The Peters Report: Nvidia Stock Got Smashed!!

As goes NDVA?! So goes the markets?! We’ll see!!

Hey, MFG!

Here's a quick update on the recent news surrounding NVIDIA Corp NVDA 0.00%↑ stock and its price movement.

NVDA recently reported a significant increase in revenue, with a 122% jump to $30.04 billion, driven largely by the booming demand for AI technologies.

Despite these strong earnings, NVDA’s stock saw a decline of about 3% in after-hours trading. This drop occurred because, while the company beat revenue expectations, it wasn't enough to satisfy the sky-high expectations investors have set for NVDA, reflecting a sense of market caution.

Additionally, there are concerns about potential delays in the launch of NVDA’s next-generation Blackwell AI chips, which may have contributed to the cautious reaction from investors.

Despite the immediate dip, the long-term outlook for NVDA remains positive, with analysts maintaining bullish price targets, suggesting this could be a temporary setback.

This market reaction underscores the importance of setting realistic expectations even for high-performing companies and highlights the volatility that can come with investing in tech stocks.

When stocks get smashed, they present opportunities for traders and investors to capitalize on. Just so you know there are a few a ways you can play this trade.

NVDA 0.00%↑ is not quite a buy here yet according to The Money Flow Trading System, but let’s see where price closes today. This stock is definitely on my watchlist.

Let’s dig into different ways to play NVDA and at the end, I’ll give you a video of me covering the multiple ways I approach this trade and how you can play too.

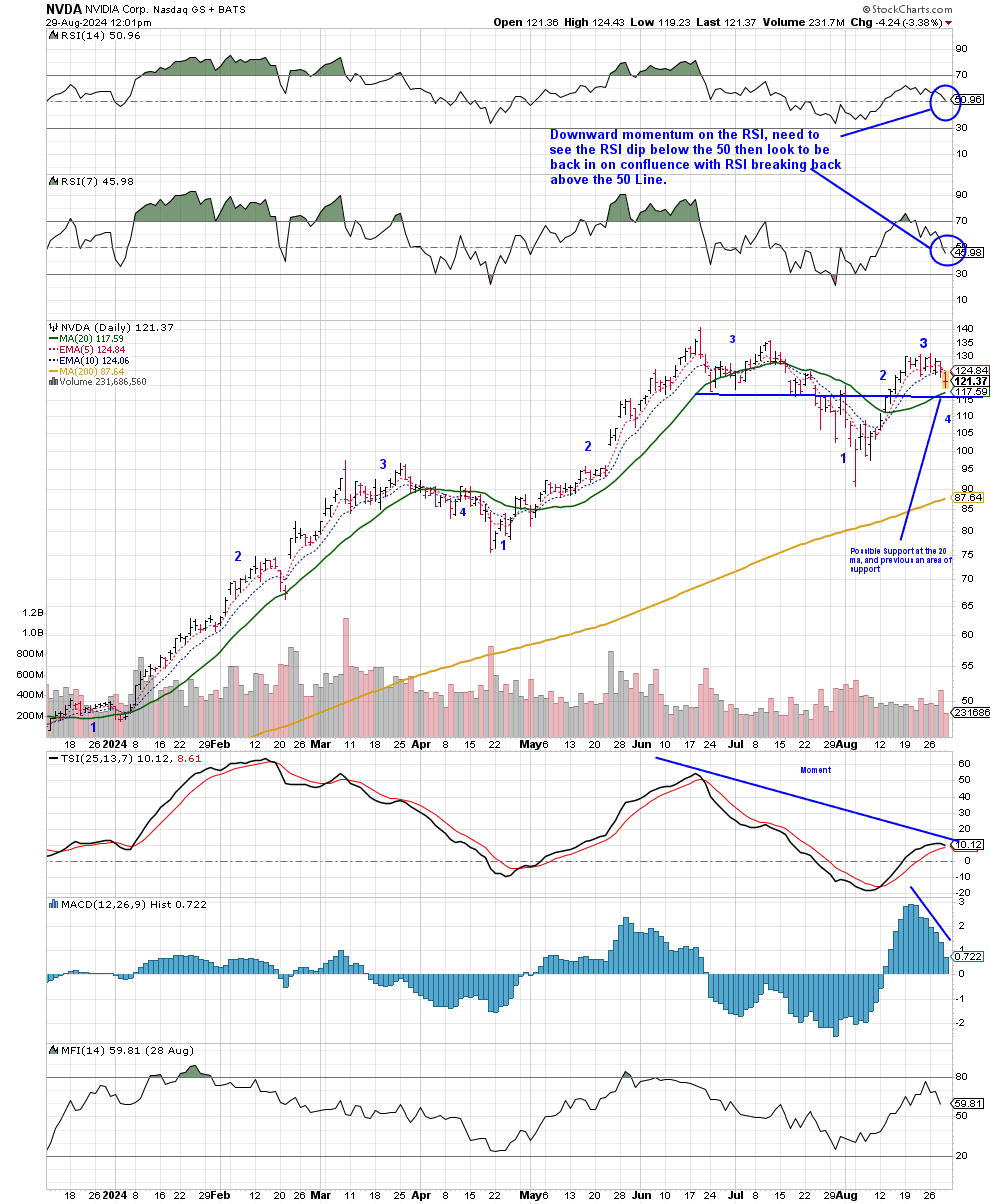

Always remember to use the unleveraged chart for your trade analysis and plan.

[See NVDA chart below.]

👆👆NVDA chart, the underlying stock of NVIDIA vs. the 2x leveraged daily NDVA ETF NVDX chart. 👇👇

[See NVDX NVDX 0.00%↑ chart below.]

Grab a free copy of Gerald’s life-changing ebook “You Don’t Have To Die Broke!” CLICK HERE!

Here are multiple ways to play the NVDA trade:

NVDA - This is the underlying stock of NVIDIA Corporation. Buying NVDA shares provides direct exposure to the company’s performance and its role as a leader in the AI and semiconductor markets.

NVDX NVDX 0.00%↑ - T-Rex 2x Leveraged Long Daily NVDA ETF offers leveraged exposure to NVDA, allowing investors to potentially amplify their returns by doubling the daily performance of the stock. This is suitable for traders looking to capitalize on short-term price movements.

NVD NVD 0.00%↑ - The GraniteShares 2x Leveraged Short Daily NVDA ETF provides a way to profit from declines in NVDA’s stock price by offering leveraged short exposure. This ETF is designed for those who anticipate a drop in NVDA’s share price and want to profit from it.

NVDY NVDY 0.00%↑ - YieldMax NVDA Option-Income Strategy ETF is focused on generating income from NVDA by using an options-based strategy. This can be an appealing choice for investors looking to earn monthly income while maintaining exposure to NVDA’s stock.

DIPS DIPS 0.00%↑ - YieldMax NVDA Short Option-Income Strategy ETF also utilizes an options-based strategy, but with a short bias, aiming to generate monthly income from a bearish stance on NVDA. This is ideal for investors who believe the stock might face downward pressure and want to generate income from that view.

These diverse trading options cater to a range of investment strategies, from direct exposure to income generation and leveraged trading, allowing investors to tailor their approach based on market conditions and their financial goals.

See NVDA chart inside my “Trade Ideas” Chart Pack CLICK HERE

See NVDX chart inside my “Trade Ideas” Chart Pack CLICK HERE

To purchase GP’s Trading Book- The Money Flow Trading System CLICK HERE

Here is a link to my article covering leveraged funds and my trading strategy for these funds.