gauge sentiment and make informed decisions, taking a more defensive stance during periods of excessive optimism.

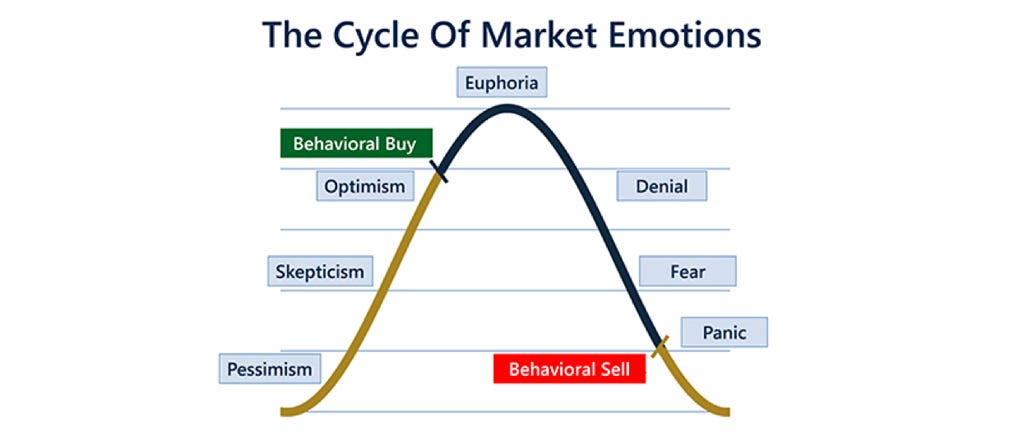

The Emotional Cycle of the Stock Market

The stock market's emotional cycle mirrors the psychological phases investors experience during market cycles.

Understanding this cycle can help investors recognize their own emotional responses and make more rational decisions.

Disbelief: After a market decline, investors are skeptical about the initial recovery, doubting that the uptrend will continue.

Hope: As the market shows consistent gains, investors begin to feel hopeful, cautiously re-entering the market.

Optimism: With steady market rises, optimism grows. Investors gain confidence, believing in the market's recovery.

Belief: The market's continued rise solidifies belief in the uptrend. Investors invest more heavily, convinced of sustained growth.

Thrill: The market performs exceptionally well, creating excitement. Investors see substantial gains and become more aggressive in their trades.

Euphoria: At this peak of market sentiment, investors feel invincible, ignoring risks. This phase often marks speculative bubbles.

Complacency: After euphoria, the market may show instability. Investors become complacent, assuming corrections are temporary.

Anxiety: The market starts to decline, causing anxiety. Investors worry, but hope for a quick recovery.

Denial: As declines continue, investors enter denial, ignoring negative news and holding onto the belief in a rebound.

Panic: Sustained declines lead to panic. Investors rush to sell, often causing sharp market drops.

Capitulation: Investors give up hope of recovery, selling at significant losses. This widespread selling often marks the market's lowest point.

Anger: After selling at a loss, investors feel anger and frustration, blaming various factors for their losses.

Depression: Marked by despondency, investors regret their decisions and may withdraw from the market.

Disbelief: As the market shows signs of recovery, investors remain skeptical, doubting the sustainability of the uptrend.

Hope: The cycle restarts as the market continues to rise, and investors begin to feel hopeful once more.

Looking for a group of likeminded people to trade with? Text alerts and the MFGDiscord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

Along with crowd psychology, it’s important to understand market sentiment.

Market Sentiment Explained

Market sentiment refers to the overall attitude or feeling of investors toward a particular security or the market as a whole.

It reflects the collective mood of market participants and can be either bullish (positive) or bearish (negative).

Market sentiment is often considered a contrarian indicator; extreme levels of sentiment can signal a potential market reversal.

Key Aspects of Market Sentiment:

Bullish Sentiment: When investors are optimistic about the market or a particular security, they are said to be bullish. This typically leads to increased buying activity and rising prices.

Bearish Sentiment: When investors are pessimistic, they are said to be bearish. This usually results in increased selling activity and falling prices.

Sentiment Indicators: Various tools and metrics gauge market sentiment, such as the Volatility Index (VIX), put/call ratios, and investor sentiment surveys. These indicators provide insights into the prevailing mood of the market and can help predict potential market movements.

Contrarian Indicators: Extreme levels of market sentiment can serve as contrarian indicators. For example, excessively bullish sentiment might indicate that the market is overbought and due for a correction, while extreme bearish sentiment might suggest that the market is oversold and due for a rebound.

The Connection Between Crowd Psychology and Market Sentiment

Crowd psychology and market sentiment are closely correlated.

The collective emotions and behaviors of investors (crowd psychology) directly influence the overall mood of the market (market sentiment).

For example, during periods of optimism and rising prices, crowd psychology can lead to bullish sentiment. Conversely, during market downturns, fear and panic can lead to bearish sentiment.

**Crowd psychology- collective emotions and behaviors of investors.

**Market sentiment- overall mood of the market.

Practical Implications for Investors & Traders:

Recognizing Trends: Understanding crowd psychology can help investors identify and capitalize on market trends. By recognizing when the crowd is overly optimistic or pessimistic, investors can make more informed decisions.

Managing Emotions: Being aware of the emotional cycle of the market can help investors manage their own emotions. This can lead to more disciplined decision-making and avoid the pitfalls of impulsive actions driven by fear or greed.

Contrarian Strategies: Investors can use market sentiment indicators to adopt contrarian strategies, buying when others are fearful and selling when others are greedy. This approach can help identify undervalued or overvalued assets.

GP’s Wrap-Up

Understanding crowd psychology and market sentiment is crucial for navigating the stock market. These concepts explain how collective behaviors and emotions drive market movements, often beyond what fundamental analysis might predict.

By recognizing and managing these factors, investors can gain a significant edge, making more rational and informed decisions in an often emotionally charged environment.

“Be fearful when others are greedy and be greedy only when others are fearful.” - Warren Buffet

Always remember, whatever you think about comes about, whatever you focus on grows! - GP

If you need help with setting up your charts and want a mini crash course in the Money Flow, consider GP's course:

"Getting Started with Stock Charts the Money Flow Way" and you will be ready to add shares to your portfolios on stage 1 when the markets are about to possibly rotate and trim profits when opportunities arise. CLICK HERE!

FINANCIAL DISCLAIMER

This is not financial advice, but education to increase awareness. Before making investment decisions, always do thorough research and possibly consult with a financial advisor. The above descriptions are a broad overview and may not capture all nuances associated with each asset.

🧠💪🏼

🤓🤓🤓🤓🤓