The MFG Bitcoin Vol 4 April 13th Update

Explore how the limited supply of Bitcoin makes it a rare asset in a digital age

The Money Flow Trading Society

After becoming the best performing asset of 2023, Bitcoin (BTC) has held the #1 spot in the indexes tracked by the MFG almost all of 2024. BTC surpassed its highs of 2021 and hit $73,000 setting a new all-time high. History was made in January with the SEC's approval of 11 Spot BTC ETFs, which began trading the next day. What started out as a speculative investment, BTC is now considered a real digital asset class with a fixed-supply of 21 million coins, which contributes to its value.

Grab a free copy of Gerald’s ebook You Don’t Have To Die Broke!

The MFG Bitcoin Vol 4 April 13th Update

BTC is both a risk on and risk off asset that offers transparency and decentralization compared to banks, which are opaque and centralized. There is no counterparty risk. We saw proof of this concept with the regional banks collapse in March 2023. BTC is the first peer-to-peer system that enables users to send and receive payments anywhere in the world with low transaction fees and high security. BTC can be divided into smaller units known as satoshis, allowing for micro-transactions.

BTC hit $73,000 and reached a new all time high, but has cooled off a bit. We have also see Bitcoin Cash (BCH) break out ahead of BTC and other coins and move parabolically. BTC will either go sideways, up, or down from here. Where it goes, I don't know; no one knows. I'm bullish and believe BTC is going higher and could go as high as the Moon. Either way, the MFG follows the Money Flow rules and has a plan to execute.

BTC has held its stage 3 consolidation zone. We never know when a stage 3 will become a stage 1. They are the same thing, just reversed. Price has moved sideways a bit and been hanging around its 20-day SMA giving us a chance to add to our positions. Stay bullish and have conviction. My first upside target is $100,000.

Visit the new newsletter and make sure to subscribe to stay up to date:

geraldpeters.info

BITCOIN NEWS UPDATE!

The SEC has officially approved the first spot BTC ETFs in the United States, marking a significant milestone for the cryptocurrency market. This approval, granted on January 10, 2024, follows a period of speculation and anticipation within the crypto and investment communities!

The SEC's approval encompasses 11 applications from major financial institutions, including BlackRock, Ark Investments/21Shares, and Fidelity, just to name a few. This development is expected to dramatically increase access to BTC for a wider range of investors, allowing them to gain exposure to BTC's price movements through a regulated investment product without the need to directly purchase or hold the cryptocurrency. Most of these ETFs began trading the day after their approval was announced, igniting competition among issuers for market share.

The approval is viewed as a significant positive step towards the institutionalization of BTC as an independent, unique asset class and is expected to offer a safer, more accessible way for investors to engage with BTC through their regular brokerage accounts. This approval came after years of rejections from the SEC, which had previously cited concerns over market manipulation and fraud.

The turning point appears to have been a court case won by Grayscale in August 2023, which challenged the SEC's rejection of its application to convert its Grayscale Bitcoin Trust into a spot Bitcoin ETF. Following this legal victory, the SEC reconsidered its stance, leading to the recent approvals.

Furthermore, the SEC's decision has sparked interest in the potential for future approvals of ETFs for other cryptocurrencies, like ETH, SOL, and XRP suggesting that this could be the beginning of a broader acceptance of crypto-based ETFs. Despite the regulatory approval, SEC Chair Gary Gensler reiterated that BTC remains a "speculative, volatile asset" and emphasized that the approval does not signify an endorsement of BTC or a relaxation of the SEC's oversight of the crypto market.

This historic approval represents a significant leap forward for the cryptocurrency industry, potentially paving the way for greater institutional participation and wider adoption of BTC and other cryptocurrencies as legitimate components of investment portfolios.

Bitcoin Halving Event 2024

Halving is when the block reward for mining BTC is cut in half and occurs every 4 years. The 4th BTC halving event is anticipated to occur on April 20, 2024. Right now the daily production cap is 900 BTC, after the halving it will be 450. Historically, halvings have boosted BTC’s price.

What's unique about this halving event is the supply is more limited as ETF managers like Ark, Fidelity and Black Rock and others are buying the liquid supply. The ETF approval gave institutions and retail investors a frictionless way to gain exposure to BTC without having to own the underlying asset.

Bitcoin's Blueprint: Digital Scarcity

BTC is fundamentally about digital scarcity, a concept that is central to its value and operation. Unlike traditional currencies that can be printed endlessly by governments, BTC has a fixed supply limit of 21 million coins, which is expected to be reached by around 2140. This scarcity is enforced through the network's underlying blockchain technology, specifically through a mechanism known as the "halving."

Every 210,000 blocks, or approximately every four years, the reward that miners receive for adding a new block to the BTC blockchain is cut in half. The halving decreases the rate at which new bitcoins are created, which gives the cryptocurrency its deflationary characteristic. The halving helps to ensure that Bitcoin's supply will grow at a predictable and decreasing rate towards the 21 million maximum.

Digital scarcity is crucial because it creates a predictable and limited supply, which can help to maintain or increase value over time if demand remains steady or increases. This contrasts sharply with traditional fiat currencies, which can suffer from inflation when too much money is printed.

BTC's approach to digital scarcity has inspired the creation of other cryptocurrencies and digital assets, each with their own mechanisms for creating scarcity and value. These can include other capped supply cryptocurrencies, unique digital tokens, and even non-fungible tokens (NFTs), which use blockchain technology to create one-of-a-kind digital items.

Purchase a hard copy of Gerald’s trading strategy book called The Money Flow Trading System.

BTC Daily Chart

BTC is currently in a stage 3 consolidation zone, but could be possibly forming a new stage 1. Any time price drops below the 20-day SMA, I turn on my daily drip BTC buys.

BTC is going to the moon!

My three upside targets on BTC are:

$100,000

$500,000

$1,000,000

Again, let me point out that I have no clue where BTC is going; no one knows! Bitcoin and blockchain technology are just in the beginning phase and could be much bigger than the mind can imagine. I'm a HODLer and believer that BTC could go to affinity and beyond. How many people do you know that actually own BTC? Seriously, or that have a cold wallet or added it to their 401(k)s yet? Most likely, not very many. That being said, we are still in the beginning. HODL your BTC and build your positions. Ride the Wave.

Video of BTC Documentary- "This Machine Greens" which explores BTC's complex relationship with energy and makes a compelling case for BTC as a net positive for the environment.

Common ways to get exposure to Bitcoin:

$BTCUSD, GBTC, BITO, BITX

Bitcoin mining companies:

CLSK, MARA, RIOT

11 new spot BTC ETF Approvals:

GBTC, IBIT, FBTC, ARKB, BITB, BTCO, BTCW, HODL, EZBC, BRRR, DEFI

Which spot ETF will win? No one knows for certain, but currently BlackRock’s iShares Bitcoin Trust (IBIT) is leading the way and Fidelity's Wise Origin Bitcoin Trust (FBTC) is following right behind. After these 2 leading ETFs, is ARK's 21Shares Bitcoin ETF (ARKB).

We are in a crypto bull market, but really just getting started. BTC is the wind for the crypto market. If BTC continues its trend, it will pave the way for alt coins to pop 4-5x; we saw this last bull run in 2021. Follow your charts, take profits when necessary, add on stage 1s, and HODL!!! Don't be too quick to sell your winning coins. BTC is just at its inception as an asset class. Be patient and stay in flow.

My largest position now- Bitcoin Cash (BCH)

Common ways to get exposure to Bitcoin Cash:

$BCHUSD, BCHG

BCH Daily chart

We currently have a possible stage 4 decline underway in BCH giving us another chance to add to our positions. Downside targets $500, $380, and $290.

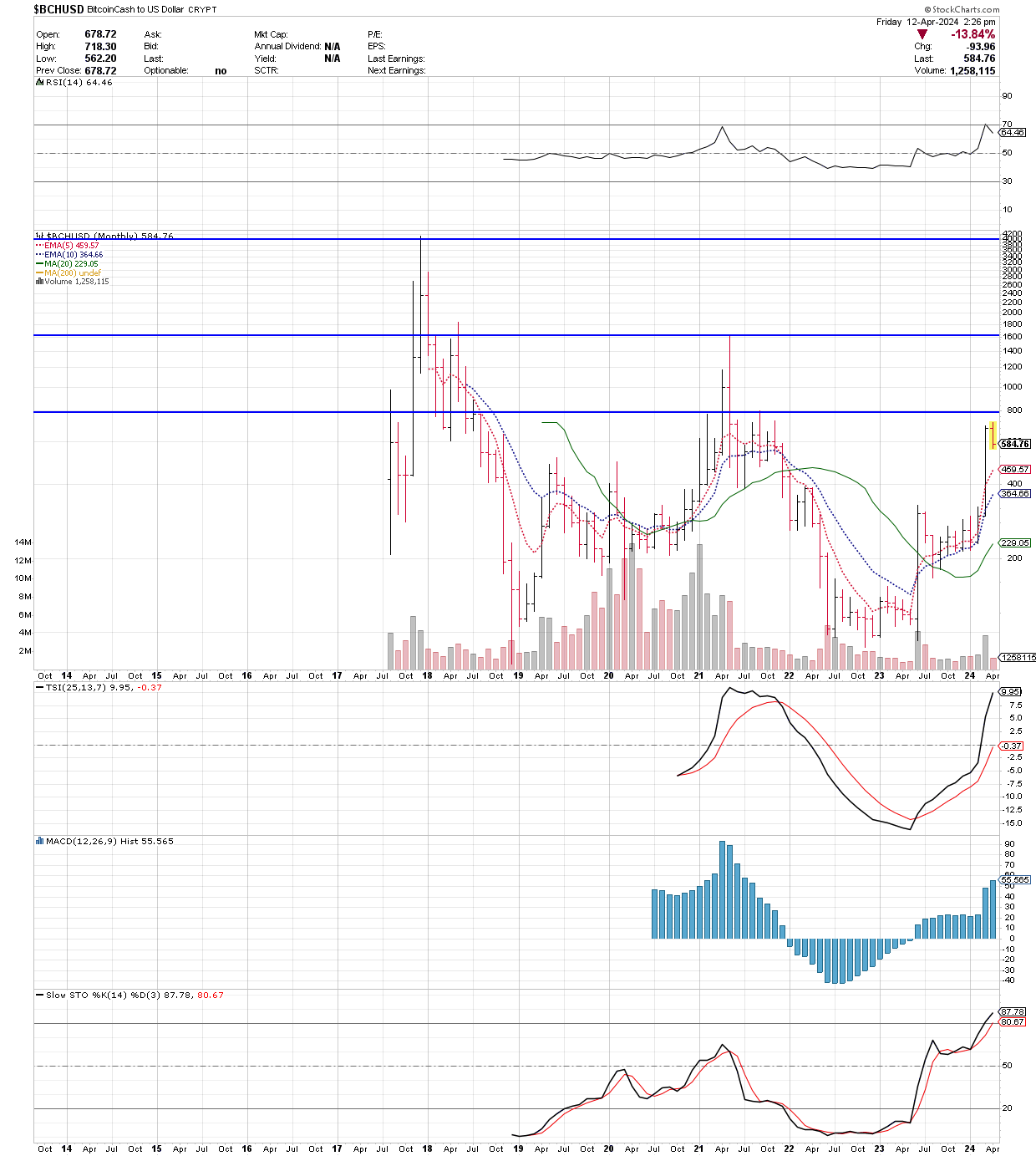

BCH Monthly chart

My four upside targets on Bitcoin Cash (BCH) are:

$800

$1,600

$4,000

$10,000 Hail Mary target...

What is Bitcoin Cash (BCH)?

Bitcoin Cash (BCH) brings sound money to the world, fulfilling the original promise of Bitcoin as "Peer-to-Peer Electronic Cash." Merchants and users are empowered with low fees, quicker transactions, and reliable confirmations. The future shines brightly with unrestricted growth, global adoption, permission-less innovation, and decentralized development.

The Story Behind Bitcoin Cash (BCH)

The story behind Bitcoin Cash (BCH) is deeply intertwined with the ongoing debates and challenges surrounding BTC's scalability. As BTC grew in popularity, it became evident that its underlying technology had limitations in terms of how many transactions could be processed quickly and efficiently. The heart of the dispute was how to best scale BTC to accommodate its growing user base and transaction volume.

Prelude to the Fork

BTC transactions are recorded in a public ledger known as the blockchain. The blockchain is made up of blocks, and at the time, each block in the BTC blockchain was limited to 1 megabyte (MB) in size. This limitation was initially implemented to prevent spam attacks on the network, but eventually led to scaling issues as BTC's usage increased. The 1 MB block size cap meant that the network could only handle a limited number of transactions per second, leading to delays and increased transaction fees during periods of high demand.

The Scaling Debate

The Bitcoin community was divided on how to solve the scaling issue. Two primary camps emerged:

Those advocating for a larger block size believed that increasing the block size would allow more transactions to be processed within each block, thereby increasing the network's capacity. This approach aimed to keep transaction fees low and processing times fast, making BTC more practical for daily transactions.

Those advocating for keeping the block size small preferred to explore off-chain solutions like the Lightning Network to handle the increased transaction volume. They argued that increasing the block size would lead to greater centralization since larger blocks could require more resources to process and store, potentially pricing out smaller participants.

The Hard Fork

After years of debate and failed attempts at compromise, the disagreement led to a significant event in Bitcoin's history: a hard fork. A hard fork is a change to the protocol that is not backward compatible, meaning that nodes (computers running the software) that do not upgrade to the new version are separated from the network.

On August 1, 2017, a group of developers, miners, and users who supported the larger block size proposal initiated a hard fork of the Bitcoin blockchain, creating Bitcoin Cash (BCH). BCH featured an increased block size limit of 8 MB, aimed at allowing more transactions per block. The fork meant that anyone who held BTC at the time of the fork would automatically receive an equivalent amount of BCH, effectively creating a new cryptocurrency.

Aftermath and Legacy

BCH itself has undergone further forks and debates about its direction and development. For example, in November 2018, another contentious hard fork of BCH resulted in the creation of Bitcoin SV (BSV), which further increased the block size limit.

The creation of BCH marked a significant moment in the evolution of blockchain technology and cryptocurrency. It highlighted the challenges of governance and scalability in decentralized networks and sparked a broader discussion on how best to develop blockchain technologies to accommodate the needs of a growing user base.

Despite the controversies and challenges, BCH remains an active and significant player in the cryptocurrency space, committed to its vision of fast, reliable, and low-cost transactions.

What is the difference between Bitcoin (BTC) and Bitcoin Cash (BCH)?

BTC and BCH share a common origin up until August 1, 2017, when BCH was created through a hard fork of the original BTC blockchain. This event marked the divergence of two distinct cryptocurrencies with differing philosophies, technical specifications, and objectives. Here are the key differences between BTC and BCH:

Block Size Limit

Bitcoin: The original Bitcoin network has a block size limit of 1 MB. This was a design choice to make blocks propagate quickly and to keep the network accessible to individuals with less powerful computing resources, with a focus on maintaining decentralization; however, it limits the number of transactions that can be processed per block, affecting transaction throughput and speed, especially during peak times.

Bitcoin Cash: Bitcoin Cash was created with an initial block size limit of 8 MB, which was later increased to 32 MB, and proposals exist to increase it further if needed. The larger block size allows BCH to process a significantly higher number of transactions per block, aiming to improve transaction speed and reduce fees, making it more feasible for everyday transactions.

Scalability and Transaction Fees

Bitcoin: Due to its smaller block size, BTC has experienced periods of congestion, leading to higher transaction fees and longer confirmation times during peak usage. Solutions like the Lightning Network have been implemented to address these issues by optimizing block space and enabling off-chain transactions, respectively.

Bitcoin Cash: By increasing the block size, BCH aims to accommodate more transactions in a block, reducing the likelihood of congestion, keeping transaction fees lower, and making it more practical for small transactions and everyday use.

Philosophical and Practical Focus

Bitcoin: BTC is primarily seen as a store of value and digital gold. Its community tends to prioritize security, decentralization, and immutability over transaction throughput. While there are efforts to make BTC more scalable, the core philosophy emphasizes cautious and minimal changes to the protocol to maintain its robustness and security.

Bitcoin Cash: BCH emphasizes being a currency, medium of exchange, or electronic cash. The community behind BCH believes in on-chain scaling as a primary method to achieve a global payment system, making it more focused on transactional utility.

Bitcoin remains the leading cryptocurrency by market capitalization and is favored for its qualities as a store of value, while Bitcoin Cash aims to fulfill the vision of Bitcoin as a peer-to-peer electronic cash system, with a focus on fast, low-cost transactions suitable for everyday use.

I'm very bullish on BCH. My goal is to accumulate 40 coins to buy an apartment building. I own both BTC and BCH and you should too. Remember, see BTC as a store of value, or digital gold, and BCH as a currency.

-G.P. aka Gerald Peters

GP this article was incredibly, it broke it down for me like nothing else. Thanks so much🤛🤛🤛

Great write up! Thank you