How MicroStrategy (MSTR) Could Reshape The NASDAQ 100😱

Breaking down the ripple effect of MicroStrategy's move into the NASDAQ 100.✍️

Bitcoin (BTC) broke through $100K!! 💥

Congratulations, MFG!! 🥳

Bitcoin (BTC) has just blew through the $100,000 mark—a monumental moment in financial history that we’re witnessing together.

This milestone represents more than just a price rip; it signifies a transformative shift in the world of finance and technology.

👉For those who believed in the BTC trade and took action, congratulations—you’re reaping the rewards of courage and conviction.👏🥳🎉

As we dive into today’s article on MicroStrategy (MSTR) and its potential inclusion in the NASDAQ 100 (QQQ) , this milestone highlights how BTC is no longer just a speculative asset—it’s becoming a central pillar of the financial world.

👉MSTR’s bold BTC strategy has played a pivotal role in this evolution, bridging the gap between traditional markets and cryptocurrency.

👉Let’s dig into how this move could reshape portfolios and challenge conventional investing.

How MicroStrategy (MSTR) Could Reshape the NASDAQ 100

The NASDAQ 100 QQQ 0.00%↑ is on the brink of a significant shake-up, and MicroStrategy MSTX 0.00%↑ is at the center of it. If you're holding tech-heavy ETFs like QQQ, this development could change your exposure—and your returns—in ways you might not expect.

Here’s what you need to know about MSTR’s potential inclusion in the NASDAQ 100 and how it could impact your portfolio.👇

The NASDAQ Restructuring: What’s Happening?

Every year, on the last trading day of November, the NASDAQ reviews its indexes to ensure their composition reflects current market capitalizations.

This process often flies under the radar, but its impact on investors can be profound.👈

👉This year, the spotlight is on MicroStrategy (MSTR).

While MSTR trades on the NASDAQ, it has not been a part of the NASDAQ 100 index (QQQ)—until now.

👉Sitting at approximately 42nd place by market cap, MSTR is poised for inclusion in this exclusive group of the largest non-financial companies.

Why Does This Matter?🤯

The potential addition of MSTR to the NASDAQ 100 triggers a significant chain reaction:

ETF Holdings Will Shift

Funds that track the NASDAQ 100—such as QQQ, QYLD, and QQQM—will be required to purchase MSTR. These funds replicate the index by holding shares of its constituents in proportion to their weightings.

👉As a result, they’ll need to collectively buy an estimated $2 billion worth of MSTR stock.

👉This influx of institutional buying could lead to significant price appreciation in MSTR shares, potentially increasing its market cap even further. For investors, this also means heightened interest and scrutiny on MSTR's fundamentals.

Bitcoin Exposure Through QQQ

With MSTR’s substantial BTC holdings, investors in QQQ and similar funds will gain indirect exposure to Bitcoin. For example, holding QQQ will provide about 0.2% exposure to Bitcoin through MSTR.

👉Does this mean BTC exposure is becoming the new norm for traditional investors? And if so, how should you position yourself to capitalize on—or mitigate—the risks?

Increased Volatility

MSTR’s inclusion could amplify volatility within the QQQ. Its price fluctuations—closely tied to BTC—may influence the index and related ETFs. This added volatility might disrupt short-term trading strategies or long-term investment outcomes, depending on how BTC performs.

🚨Important Dates to Watch‼️

December 14, 2024: The official list of NASDAQ 100 QQQ 0.00%↑ constituents will be announced.

December 20, 2024: The changes will take effect, and trading will reflect the new composition.

Between now and December 14, speculation will dominate.

After the announcement, funds will begin adjusting their holdings, which could drive significant movement in MSTR’s stock price.

Bitcoin’s Growing Presence in Corporate Treasuries

👉MicroStrategy isn’t the only company holding Bitcoin on its balance sheet.

👉Telsa TSLA 0.00%↑ , Square SQ 0.00%↑ , and others have already incorporated BTC, with rumors that Microsoft MSFT 0.00%↑ might follow suit.

🚨This trend signals a shift toward Bitcoin exposure becoming unavoidable for mainstream investors.‼️

For income investors, this development brings both opportunities and challenges.

👉On one hand, BTC’s price appreciation could enhance returns.

👉On the other, its inherent volatility may disrupt income-generating strategies tied to ETFs like QQQ.

Managing Risk: What Should You Do?🤘

This raises a critical question: How much exposure to Bitcoin is too much?

PRACTICE PROPER POSITION SIZING!!

DON’T PUT ALL OF YOUR MONEY INTO BTC!!

DON’T SELL OR WITHDRAW YOUR RETIREMENT TO BUY BITCOIN!!

USE NEW MONEY TO BUY BTC!! Personally, I was borrowing money to buy BTC.

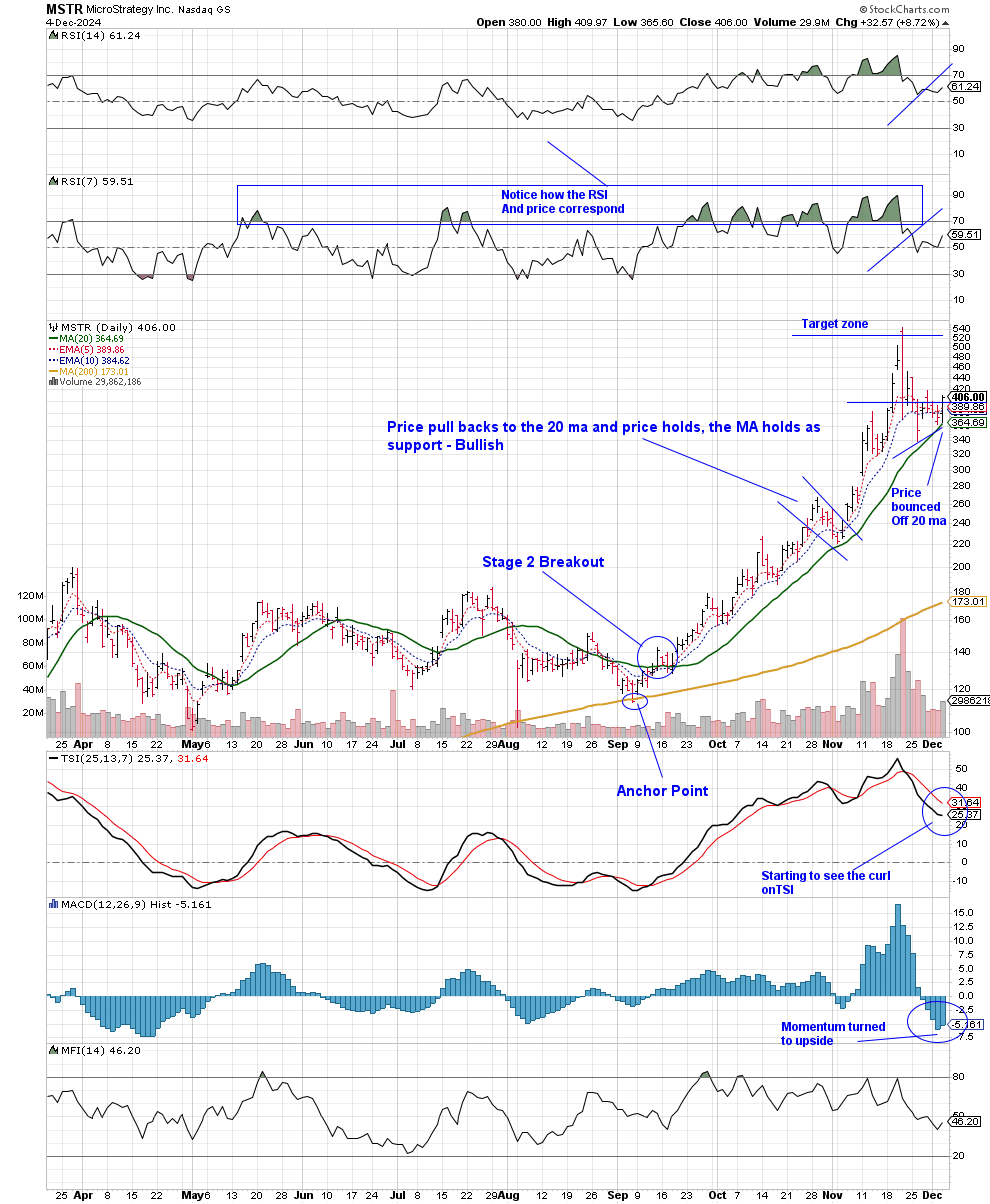

MSTR From A Technical Analysis Standpoint 👇

MSTR has been building out a stage 3 consolidation zone after BTC exploded parabolically. The stock was looking like it may roll over the last few days; however, today price tested its 20-day SMA, but closed back above it. This is super bullish. Price also closed back above its 5-day EMA. The TSI has started to curl and the MACD histogram ticked upwards confirming the momentum is shifting into favor.

👉This setup is telling me that this could be a stage 3 turning into a new stage 1.👈

Not only do you have an opportunity to add to a stock that’s been on a runaway, but to make history in a stock that may surge higher than you can imagine if MSTR gets inducted to the QQQ.

👉This speculation and potential catalyst along with confluence of the Money Flow indicators is why I’m drip adding

The Bigger Picture

MSTR’s potential inclusion in the NASDAQ 100 could set a precedent for other companies with significant BTC holdings.

As Bitcoin’s role in corporate treasuries grows, the relationship between cryptocurrency and traditional markets is evolving.

Could this pave the way for more blockchain-heavy companies to join mainstream indexes?🤔

At the same time, it’s essential to weigh the broader market sentiment. Will this trend bring more stability to Bitcoin’s price, or will it introduce unnecessary risk to traditional indexes like the NASDAQ 100 (QQQ)?

GP’s Wrap-up🐼

MicroStrategy’s potential inclusion in the NASDAQ 100 marks a turning point for both the index and Bitcoin’s integration into mainstream investing. Whether you’re a experienced trader or a long-term investor, it’s vital to stay informed and adapt your strategy to these changes.

As December 14th approaches, keep an eye on MSTR and the QQQ. Monitor the announcement closely, and consider how this shift aligns with your broader investment strategy.

👉Whether you’re pro-Bitcoin or a cautious skeptic, this move by MicroStrategy will ripple through markets—and you don’t want to be caught off guard.👈

Keep in flow and stay one step ahead, MFG.🏄🏄♀️

Always remember, whatever you think about comes about, whatever you focus on grows. - GP

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

Purchase GP’s Trading ebook: The Money Flow Trading System CLICK HERE

Yes yes yes

Amazing find, GP!! 🥳🧙🐐