It’s September 1st, MFG!! It's Time to Calculate Your Net Worth!!

The wealthy are meticulous about tracking their assets.

Hey, MFG!

I hope you’ve been GETTING RICH this summer and building your family’s wealth!!

Can you believe we're already past the halfway mark of the year? Summer may be almost over, but the year is not!

Now’s a great time to revisit those financial goals you set at the beginning of the year.

If you haven't been on track, now's your chance to reignite that motivation and take decisive action! You have 4 months left in 2024 to keep pushing.

Building wealth requires consistent effort in improving your financial health and education. It's a daily commitment that involves focus, study, and dedication.

To build wealth, you need to manage your time effectively, generate a solid income, and find high-yield opportunities to grow your money.

This cycle of earning and investing should become second nature.

One of the best ways to stay in tune with your finances and get a clear picture of your current situation is by regularly tracking your net worth.

Regular net worth tracking helps you monitor your financial progress and witness your wealth accumulation over time.

While some prefer to check their net worth quarterly or semi-annually, I strongly recommend doing it monthly—specifically on the first of every month.

Personally, I make it a habit to calculate my net worth daily, constantly adding up my assets. I enjoy the process, and once it becomes a routine, tracking your net worth will feel automatic.

Remember, “Whatever you think about comes about, and whatever you focus on grows.” By keeping your net worth top of mind, you can accelerate your path to wealth.

Every month, I take the time to review all my investments. I print out the details of my buy-and-hold portfolio, noting my monthly dividend income. I also review my speculative investments, brokerage accounts, and rental houses.

My crypto portfolio gets a look, too—I check how much Bitcoin (BTC) I need to accumulate and review real estate deals.

I lay everything out, analyze my financial empire, and make decisions on where to allocate my resources. This is called portfolio management.

This monthly review process helps me see the bigger picture, stay focused on my assets, and strategize effectively.

Remember, making money work for you is a skill that requires constant learning and attention, which is why daily financial education is vital for your wealth.

Now is the time to push harder, refine your strategies, and prepare to end 2024 on a high note!

Conduct a summer financial check-in, sharpen your focus, and set the stage for an outstanding finish to the year.

Your financial future is in your hands—take charge, stay motivated, and watch your wealth grow!!

Let's make the rest of this year your most successful yet!!

-GP a.k.a Fullauto11

The Peters Report - Stock & Crypto Trader’s Resource

Looking for a group of likeminded people to trade with? Text alerts and the MFGDiscord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

It’s September 1st, MFG!! It’s Time to Calculate Your Net Worth!!

Net worth is a critical indicator of an individual's or entity's financial health and stability. It provides a clear snapshot of the overall financial position by showing the balance between assets and liabilities.

Learning how to perform this exercise is crucial to your success in wealth building.

Regularly calculating net worth helps track financial progress over time, allowing for informed decision-making regarding spending, saving, and investing.

It serves as a foundation for financial planning, enabling individuals to set realistic and achievable financial goals.

Understanding net worth also highlights areas where financial adjustments may be necessary, such as reducing debt or increasing asset accumulation.

Overall, net worth is an essential tool for managing and improving one's financial well-being.

Let’s dig into how to calculate your net worth. Use EXACT numbers for this exercise.

How to Calculate Your Net Worth:

List All Assets:

Cash and Cash Equivalents: Savings accounts, checking accounts, and cash on hand.

Investments: Stocks, bonds, mutual funds, crypto, retirement accounts (e.g., 401(k), IRA).

Real Estate: Market value of owned properties.

Personal Property: Value of vehicles, jewelry, art, and other valuable items.

Business Interests: Equity in businesses you own.

Other Assets: Any other items of value you own.

List All Liabilities:

Mortgages: Remaining balance on home loans.

Loans: Personal loans, student loans, car loans, etc.

Credit Card Debt: Outstanding balances on credit cards.

Other Debts: Any other forms of debt or financial obligations.

Calculate Net Worth:

Net Worth = Total Assets - Total Liabilities

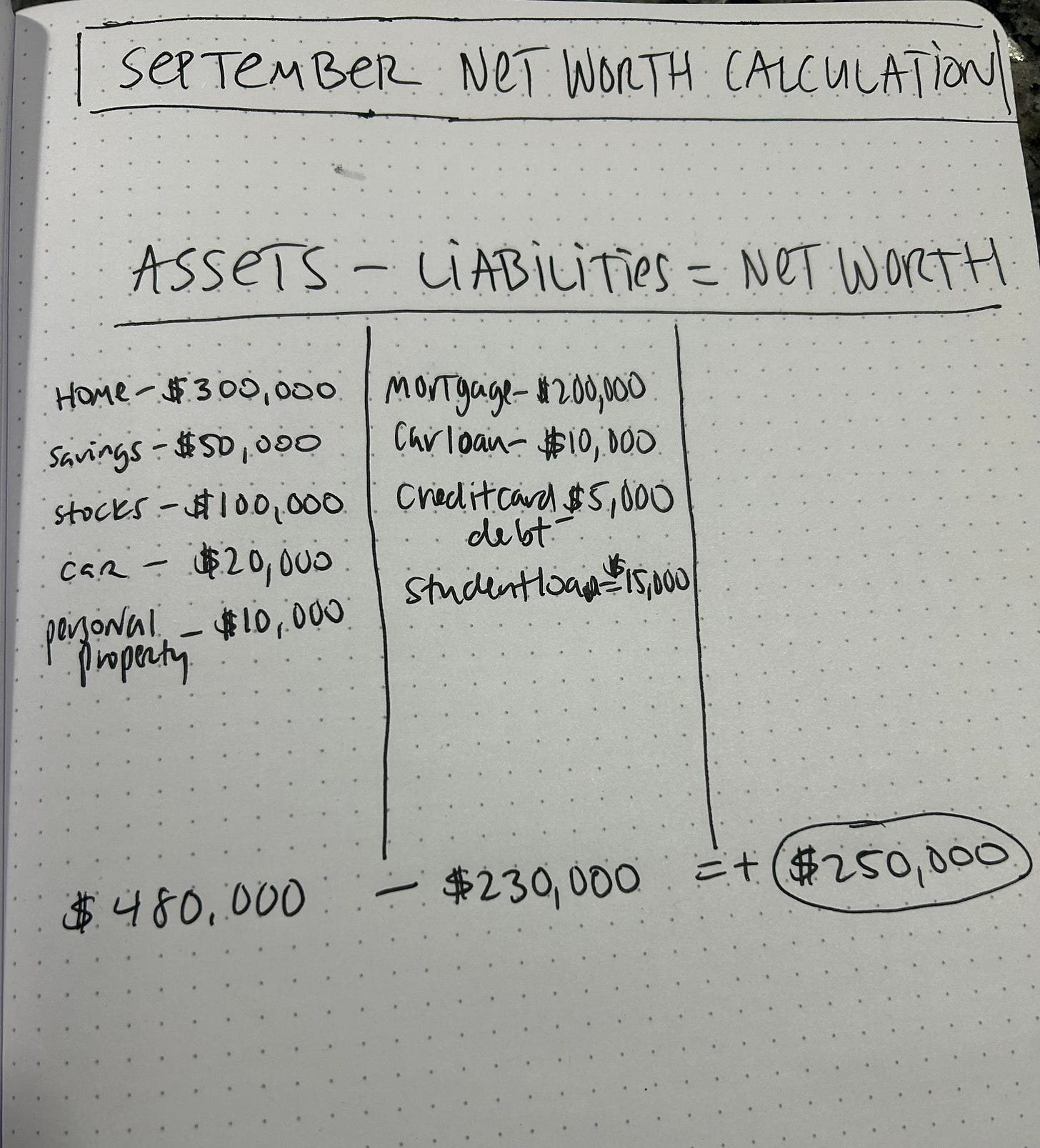

Example:

Assets:

Home value: $300,000

Savings: $50,000

Investments: $100,000

Car: $20,000

Personal property: $10,000

Total Assets: $480,000

Liabilities:

Mortgage: $200,000

Car loan: $10,000

Credit card debt: $5,000

Student loans: $15,000

Total Liabilities: $230,000

Net Worth Calculation:

Net Worth = $480,000 (Total Assets) - $230,000 (Total Liabilities) = $250,000

Grab a free copy of Gerald’s ebook You Don’t Have To Die Broke! CLICK HERE!

Summer is Coming to an End: Check Your Progress

September marks a significant milestone as we move further into the year. It's the perfect time to reassess your New Year's resolutions and financial goals. Ask yourself:

Do you have a chunk of money saved up?

Do you own any Bitcoin (BTC)?

Are you buying BTC daily?

Have you attacked debt like planned?

Are you investing everyday?

Do you have a buy and hold investment account?

Do you even trade, bro?

Use this net worth calculation as a benchmark to evaluate where you stand and determine any adjustments needed for the rest of the year.

LET’S GO, MFG!

Get your net worth calculation done today and send me a picture of it!!

I believe in you!!

"Every man who becomes rich by competition throws down behind him the ladder by which he rises, and keeps others down; but every man who gets rich by creation opens a way for thousands to follow him, and inspires them to do so." - Wallace Wattles, The Science of Getting Rich

Always remember, whatever you think about comes about, whatever you focus on grows. - GP

The Peters Report - Stock & Crypto Trader’s Resource

Looking for a group of likeminded people to trade with? Text alerts and the MFG DISCORD. Text GP 1-936-661-7786 to join.

If you need help with setting up your stock charts and want a mini crash course in The Money Flow, consider GP's course:

"Getting Started with Stock Charts the Money Flow Way" and you will be ready to add shares to your portfolios on stage 1 when the markets are about to possibly rotate and trim profits when opportunities arise. CLICK HERE!

September net worth calculation ✅

Going to set a benchmark a work on calculating net worth