Hey MFG!

The Diamonds (DIA) has taken a nosedive and entered a stage 4 decline along with Bonds (TLT), which is back below its 200-day SMA. The Nasdaq (QQQ) and the S&P 500 (SPY) are still holding stage 3 consolidation zones. A possible stage 4 is underway in Gold (GLD). A stage 2 uptrend is still underway in Bitcoin (BTC). OIL (USO) is also in a stage 2 breakout right above its 200-day SMA.

Yesterday, I added to my swing trade in TSLR and my position in extreme-yield fund TSLY. I’m keeping a close eye on BX, AGNC, BXMT, NUE, BMY, CRM, CART, GILD, KLG, and SOLV.

My last message to you was about my swing trade in CONL. Since then, it’s still in a stage 2 breakout. CONL looks good here; price is above all 3 of the moving averages which are in numerical alignment. You could add to this position on any weakness.

***P.S. I’m hosting a Swing Trading Webinar Saturday June 1st at 10 am CST on Zoom, Reserve Your Spot Today! CLICK HERE!!

“Mastering Swing Trading – the Money Flow Way” LAST CHANCE!! Sale ends Friday, May 31st at Midnight.***

NEW ANNOUNCEMENT!!

My newest ebook, The Bread-And-Butter Trading System will be available for sale soon!! I’m not sure where that term came from, but bread and butter are staple American foods.

This strategy became my staple food- my go to strategy to add “alpha” to my buy and hold stock dividend portfolio. It literally became my bread-and-butter trading method.

Stay tuned for the release date and be among the first to get your copy. Don't miss out on this opportunity to step up your buy and hold portfolios and advance your trading skills.

Follow the MFG Substack to receive an exclusive discount and be notified as soon as the ebook is available!

THIS WEEK’S HOMEWORK VIDEO!! THE ART OF MONEY GETTING BY P.T. BARNUM!! CLICK HERE!!

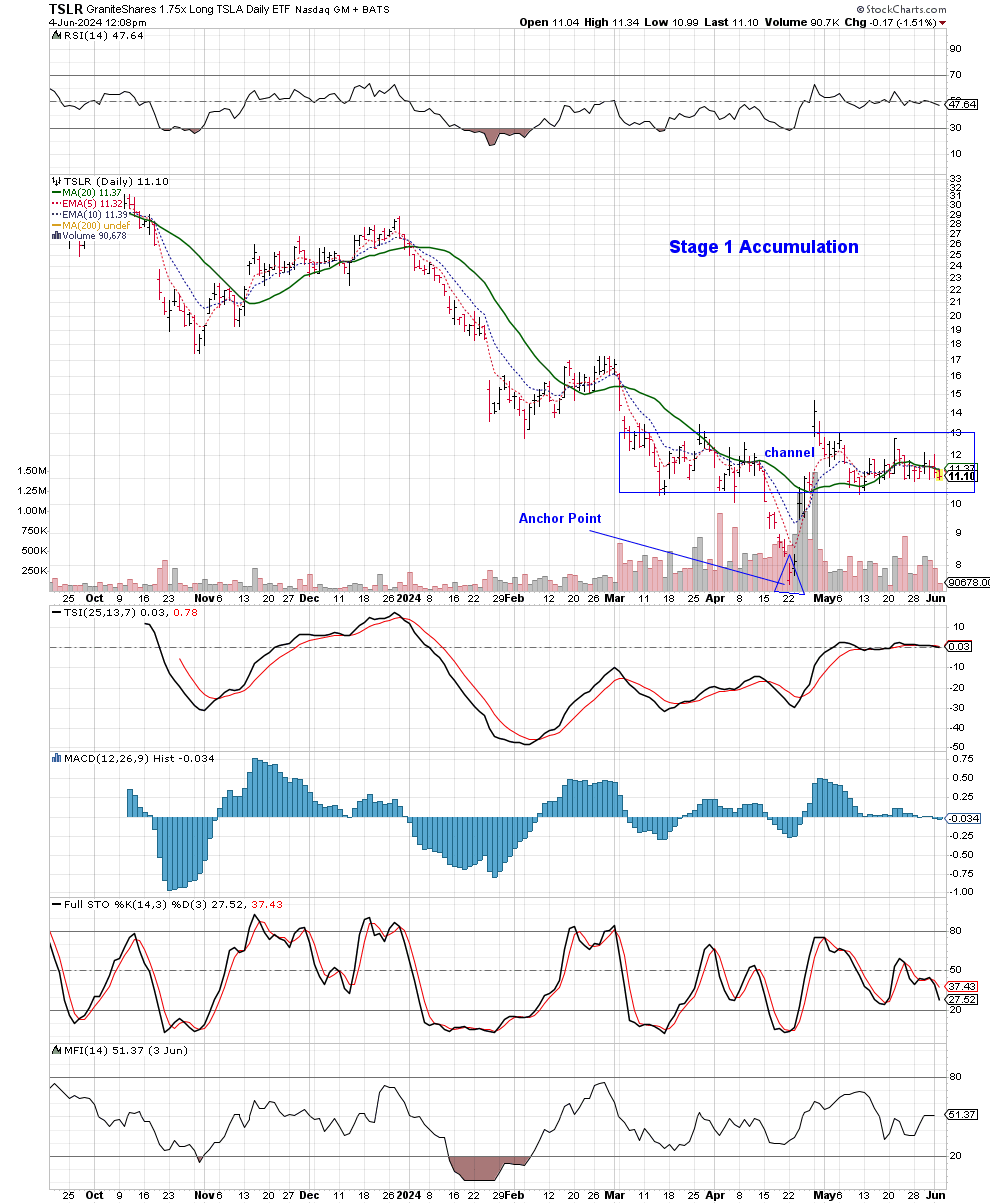

Today's message is about GraniteShares 2x Long TSLA ETF (TSLR), a 2x leveraged fund of Tesla (TSLA). Yesterday, price broke back above the 20-day SMA, confirming a stage 2 breakout according to the Money Flow Trading System.

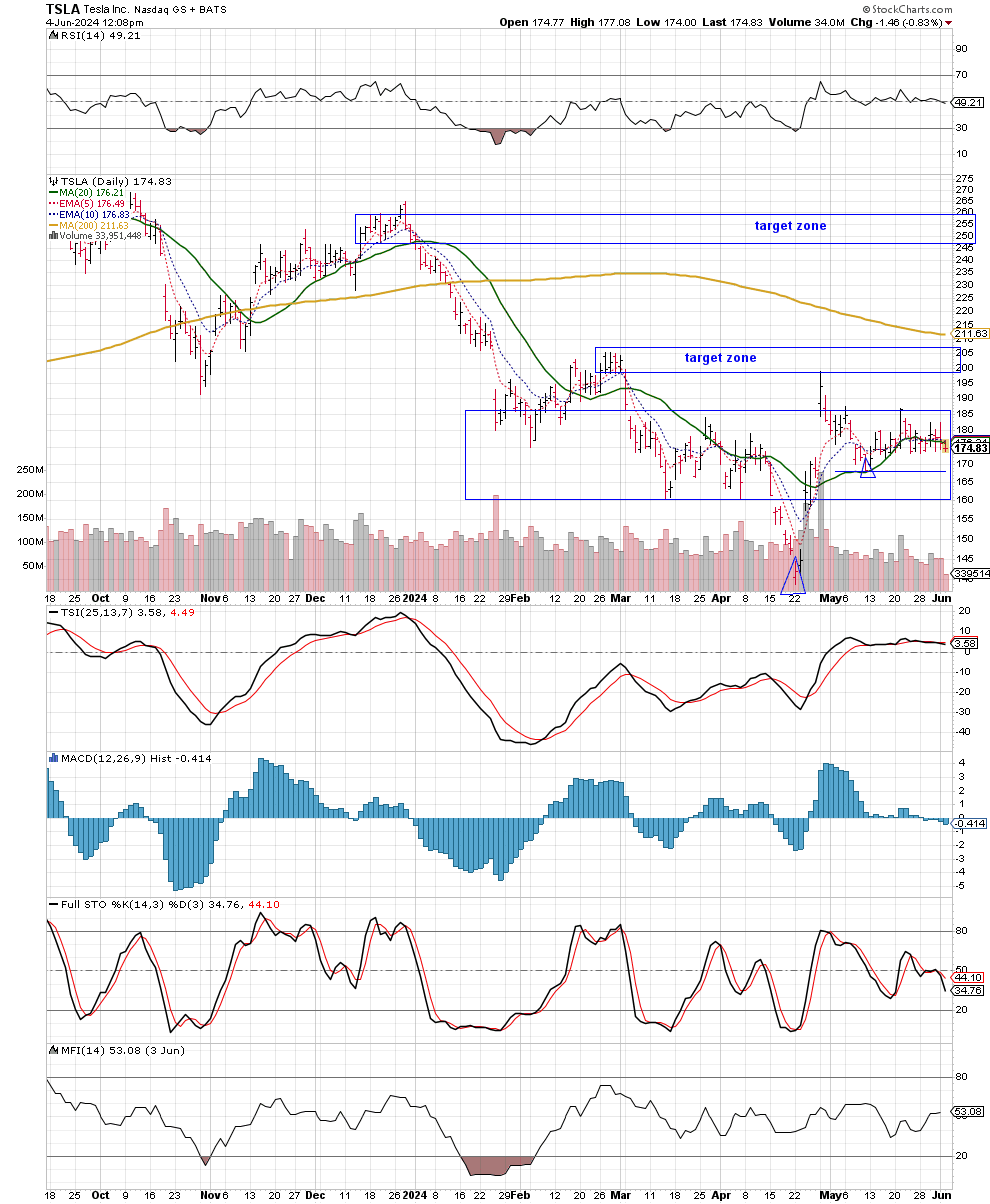

Typically, leveraged funds are not meant to be held long term. This gives us a perfect opportunity to open a leveraged swing trade in TSLR. When trading leveraged funds, it’s important to use the un-leveraged chart to make your analysis. In this case, use the TSLA chart.

The Case for Owning Tesla, Inc. (TSLA) Shares

Tesla, Inc. (TSLA) is a leading innovator in the electric vehicle (EV) market, energy storage solutions, and renewable energy generation. Founded in 2003, TSLA’s mission is to accelerate the world's transition to sustainable energy.

The company designs and manufactures electric vehicles, including the Model S, Model 3, Model X, and Model Y, as well as energy products such as solar panels, Solar Roof, and Powerwall.

[See TSLA (unleverged chart) below with stop zone and targets.]

See TSLA chart inside my “Trade Ideas” Chart Pack CLICK HERE

[See TSLR (2x leveraged TSLA chart) above with anchor point.]

Tesla's commitment to innovation extends to its development of the Full Self-Driving (FSD) software and 4680 battery cells, which promise to reduce costs and improve vehicle performance.

TSLA recently announced a limited-time 0.99% APR financing for the Model Y, aimed at boosting sales in the face of high-interest rates. This move makes owning a Tesla more affordable and attractive to a broader range of consumers, potentially increasing sales and market penetration.

TSLA’s development of the 4680 battery cells is a significant leap forward. These cells are expected to be cheaper than those from suppliers by the end of the year, thanks to technological innovations and improved production efficiency. This cost reduction is likely to enhance Tesla's margins and make its vehicles even more competitive.

TSLA continues to expand its global footprint, with notable performance in key markets such as China. The company's ability to register significant new vehicle numbers even amid economic fluctuations underscores its robust demand and growth potential.

Tesla's investment in a new lithium refinery in Texas exemplifies its dedication to securing the supply chain for battery production. This $1 billion investment will support the growing demand for EV batteries and strengthen Tesla's position in the sustainable energy market.

TSLA remains a pioneer in the EV industry, continually pushing the boundaries of technology and sustainability. With its strategic initiatives, innovative products, and commitment to cost efficiency, TSLA is well-positioned for continued growth, making it a compelling addition to any investment portfolio.

Consider adding shares of TSLA here, opening a swing trade in TSLR, and adding to extreme-yield fund TSLY for monthly dividend income. There’s always multiple ways to play the trade.

If you need help with identifying which stages your stocks are in, or using the Money Flow indicators, consider my course:

“The Money Flow Trading System Swing Trading Bootcamp!” CLICK HERE!

"Don't wish it were easier. Wish you were better." - Jim Rohn

Always remember, whatever you think about comes about, whatever you focus on grows. - GP

Purchase a hard copy of Gerald’s trading strategy book called The Money Flow Trading System.

We never know where the market is going to go. We do know the stock market climbs higher 70% of the time. Check your charts everyday and keep in flow.

If you need help with this, consider Gerald's course, "Getting Started with Stock Charts the Money Flow Way" and you will be ready to add shares to your portfolios on stage 1 when the markets are about to possibly rotate and trim profits when opportunities arise.

They say that you can’t buy bottoms or sell tops; The Money Flow Trading System can show you how to buy ALL the tops and the bottoms and stay in the flow.

That is what the Money Flow Trading System is all about. Being in flow with the stock market. Simple? YES! Easy? NO, but what in life that is worth having is? Stay the course, don't give up and don't get shaken out by wars, the Fed raising rates, rumors of recession, or any other event that may come.

Don't forget, 70% of the time the stock market climbs higher and the other 30% sets up for good buying opportunities.

Added to TSLL and TSLY 🤑

Thanks for all of these, GP! Loving the homework video as well.