How to Assess The Wind: The Major Indexes Tracked By The MFG

The difference between a top-down and bottom-up approach in analyzing the stock market.

Hey, MFG!

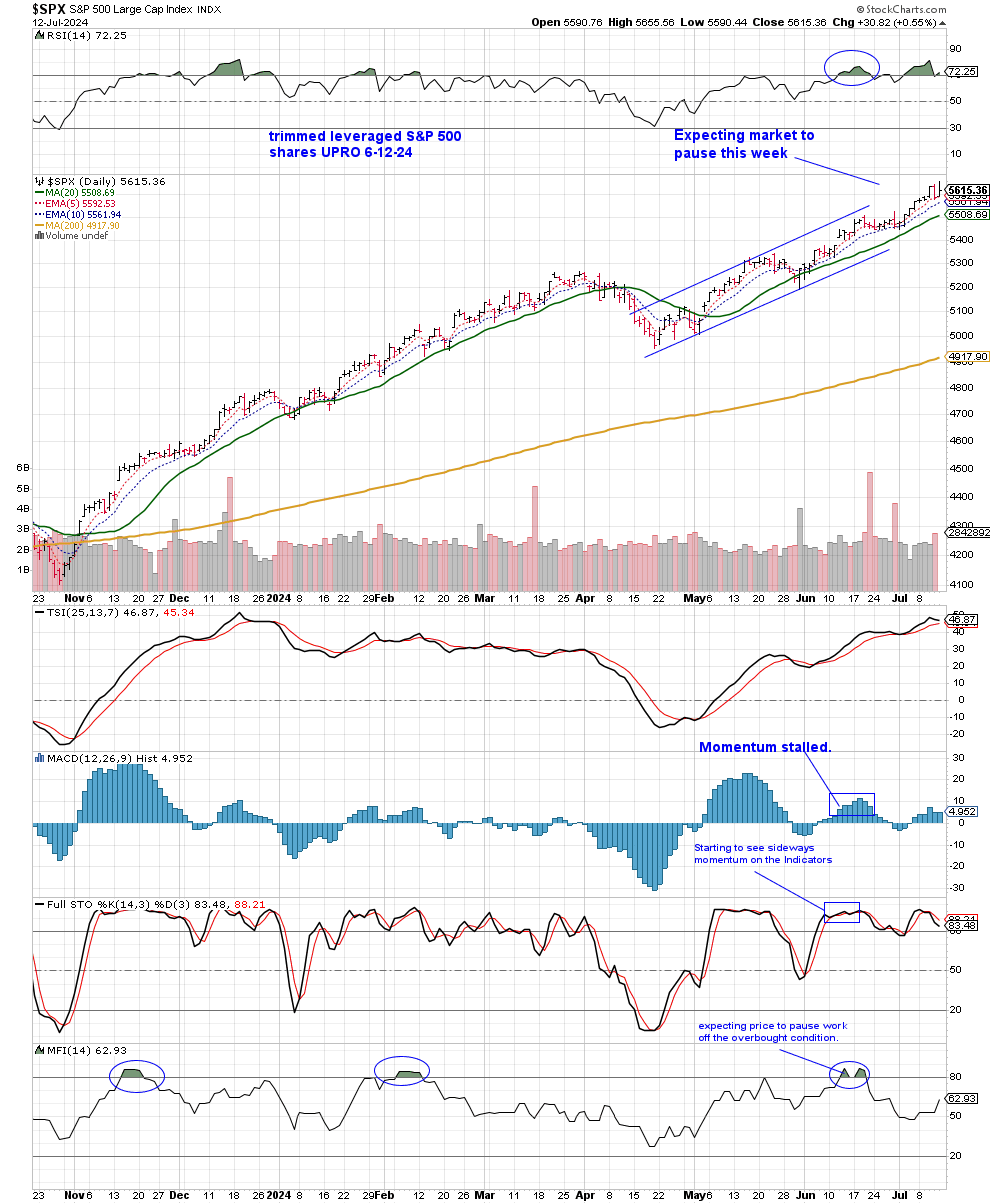

The markets were flying today! The S&P 500 (SPY) continues to lead the Wind and is back to trading at an extreme-high RSI reading.

The Diamonds (DIA) popped higher and is also now trading at an extreme-high RSI reading. Always use caution here and lock in profits.

The Nasdaq (QQQ) made a nice recovery today. A possible stage 3 could be starting to form here. This is why I always say to stay bullish.

Bonds (TLT), Oil (USO), and Gold (GLD) are still in stage 2 uptrends above their 200-day SMA.

Bitcoin (BTC) and Bitcoin Cash (BCH) are in stage 1 accumulation zones. I’m a buyer of all stage 1s of BTC and BCH.

The Russell 2000 (IWMY) is also now trading at an extreme-high RSI reading.

Today’s message is about tracking “The Wind,” the 7 asset classes tracked by the MFG. It’s absolutely imperative that you know how to assess the The Wind and perform this exercise first when you approach your Sunday homework. I rank The Wind everyday to keep in flow.

Grab a free copy of Gerald’s ebook You Don’t Have To Die Broke! CLICK HERE!

Always remain bullish and follow The Money Flow.

The Peters Report - Stock & Crypto Trader’s Resource

-GP a.k.a Fullauto11

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

How to Assess The Wind: The Major Indexes Tracked By The MFG

Why track and rank the major indexes?

Because it’s the Wind 💨 behind all asset movement!

As a Money Flow Trader, you should always be studying and be able to see the larger fundamental picture.

Where is The Wind? Is it blowing in your face or at your back?

Which asset class is leading the way? Which sectors of the S&P 500 (SPY) pose an opportunity for a swing trade or a buy and hold position?

It's The Wind 💨 at your back when the index is climbing in price and it’s The Wind blowing in your face when the index is falling.

Think in terms of a sail boat 🛥️. It’s impossible to sail with much success if the wind is blowing against you.

It's very hard for a stock to climb higher in price if its index is falling. The direction of an asset's primary index puts pressure on assets that make up the index.

So much of today's buying and selling is computer and algorithm-based, it’s mass and broad selling without much thought given to the underlying fundamentals of a company.

So on one hand, it can be frustrating to see your awesome stock or coin drop due to nothing having to do with its production efforts, and on other hand it gives us an incredible opportunity.

Understanding The "Wind" in The Stock Market

Tracking major indexes and assets is like understanding the wind when sailing. Just as a sailboat relies on the wind to move smoothly, stocks rely on the overall market direction to perform well. Here’s why it's important:

Market Direction: Major indexes like the S&P 500 (SPY) and Nasdaq-100 (QQQ) show the general direction of the market. When these indexes are going up, most stocks are likely to go up too. When they go down, it’s harder for individual stocks to rise.

Sentiment Indicator: The performance of assets like Bonds (TLT), Oil (USO), gold (GLD), and Bitcoin (BTC) reflects investor sentiment. For example, rising bond prices might mean investors are seeking safety, indicating a cautious market.

Risk Assessment: By tracking these indexes, you can gauge the overall market risk. If the indexes are falling, it might be a signal to be more cautious with your investments.

Informed Decisions: Understanding the market’s "wind" helps you make better decisions. You’ll know when it’s a good time to invest aggressively or when to be more conservative.

How To Asses & Rank The Wind

You should have a chart list called “The Wind” with the 7 asset classes tracked by the MFG. I like to call these the “Big 7.”

If you need help with creating chart lists and setting up your stock charts, consider Gerald's course, "Getting Started with Stock Charts the Money Flow Way" and you will be ready to go.

These assets included in ranking The Wind are the S&P 500 (SPY), the Nasdaq (QQQ), the Dow Jones (DIA), Bonds (TLT), Oil (USO), Gold (GLD), and Bitcoin ($BTCUSD).

Here's a detailed breakdown of each asset:

QQQ (Nasdaq-100 Index ETF): Tracks the performance of the largest non-financial companies listed on the Nasdaq. It provides insight into the tech-heavy sector and growth stocks.

SPY (S&P 500 Index ETF): Tracks the performance of 500 large-cap U.S. companies. It represents the overall health of the U.S. stock market.

DIA (Dow Jones Industrial Average ETF): Tracks 30 large, publicly-owned companies based in the United States. It's a good indicator of the market performance of established companies.

TLT (iShares 20+ Year Treasury Bond ETF): Tracks long-term U.S. Treasury bonds. It's an indicator of the bond market and can reflect investor sentiment towards risk.

BTC (Bitcoin): Represents the cryptocurrency market. It often indicates market sentiment towards alternative assets and risk appetite.

USO (United States Oil Fund): Tracks the price of oil. It provides insights into the energy sector and can reflect broader economic conditions.

GLD (SPDR Gold Shares ETF): Tracks the price of gold. It's often seen as a safe-haven asset and can indicate market sentiment towards risk and inflation.

Key considerations:

When you perform this exercise, you want to write down which stage each asset is in and what the RSI is. Use the stages and the RSI to rank them.

You want to also look at where the asset is in terms of the 200-day SMA. Is it above or below it?

A stage 3 is higher than stage 2, and a stage 2 is ranked higher than a stage 1, and so forth.

If two asset classes are both flying in a stage 2 uptrends, like the SPY and the QQQ have been recently, then you look at the RSI reading. Whichever has the higher RSI reading is usually ranked higher.

If Bonds (TLT) are in a stage 2 trading below its 200-day SMA average and Oil (USO) is also in a stage 2, but trading above it’s 200-day SMA, then USO would be ranked before TLT.

By tracking these indexes and assets daily, you can get a comprehensive view of the market's "wind" direction.

Again, when these indexes are rising, it suggests a favorable environment for stocks to move higher. Conversely, when these indexes are falling, it indicates a challenging environment for stocks to gain value.

This approach helps you understand the broader market trends and align your trading or investment strategies accordingly. It’s like navigating a sailboat; you adjust your sails based on the wind direction to maximize your movement and efficiency.

A Top-Down Approach to The Stock Market

Tracking the major indexes like this is a classic example of a top-down approach to analyzing the stock market.

It starts with the big picture and narrows down to individual stocks, helping you make informed and strategic investment decisions.

Big Picture First: You start by looking at the overall market and economic conditions. This includes major indexes (like SPY, QQQ, DIA) and key assets (like TLT, BTC, USO, GLD) to understand the broader trends.

Market Sentiment: You assess the general sentiment and direction of the market. Are investors feeling optimistic or cautious? This helps in gauging the overall environment in which individual stocks are operating.

Sector Performance: After understanding the broader market, you can drill down into specific sectors that are performing well or showing potential.

Individual Stocks: Finally, you look at individual stocks within the context of the broader market and sector trends. This ensures you are picking stocks that have the wind at their back, increasing their likelihood of performing well.

A Bottom-Up Approach to The Stock Market

The bottom-up approach starts with individual stocks, focusing on their fundamentals, and then considers the broader market and sector context.

Stock Analysis: Begin by analyzing individual stocks based on their fundamentals; for example, identify a stock like Shopify (SHOP) based on its strong revenue growth, innovative business model, and expanding market share

Company Research: Conduct in-depth research on the company's management team, competitive position, and future prospects. For example, dig into SHOP’s financial statements, management team, competitive advantages, and growth strategies.

Sector and Market: Consider the sector and overall market conditions, but they are secondary to the individual stock analysis. Ex) Look at the e-commerce sector to ensure SHOP is not facing major headwinds.

Top-Down & Bottom-Up Comparison

Focus: Top-down focuses on the big picture first, while bottom-up focuses on individual stocks.

Process: Top-down filters down from the market to stocks; bottom-up builds up from stocks to the market.

Risk Management: Top-down can help manage risk by aligning with market trends; bottom-up can uncover undervalued opportunities regardless of market conditions.

GP’s Wrap-Up

In summary, a top-down approach starts with the overall market, moves to sectors, and ends with individual stocks. It's useful for aligning investments with broad market trends and economic conditions.

A bottom-up approach begins with individual stock analysis and considers broader market conditions later. It's useful for finding fundamentally strong stocks that may outperform regardless of market trends.

Both approaches have their strengths and can be used complementarily, depending on the investor’s strategy and goals.

I hope this helps you with your Sunday homework while ranking The Wind and approaching the overall stock market each week and everyday.

Let me know if I can do anything to help. I believe in you.

DO YOUR HOMEWORK!!!

If you need help with identifying which stages your stocks are in, or using the Money Flow indicators, consider my course:

“The Money Flow Trading System Swing Trading Bootcamp Course!” CLICK HERE!

“If you want to help the poor, demonstrate to them that they can become rich; prove it by getting rich yourself.” - Wallace Wattles, The Science of Getting Rich

Always remember, whatever you think about comes about, whatever you focus on grows. - GP

Purchase a hard copy of Gerald’s swing trading strategy book called The Money Flow Trading System. CLICK HERE!

We never know where the market is going to go. We do know the stock market climbs higher 70% of the time. Check your charts everyday and keep in flow.

If you need help with this, consider Gerald's course, "Getting Started with Stock Charts the Money Flow Way" and you will be ready to add shares to your portfolios on stage 1 when the markets are about to possibly rotate and trim profits when opportunities arise.

They say that you can’t buy bottoms or sell tops; The Money Flow Trading System can show you how to buy ALL the tops and the bottoms and stay in the flow.

That is what the Money Flow Trading System is all about. Being in flow with the stock market. Simple? YES! Easy? NO, but what in life that is worth having is? Stay the course, don't give up and don't get shaken out by wars, the Fed raising rates, rumors of recession, or any other event that may come.

Don't forget, 70% of the time the stock market climbs higher and the other 30% sets up for good buying opportunities.

Gerald, thanks so much for this one, truly broke it down for me. I’ve been working on following market trends and this was a basic 101 write for me that has really helped. GP MFG

Good detailed write up of assessing The Wind.