MFG Trade of The Week

How PZZA's Digital Transformation and Market Expansion Drive Long-Term Growth

Hey MFG!

The markets are ripping! Trading and tracking the markets is the only reason I get up in the morning. The Nasdaq (QQQ), Bitcoin (BTC), and S&P 500 (SPY) are still holding strong stage 3 consolidation zones.

We saw a beautiful breakout move in Bonds (TLT), which blew right through its 200-day SMA. The Diamonds (DIA) are back in a stage 1 accumulation zone and OIL (USO) has entered a stage 4 decline and fallen below its 200-day SMA .

This week, I’ve added to my swing trade in TSLR and my positions in extreme-yield funds JEPY and QQQY. I also cut my 2x leveraged OIL trade- GUSH for a loss and opened a new swing trade in GME. I’m keeping a close eye on UBER, ABNB, LYFT, CART, DASH, CRM, CART, DNUT, and RDDT.

My last message to you was about my swing trade in TSLR. Price has continued to move sideways and closed right below its 20-day SMA yesterday. I’m watching this trade closely here. You could add to this position on any weakness. AAPL and AI are trading at extreme-high RSI readings and could be trimmed here.

Grab a free copy of Gerald’s ebook You Don’t Have To Die Broke! CLICK HERE!

Always remain bullish and follow The Money Flow.

The Peters Report - Stock & Crypto Trader’s Resource

-GP a.k.a Fullauto11

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

NEW ANNOUNCEMENT!!

My newest ebook, The Bread-And-Butter Trading System will be available for sale soon!! I’m not sure where that term came from, but bread and butter are staple American foods.

This strategy became my staple food- my go to strategy to add “alpha” to my buy and hold stock dividend portfolio. It literally became my bread-and-butter trading method.

Stay tuned for the release date and be among the first to get your copy. Don't miss out on this opportunity to step up your buy and hold portfolios and advance your trading skills.

Follow the The Peters Report to receive an exclusive discount and be notified as soon as the ebook is available!

THIS WEEK’S HOMEWORK VIDEO!! MASTERING THE SWING TRADE 101 - THE MONEY FLOW WAY!! CLICK HERE!!

MFG Swing Trade of The Week

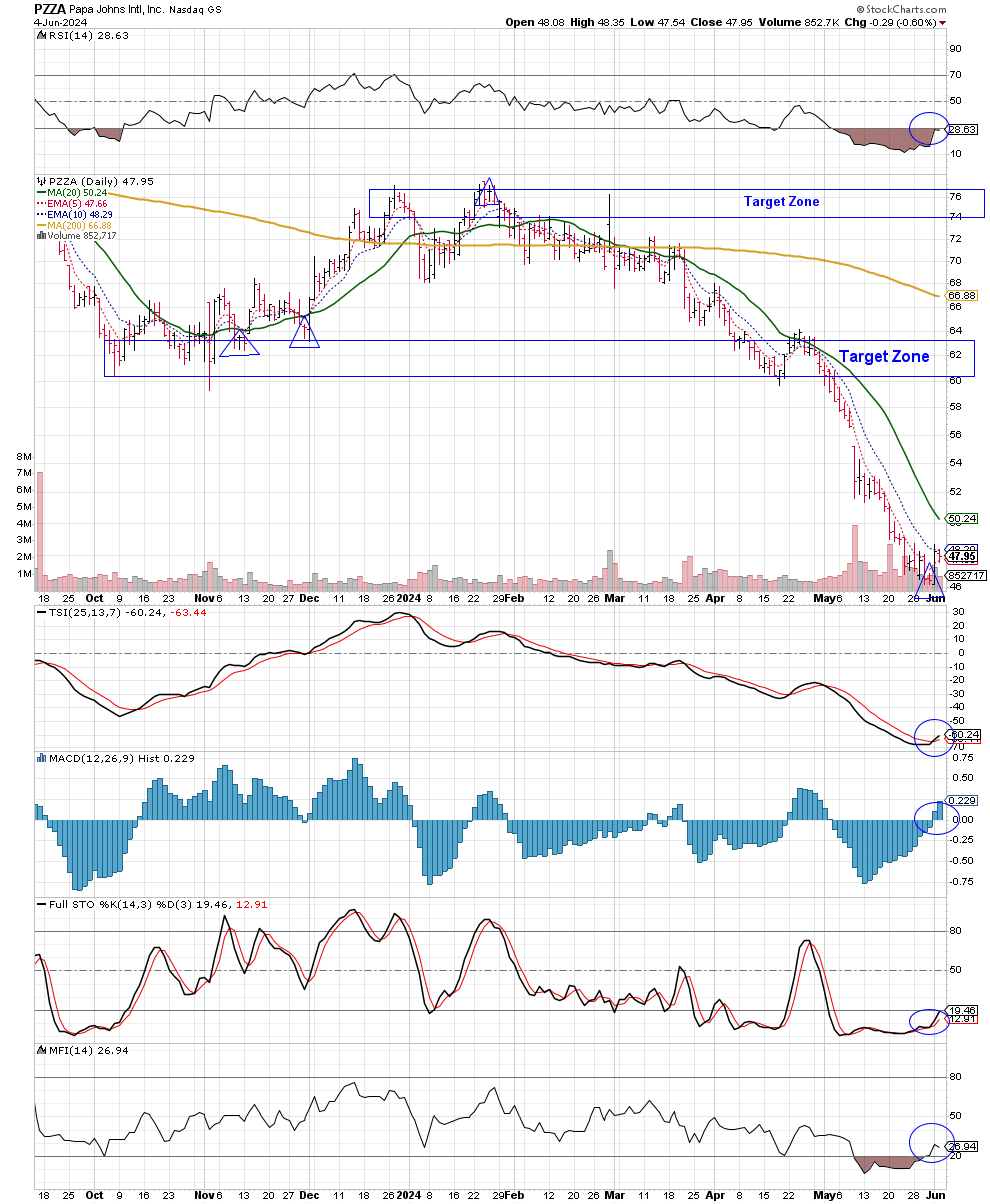

Today's message is about Papa Johns Intl, Inc. (PZZA), an American pizza restaurant chain and dividend payer. According to Analyst Sean from Morningstar, the company is currently undervalued and has a fair value of $69.

PZZA currently in a stage 1 accumulation zone according to the Money Flow Trading System and trading below its 200-day SMA, which poses great opportunities to add to our buy and hold portfolios and put on a typical Money Flow swing trade or a Bread-and-Butter Trade. I’m looking to establish a position here.

PZZA is part of the SPDR consumer discretionary sector (XLY) under restaurants and bars. The XLY is also in a stage 1 zone. Other industries in the XLY include retail, automobiles, apparel, hotels, and durables. The top 5 holdings of the XLY include AMZN, TSLA, HD, MCD, and BKNG.

[See PZZA chart below with stop zone and targets.]

See PZZA chart inside my “Trade Ideas” Chart Pack CLICK HERE

CONFLUENCE of the Money Flow Technical Indicators

PZZA is currently forming a stage 1 accumulation zone. The RSI put in an extreme-low bottom, price jumped above the 5-day EMA (the trigger), the MACD histogram turned positive, and the TSI crossed.

This is what you call confluence of 2 or more of the money flow technical indicators coming together to form a buyable, confirmed stage 1 accumulation zone.

The Case for Owning Papa John’s Intl, Inc. (PZZA) Shares

Founded in 1984 by John Schnatter, Papa John's (PZZA) has grown to become one of the largest pizza delivery companies in the world. The company operates and franchises pizza delivery and carryout restaurants under the Papa John's brand.

PZZA is known for its "Better Ingredients. Better Pizza." motto, which emphasizes quality and freshness. The company has a significant market share in the competitive pizza industry, with thousands of locations worldwide.

PZZA offers a diverse menu that includes traditional and specialty pizzas, sides, desserts, and beverages. Recent innovations include new pizza recipes, limited-time offerings, and customizable options to cater to diverse customer preferences.

The company invests in technology to improve the customer experience, including a user-friendly mobile app and online ordering system. PZZA also focuses on enhancing delivery efficiency and exploring new delivery methods.

The increasing demand for online food delivery presents a significant growth opportunity. PZZA continues to invest in its digital platforms to capture a larger share of the online ordering market.

The rise in at-home dining and convenience food options supports the growth of pizza delivery services. PZZA is well-positioned to benefit from these trends, with a strong brand and loyal customer base.

GP’s Wrap-Up

We could consider investing or putting on a trade here in PZZA due to its strong brand presence and commitment to quality, which drive consistent revenue growth and customer loyalty.

The company's focus on digital transformation and innovative menu offerings positions it well to capitalize on the growing demand for online food delivery.

Consider adding shares of PZZA here. There’s always multiple ways to play the trade or gain exposure in your portfolios. We can put on a BnB swing trade or add PZZA to our buy and hold portfolios.

If you need help with identifying which stages your stocks are in, or using the Money Flow indicators, consider my course:

“The Money Flow Trading System Swing Trading Bootcamp Course!” CLICK HERE!

"Plant your seeds in the spring and defend and nourish them in the summer to reap them in the fall." - Jim Rohn

Always remember, whatever you think about comes about, whatever you focus on grows. - GP

Purchase a hard copy of Gerald’s swing trading strategy book called The Money Flow Trading System. CLICK HERE!

We never know where the market is going to go. We do know the stock market climbs higher 70% of the time. Check your charts everyday and keep in flow.

If you need help with this, consider Gerald's course, "Getting Started with Stock Charts the Money Flow Way" and you will be ready to add shares to your portfolios on stage 1 when the markets are about to possibly rotate and trim profits when opportunities arise.

They say that you can’t buy bottoms or sell tops; The Money Flow Trading System can show you how to buy ALL the tops and the bottoms and stay in the flow.

That is what the Money Flow Trading System is all about. Being in flow with the stock market. Simple? YES! Easy? NO, but what in life that is worth having is? Stay the course, don't give up and don't get shaken out by wars, the Fed raising rates, rumors of recession, or any other event that may come.

Don't forget, 70% of the time the stock market climbs higher and the other 30% sets up for good buying opportunities.

Use code “DividendPapi” for 20% off your next pizza 🍕

Always finding us some plays! Thank you! 💎