MFG Trade of The Week

JNJ’s commitment to innovation is setting a new standard in the healthcare industry

Hey MFG!

All major indexes are pushing above their 20-day SMA. I’m all in across my leveraged and futures positions. I hope you added to your portfolios on this dip.

My last message to you was about my swing trades in AI, AIR, and WGMI. Since then, the MFG took profits in AIR. We have possible stage 2 breakouts underway in AI and WGMI. You could still add to these positions on any weakness.

Visit the new newsletter and make sure to subscribe to stay up to date:

geraldpeters.info

HOMEWORK! WATCH THIS WEEK’S MONEY FLOW SUNDAY SERVCE! CLICK HERE!

The Case for Owning Johnson & Johnson (JNJ) Shares

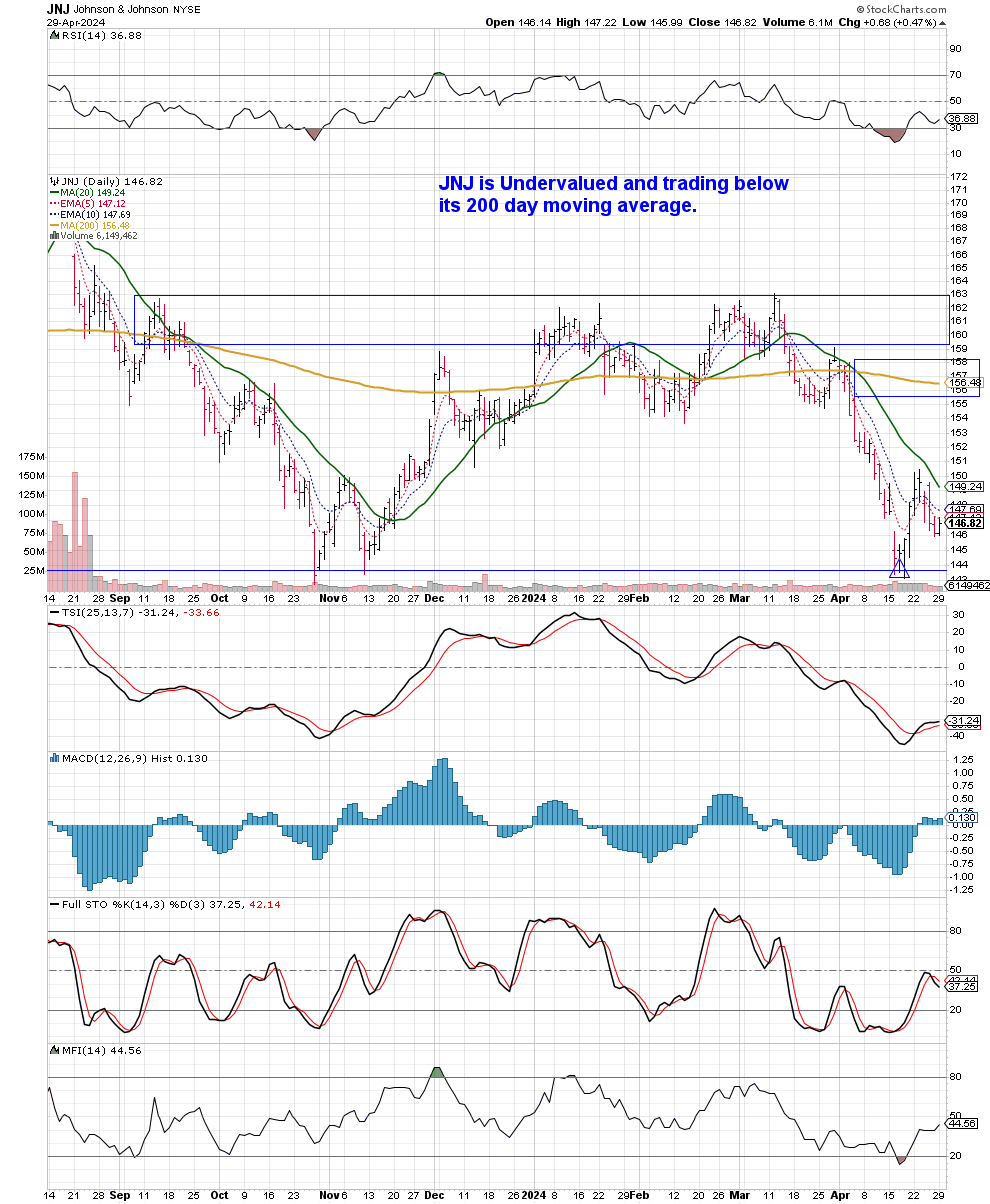

Today's message is about Johnson & Johnson (JNJ), a healthcare giant and dividend payer. It's currently in a stage 1 accumulation zone according to the Money Flow Trading System and trading below its 200-day SMA, which poses great opportunities to add to our buy and hold portfolios and put on a Bread-and-Butter Trade. I’m looking to start a BnB trade in JNJ and add some shares to my dividend portfolio.

JNJ is a leading pharmaceutical company that has consistently positioned itself at the forefront of medical and pharmaceutical innovation. It operates across three major segments: pharmaceuticals, medical devices, and consumer health. As JNJ looks towards the future, the company is poised to launch a series of groundbreaking products and technologies.

SEE JNJ CHART WITH STOP AND TARGETS CLICK HERE

JNJ has been focusing on developing consumer health products that utilize smart technology to improve everyday health management, such as smart patches that deliver medications based on biofeedback and apps that customize skincare treatments based on AI analysis. JNJ is also enhancing its drug discovery processes using AI, which can significantly speed up the development of new drugs by predicting efficacy and safety profiles.

Leveraging advanced biotechnology, JNJ is expanding its portfolio of biologics, which promises more precise treatment mechanisms for complex diseases like rheumatoid arthritis and psoriasis. JNJ is also investing in robotics to revolutionize surgical procedures including enhancements to accuracy and reductions in recovery times, which could redefine standard surgical practices.

JNJ’s commitment to innovation is setting a new standard in the healthcare industry!

If you need help with identifying which stages your stocks are in, or using the Money Flow indicators, consider my course:

“The Money Flow Trading System Swing Trading Bootcamp!” CLICK HERE!

Biotech and Pharmaceutical stocks (JNJ, PFE, BMY, GLD, ABBV, BLUE, CRSP) have gotten smashed over the past 2 years with the Covid-19 spike ending and the Fed's high interest rates creating a bear market and winter storm in these sub sectors. At some point, Big Pharma and Biotech stocks will bottom and rebound.

Investors could have a massive opportunity here in Biotech with stock prices so low and high potential for strong upside. If you don’t have any Biotech or Pharma exposure now would be a good time to do your research and consider starting some positions.

Start with the Healthcare sector (ticker: XLV) and dive deep into pharmaceuticals and biotechnology. Look for companies that have been really beat up with strong fundamentals and drug candidates in late stage clinical trials with good data and diversify. Be in Flow!

"Be fearful when others are greedy and greedy when others are fearful."- Warren Buffet

Always remember, whatever you think about comes about, whatever you focus on grows. - GP

Purchase a hard copy of Gerald’s trading strategy book called The Money Flow Trading System.

We never know where the market is going to go. We do know the stock market climbs higher 70% of the time. Check your charts everyday and keep in flow.

If you need help with this, consider Gerald's course, "Getting Started with Stock Charts the Money Flow Way" and you will be ready to add shares to your portfolios on stage 1 when the markets are about to possibly rotate and trim profits when opportunities arise.

They say that you can’t buy bottoms or sell tops; The Money Flow Trading System can show you how to buy ALL the tops and the bottoms and stay in the flow.

That is what the Money Flow Trading System is all about. Being in flow with the stock market. Simple? YES! Easy? NO, but what in life that is worth having is? Stay the course, don't give up and don't get shaken out by wars, the Fed raising rates, rumors of recession, or any other event that may come.

Don't forget, 70% of the time the stock market climbs higher and the other 30% sets up for good buying opportunities.

Thanks, GP

JNJ with the breakout today 💥💥