Hey, MFG!

The Dow Jones (DIA) closed at a record high today, while the S&P 500 (SPY) and Nasdaq (QQQ) lagged behind due to some tech stocks, such as, TSLA, NVDA, SMCI, MU, AVGO, and AMD dropping. Energy (XLE), Consumer Staples (XLP), and Utilities (XLU) were the best performing sectors of the SPY.

Gold (GLD) continues to climb higher after hitting another new all-time high last week. Bonds (TLT) have been pushing up against previous highs and trading in a wide upward-sloping channel. Oil (USO) has entered a stage 2 breakout right back above its 200-day SMA.

The breakout in Bitcoin (BTC) has lost some momentum and trading right below its 200-day SMA. Bitcoin Cash (BCH) seems to becoming back into a stage 1 accumulation zone below its 200-day SMA. Always stay bullish.

LIMITED EDITION MFG MERCH SHOP CLOSES THIS FRIDAY!! CLICK HERE!!

In The Peters Report tonight, I’m providing a comprehensive update on the notable trades I’m currently tracking in the MFG portfolio.

As we navigate the latest market movements, it's crucial to follow your charts, keep track of your positions, and adjust your strategies accordingly.

Below, you'll find the latest insights and actions taken on our key trades.

Always remain bullish and follow The Money Flow.

The Peters Report - Stock & Crypto Trader’s Resource

-GP a.k.a Fullauto11 🧙🐼

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

The Peters Report: Swing Trade Updates

1. Airbnb Inc (ABNB) 📦

ABNB ABNB 0.00%↑ is still in a stage 1 accumulation zone. As long as price stays above the 5-day EMA, I plan to drip add shares here.

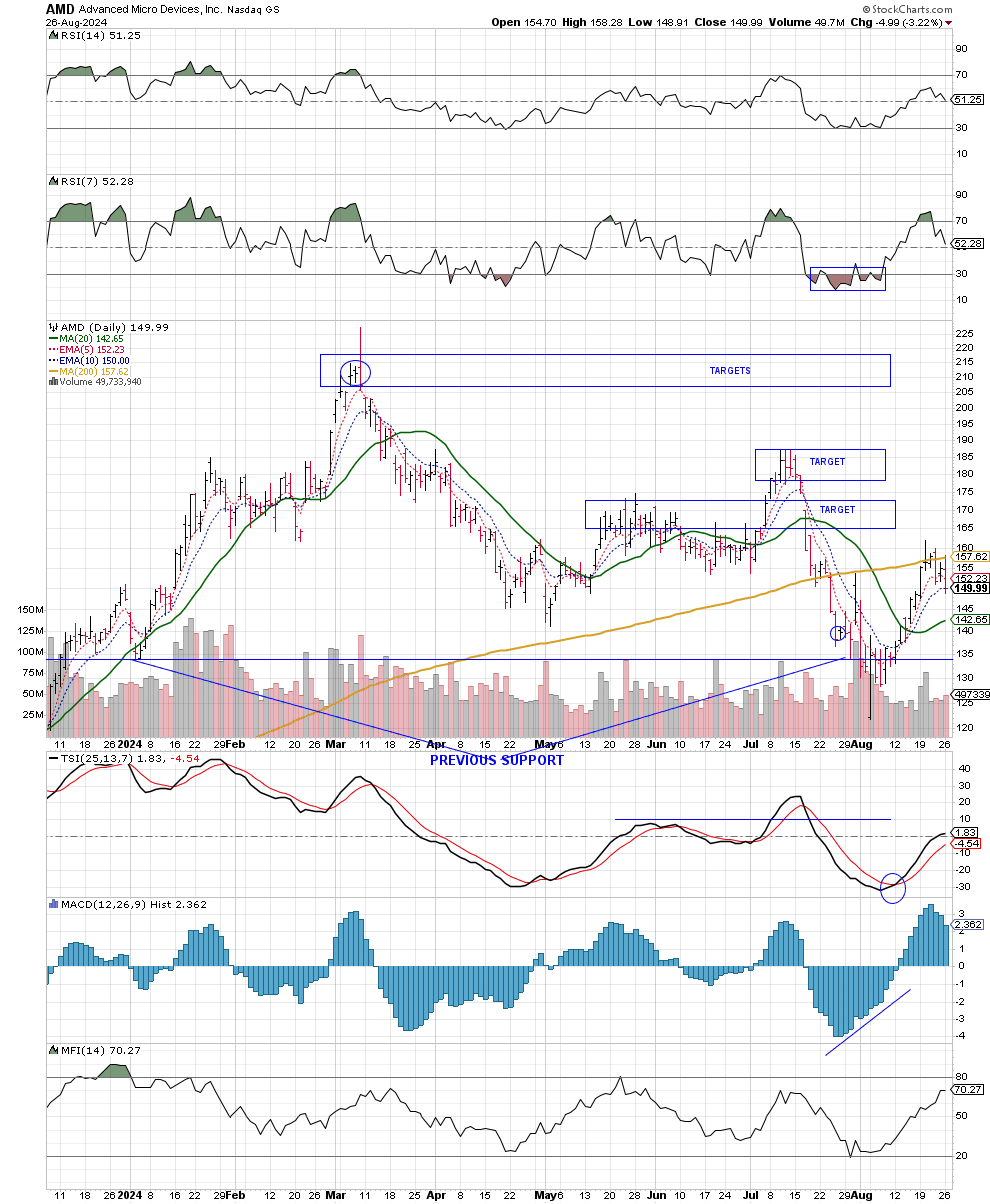

2. Advanced Micro Devices, Inc (AMDL) 💥

I took 15% of profits in my 2x AMD leveraged swing trade in AMDL AMDL 0.00%↑ on 8/20/24. The market had gone up for 2 weeks straight, price hit overhead resistance, tagged the 200-day SMA, and closed with a doji reversal on the AMD AMD 0.00%↑ chart. I was up 30% in AMDL so I trimmed a bit of shares to lock in some gains at this resistance level.

3. Maplebear Inc (CART) 💥

CART CART 0.00%↑ has been in a beautiful stage 2 uptrend and approaching an extreme-high RSI. Swingers, be ready to trim at an extreme-high RSI and $38 target. I haven’t trimmed any shares since I started my position. I have strong, longterm conviction in this stock.

4. Chevron Corp (CVX) 💥

CVX CVX 0.00%↑ has entered a stage 2 breakout and tagged its 200-day SMA to complete its Bread & Butter (B&B) trade. If CVX was a B&B trade for you, congratulations! Trade is over. There is still lots of room on the 14-day RSI for price to run to its second target of $160. You could look to add shares on any weakness or the 14-day RSI dipping below 50.

Grab a free copy of Gerald’s life-changing ebook “You Don’t Have To Die Broke!” CLICK HERE!

5. Krispy Kreme Inc. (DNUT) 📦

I like DNUT DNUT 0.00%↑ here. I’m a buyer of shares under $12 and plan to continue to build my position. I’m holding this stock until it hits its true value range of $14-15. First target is its 200-day SMA- the B&B swing trade target.

6. McDonald’s Corp (MCD) 🎉

It’s time to trim MCD MCD 0.00%↑ again! Price blew through its 200-day SMA and completed its B&B trade in the beginning of August. MCD has now approached its second target zone and banged an extreme-high RSI here. I plan to take more profits and downsize my position. True value is $300.

8. Altria Group Inc. (MO) 🎉

MO MO 0.00%↑ is one of the MFG portfolio favorites. Lots of members in the MFG Discord have been accumulating shares of this stock for years. It’s nice to see MO go on a runaway while printing lucrative dividends on the way. Congratulations to you, if you’re in MO!! Look to lock in some gains here while price is trading at an extreme-high RSI reading and let the rest of your position run.

9. Occidental Petroleum Corp. (OXY) 📦

Oil (USO) is in a stage 2 breakout above its 200-day SMA. I’m expecting a breakout in OXY OXY 0.00%↑ this week. First target is the 200-day SMA and second target is $64. OXY is still a buy here and you could look to add shares on any weakness.

10. Roku, Inc (ROKU) 🎉

It’s time to trim shares of ROKU ROKU 0.00%↑ . Congratulations if you’re in the ROKU trade!! It’s also one of the MFG Discord’s favorites. This has been a beautiful stage 2 uptrend and price has hit an extreme-high RSI, which means it’s time to take profits.

Get access to my “MFG Trade Ideas of The Week” chart pack CLICK HERE!!

GP’s Wrap-Up

It’s of the upmost importance you follow your charts and stay on top of your trades. Proper risk management is essential to be a successful trader.

As you continue to navigate the waves of the markets, our focus remains on making informed, strategic decisions to optimize The Peters Report portfolio's performance.

The MFG Team and I truly appreciate your commitment to staying in flow with the markets with us and encourage you to keep a close watch on these trades.

Stay tuned for more insights and perfect Money Flow swing trade opportunities as we strive to stay one step ahead in the ever-changing market landscape.

Always remember, whatever you think about comes about, whatever you focus on grows. - GP

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

ROKU finally 💥💥

Best teacher in the game ❤️💯