The Next Bull Run.. lets talk about it

and Remember No One Knows Anything

The Next Bull Run Stay in Flow.

By Gerald Peters | Money Flow Trading Society | @FullAuto11

THE NEXT BULL RUN ——-

Everybody’s trying to figure out where we are — bull market, bear market, or just noise.

But let me tell you straight: we’re in a bull market.

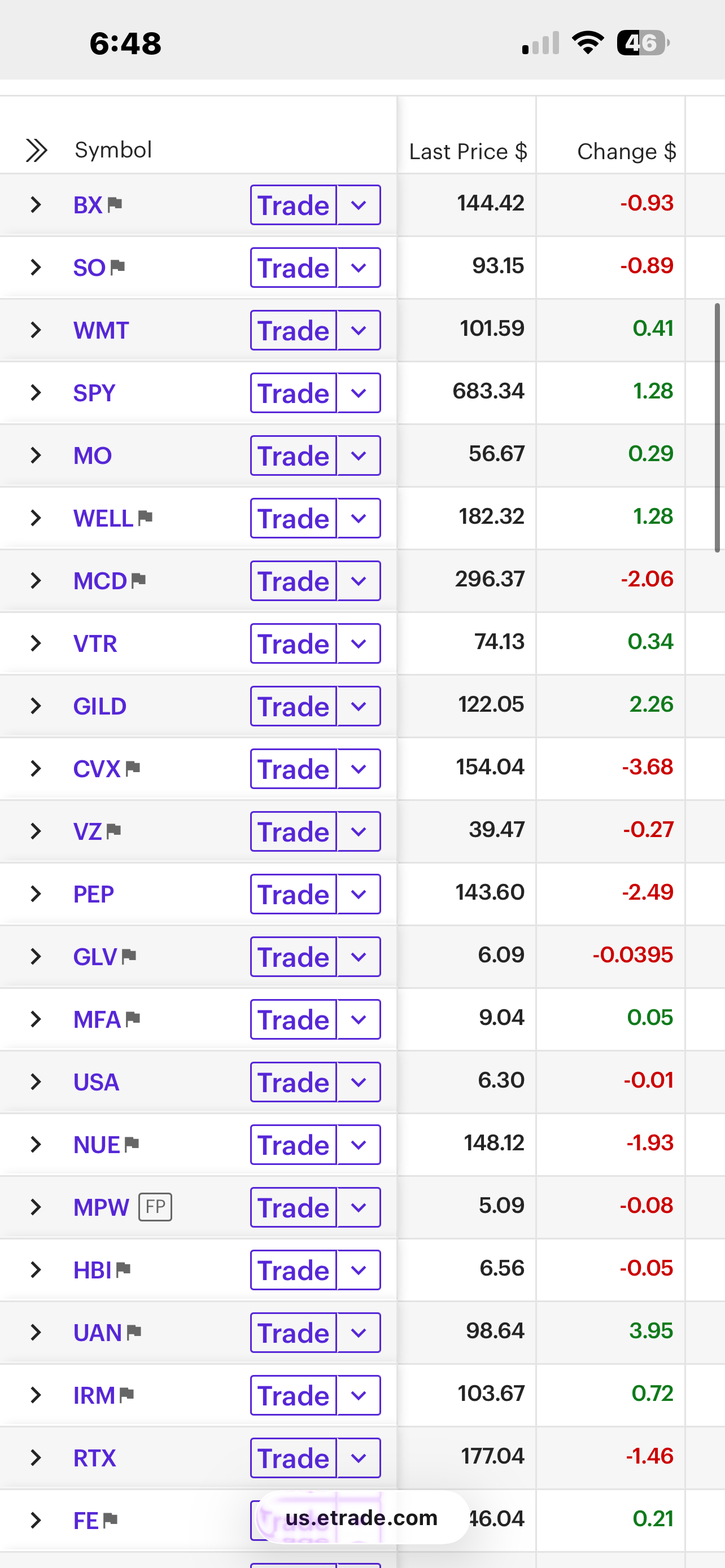

The market keeps marching. The S&P 500 closed another solid week, up roughly 0.7%, driven by strength in tech and consumer discretionary. The flow is back in motion — money moving toward the names that lead when optimism returns.

This week was packed: earnings, the Fed, and trade headlines out of Washington and Beijing. Yet through the noise, the tape stayed bullish.

Would you like to Start a Second Income Stream without a Second Job? Earn Real Passive Income! Start today and start earning income next week. CLICK HERE and see what 100s others are doing each day to collect income

By Friday’s close, the S&P 500 sat at 6,840.20, putting it +2.3% for the quarter and +16% year-to-date.

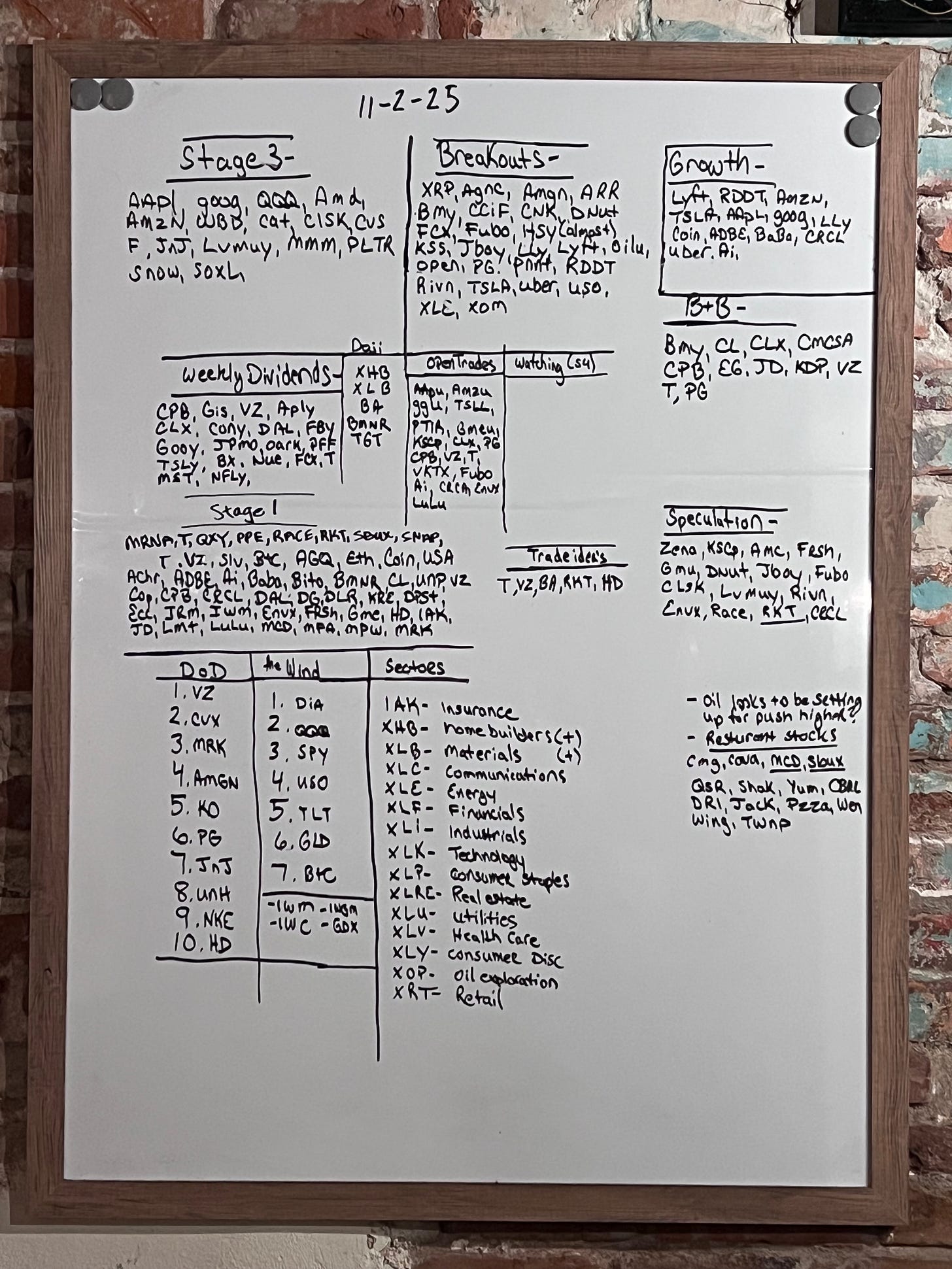

G’s Sunday Homework White Board: 11-3-25

See page 38 of ThePetersReport.com

• Amazon (AMZN) 🔼 +8.9% — strong quarter, powerful br2eakout.

• Alphabet (GOOG/GOOGL) 🔼 /+8.2% — search and cloud strength.

• Apple (AAPL) 🔼 +2.9% — steady as always.

• Meta (META) 🔽 –12% — got hit hard after guidance on AI spending.

• Microsoft (MSFT) 🔽 –1.1% — small dip after announcing higher capital expenditures.

⸻

Even with a few stumbles, the giants keep carrying this market. More than a third of the S&P’s total weight sits in these seven names — when they move, the market listens.

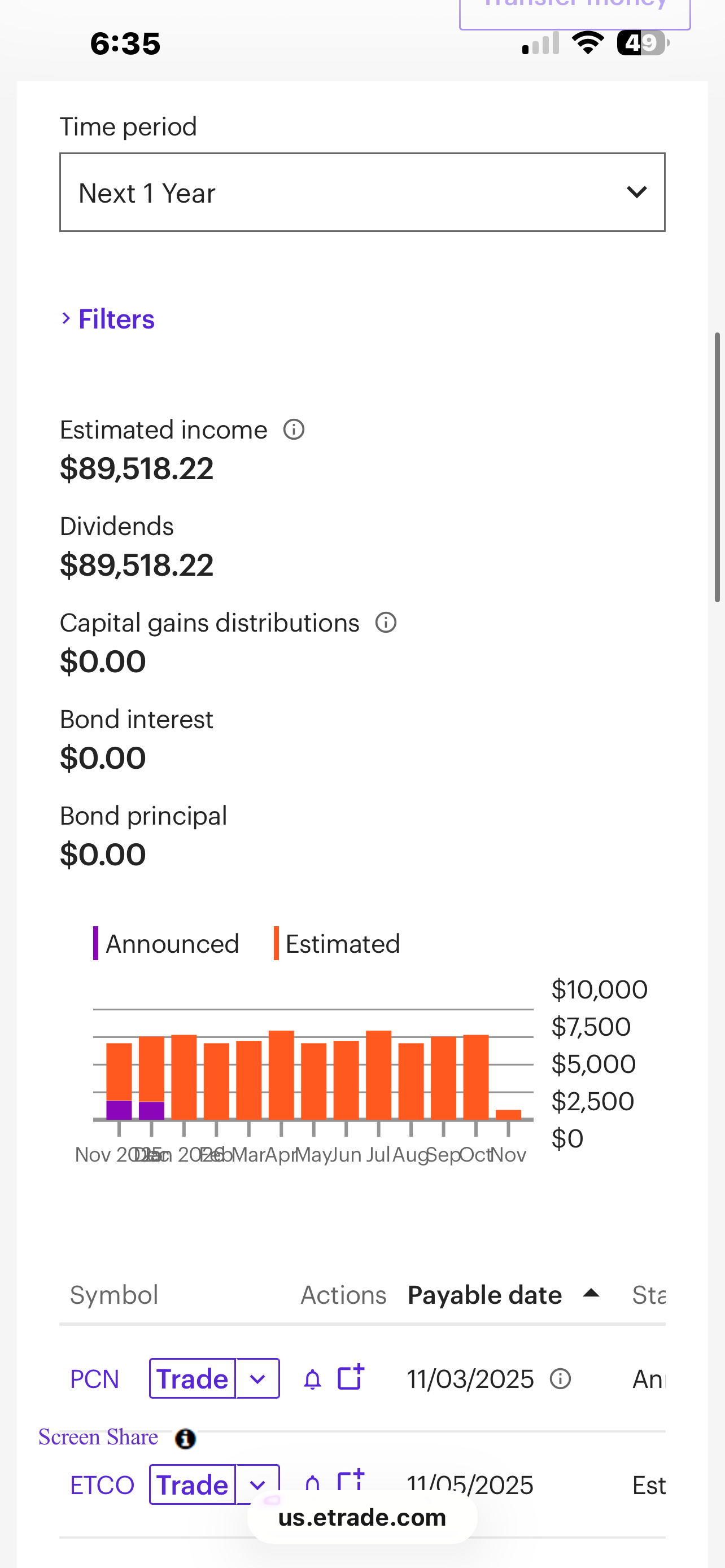

I anticipate collect $89,519 in passive dividend income this year. Simply amazing.

Trade Talks & The Trump–Xi Agreement

President Trump met with China’s President Xi Jinping Thursday to finalize a one-year trade deal.

China agreed to resume soybean purchases and extend certain rare-earth exports, easing some global trade tension.

Markets like clarity — and that meeting helped keep sentiment positive heading into November.

⸻

Weak Spots: Real Estate Takes a Hit

Not everything was rosy. Alexandria Real Estate (ARE) dropped 25% this week after falling short on Q3 estimates and lowering its full-year guidance. The stock has been a benchmark for rate-sensitive REITs, and it’s demonstrating the impact of tighter liquidity.

It’s possible we see a 25% haircut across the whole sector. Not ideal, but that’s the game. Some names will hold up better than others, and a few might even have to trim dividends deeper. But make no mistake—the industry isn’t going anywhere.

Over the past decade, I’ve made solid money trading in and out of MBS REITs, commercial property REITs, student housing REITs, and assisted living REITs.

⸻

Coming Up Next Week

Earnings on deck:

Amgen (AMGN) Chart Markup

• Uber Technologies (UBER) Chart Markups.

• Advanced Micro Devices (AMD) Chart Markups

We’ll also get key private data releases since the government shutdown has delayed some federal reports. Watch for:

• ISM Manufacturing & Services PMI

• Challenger Job Cuts

• Michigan Consumer Sentiment Survey

⸻

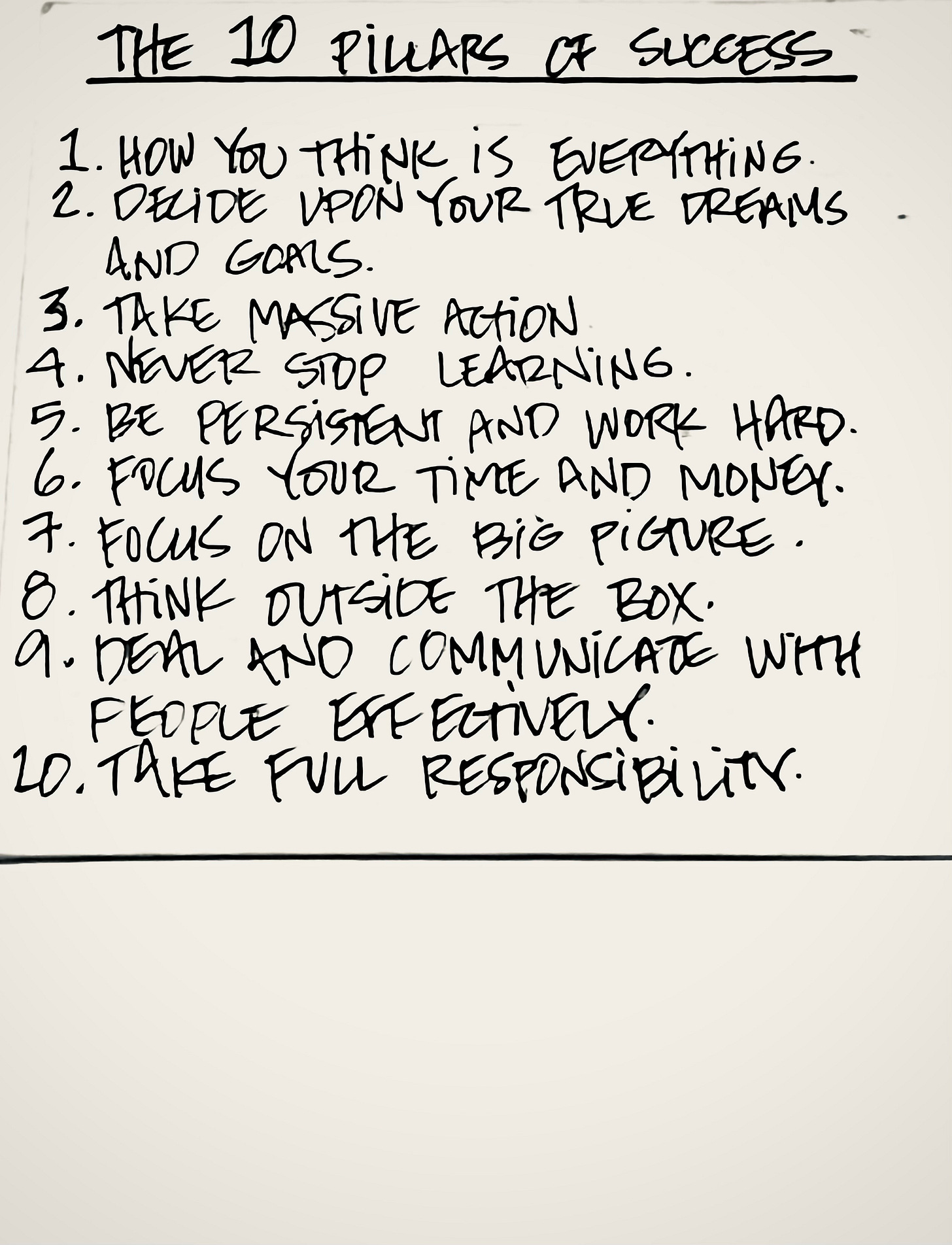

My Take

The market continues to reward patience and position. The flow is clean — rotation beneath the surface, leadership intact.

Watch for dips to get bought. Stay close to strength.

Money is moving. Be where it’s flowing.

MFG — stay sharp, stay focused, stay in the flow.

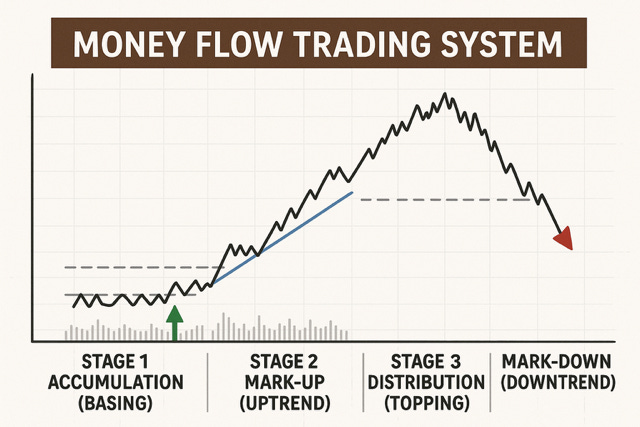

STAGE 1:

This is the accumulation zone. Time to start accumulating shares.

Stage 2 is your breakout—this is where you buy. You want to enter on the breakout bar, not two or three bars later. That’s too late. The ideal setup is getting positioned just before the breakout happens. Don’t hesitate. Scan your charts, spot the setup, and be ready to strike right before that Stage 2 move kicks off.

Stage 1’s ARE BUYABLE UNLESS THEY ARE BREAKOUT CANDLE AWAY FROM THE BREAKOUT CANDLE.

YOU DON’T WANT TO OVERPAY, VERY IMPORTANT. DON’T CHASE STOCKS

I have this week’s TOP Low Risk, HIGH Potential Return, individually Picked Swing Trade.