The Peters Report: Trade of The Week!! The Most Important AI Stock in The Market Today!!🤘

This week’s play is a top-tier trade opportunity.🤝

Hey, MFG!

The stock market is full of companies riding the AI wave, but few have cemented their dominance quite like this week’s Trade of The Week.

This powerhouse isn’t just participating in the AI revolution—it’s leading it.👈

With relentless demand for its technology, this company has become the backbone of cutting-edge industries, from machine learning to high-performance computing.

It has consistently outpaced expectations, delivering explosive growth, widening margins, and an expanding moat that leaves competitors struggling to keep up.👈

Yet, despite its meteoric rise, strategic pullbacks have provided prime entry points for traders who know where to look.

This week, I’m breaking down a high-probability trade setup that could deliver significant upside, along with key technical levels to watch.👈

Here’s what you get with every Trade of The Week:🤝

The #1 trade pick for the week, backed by thorough research and analysis and aligned with current market trends.🤘

Chart markups, fundamental breakdowns, and a 5-10 minute video explaining the entry point, stop loss, and profit targets.📈

1-3 runner-up trades that were also contenders for the top pick, giving you additional insights and options.🙌

So really, you’re getting 3 of GP’s hot stock picks for the week!!🤯👏

Exclusive updates and follow-ups on previous trades to ensure you stay in flow with the markets and get alerted with GP’s latest moves.🌊🐐

But don’t just take my word for it—here’s what two of our premium members had to say:

The full analysis is available for premium members only. Upgrade now to unlock this week's high-conviction trade.🧙

Join G and gain exclusive access to the insights and opportunities the Inner Circle uncovers—swing trades crafted with precision, designed for those serious about maximizing their returns.

👉 Are you ready to become an elite trader for life?

👉 Dive into this week’s pick to see how this setup could be a game-changer for your trading success.

👉Unlock the Trade of The Week now to transform your trading forever.

Now, let’s dive into the trade and check out a chart where G breaks down this week’s Trade of The Week, including entry points, exits, and price targets.

And as a bonus, 1 runner-up trade that almost made this week’s pick!!

The Peters Report: Swing Trade of The Week

Today’s message is about NVIDIA Corp. NVDA 0.00%↑ , a leading technology company specializing in graphics processing units (GPUs), artificial intelligence (AI), data centers, and high-performance computing.

Founded in 1993 and headquartered in Santa Clara, California, NVDA has evolved from a graphics card manufacturer into a dominant force in AI and computing infrastructure.👈

NVDA launched the world’s first Graphics Processing Unit (GPU) in 1999—the GeForce 256.

Before this, 3D graphics were handled by CPUs, and NVDA’s invention changed gaming, computing, and later, AI forever.💥

Core Operations & Primary Business Sectors:

Gaming- NVDA’s GeForce GPUs power the global gaming industry, offering high-performance graphics for PC gamers and esports.

Data Centers & AI– This is NVDA’s fastest-growing segment, with its H100 AI chips becoming the gold standard for artificial intelligence, machine learning, and cloud computing.

Automotive– NVDA’s Drive platform is a key player in autonomous vehicle development, offering AI-driven solutions for self-driving technology.

Professional Visualization– Used in industries like architecture, media, and design for rendering, simulation, and 3D workflows.

Omniverse & AI Software- NVDA is investing heavily in AI-driven cloud solutions, simulation platforms, and digital twin technology for businesses.

In 1993, Jensen Huang and his co-founders started NVDA with just $40,000, sketching out their vision on napkins at a Denny’s restaurant in San Jose. Today, NVDA is worth over a trillion dollars—one of the most successful tech companies ever built from scratch.

In the early 2000s, NVDA’s GeForce GPUs became a staple in PC gaming, making the company a household name. Today, it’s evolved beyond gaming into AI, but gaming still accounts for billions in annual revenue.

NVDA’s CEO, Jensen Huang, is known for his signature black leather jacket, which he wears at every major keynote presentation. This has become a trademark of his confident, visionary leadership style.

NVDA’s Market Position & Competitive Advantage:

AI Leadership: NVDA’s dominance in AI and machine learning is unparalleled, with its GPUs powering AI training models for companies like OpenAI, Tesla TSLA 0.00%↑ , Microsoft MSFT 0.00%↑ , and Google GOOG 0.00%↑ .

Industry Standard in GPUs: NVDA holds a dominant market share in gaming and data center GPUs, beating competitors like Advanced Micro Devices AMD 0.00%↑ and Intel INTC 0.00%↑ .

Expanding into Custom AI Chips: The company is developing custom AI chips to further strengthen its market position and reduce reliance on third-party suppliers.

NVIDIA Was Almost Named “3Dfx” & Its Green Logo Has A Secret Meaning

Before settling on NVIDIA, co-founders Jensen Huang, Chris Malachowsky, and Curtis Priem considered naming the company 3Dfx, which was later used by a competitor.

The name "NVIDIA" comes from ‘invidia,’ the Latin word for 'envy,' portraying the company’s goal of making competitors envious.👈

The company’s eye-shaped green logo represents vision and intelligence, symbolizing how NVDA’s GPUs power AI, gaming, and machine learning.

Here’s a chart markup of the trade:

[See NVDA chart below with anchor point, entry, and targets.]

NVIDIA Corp. NVDA 0.00%↑ is in a stage 1 accumulation zone right at its 200-day SMA. Price had fallen below it, but quickly got right back above it. Price dropped an anchor point and went sideways for a few days.

Price broke the box and came right back in, the TSI has curled, the MACD histogram is ticking upwards, and price jumped above the 5-day EMA, giving me the trigger to enter the trade.

The first target is previous resistance around $147.50.👈

I opened a swing trade in NVDA in my margin account. It’s 30% margin maintenance. If you like leverage, you can look into establishing a trade in your cash account in a 2x leveraged NVDA ETF, such as, NVDL, NDVX, or NVDU.

According to analyst Brian from Morningstar, NVDA has a fair value of $130 and is currently trading fairly valued.

CLICK HERE for link to NVDA chart.

Why NDVA is a key player & dominating force in the AI space:

NVDA is the supreme leader in AI computing and plays a pivotal role in the development and deployment of AI across industries.

Here’s why NVDA is essential to the AI revolution:

Dominance in AI Hardware– The Gold Standard for AI Chips

NVDA’s H100 and A100 GPUs are the most powerful AI chips available today, widely used by other big tech companies to train and run AI models. These chips power everything from large language models (LLMs) like ChatGPT to deep learning applications in healthcare, finance, and robotics.

AI Infrastructure, Cloud Services, & Data Center Growth

NVDA’s Data Center segment is the company’s fastest-growing business, providing the computing power that fuels AI-driven cloud platforms. NVDA supplies nearly 80% of AI accelerator chips used in data centers worldwide. AI-as-a-Service (AIaaS) is NVDA’s new AI cloud services allow businesses to rent GPU computing power, expanding revenue streams.

AI Adoption Across Industries

AI is transforming industries, and NVDA is at the center of it all:

Healthcare– AI-powered drug discovery, medical imaging, and diagnostic tools.

Automotive– Self-driving car technology through Nuro Driver.

Finance & Trading– AI-powered algorithms and risk analysis platforms.

Gaming & Metaverse– AI-enhanced game engines and real-time 3D rendering.

First-Mover Advantage & Competitive Moat

NVDA’s head start in AI computing gives it a massive competitive edge over rivals like AMD, INTC, and GOOG’s TPUs. Its dominance is reinforced by:

A deep-rooted ecosystem– Developers and enterprises are locked into NVDA’s CUDA platform, making switching costs high.

Strong AI partnerships– Collaborations with TSLA, OpenAI, META, and global research labs.

Unmatched R&D investment – NVDA is continuously innovating, ensuring its leadership in next-gen AI chips.

NVDA is more than just a semiconductor company—it is the foundation and backbone of modern AI. Its dominance in GPUs, AI cloud infrastructure, and software solutions makes it an irreplaceable force in AI development.

G’s Wrap-Up🐼

Let’s go, MFG!! I really hope you take every Trade of The Week with me!! Imagine how much stronger your trading skills will become if you do. LFG!! I believe in you.

Remember, the stock market is always abundant with unlimited potential and hot new stocks, waiting for those prepared to take action and put in the reps. The market rewards those who show up everyday.👈

👉The formula for success is straightforward: consistency is what separates elite traders from the rest.👈

When you remain focused, disciplined, and ready, the best opportunities will naturally fall into your lap.

Patience is key in the markets.🔑 Let the setups come to you.🧘♂️🧘♀️

Stay motivated, define your edge, and the perfect trade will find you at the right moment.👏

Your Edge🧠👇

The four stages of price movement.👈

The stock market goes up 70% of the time.👈

Keep up the constant motivation, work, and dedication, and let’s get RICH!!💰

Where two or more are gathered, there’s unstoppable power!!💪💪

Runner-Up Trade

With this week’s Trade of the Week, I'm going to give one runner-up trade.

Borr Drilling Ltd. (BORR)

[See BORR chart below with anchor point, entry, and targets.]

Borr Drilling Ltd. BORR 0.00%↑ is a pure speculation play on oil in the offshore drilling subsector, which is currently trading in a stage 1 accumulation zone. I’ve been accumulating shares here.

Price dropped an anchor point and a doji. Price got above its 5-day EMA. The MACD histogram is on the bullish side and the TSI curled and crossed. I’m also watching Oil (USO), which is in a stage 4 decline right at its 200-day SMA, closely here.

BORR has a fair value of $6 and is currently trading undervalued.

Unlike legacy offshore drilling companies that have been around for decades, BORR was founded in 2016.

Despite being a relatively young player, it has quickly become a major force in the offshore drilling industry by acquiring premium drilling assets and modernizing its fleet.

BORR started in the middle of the oil market crash in 2016, when offshore drilling companies were struggling.

Instead of waiting for a recovery, BORR capitalized on the oil market downturn by acquiring distressed assets from struggling rivals like Transocean, Seadrill, and Paragon Offshore at deep discounts.

This allowed BORR to quickly scale up while keeping costs low.

Most offshore drilling companies operate older, refurbished rigs, but BORR took a different approach by building one of the youngest and most technologically advanced jack-up rig fleets in the industry.👈

Its "Premium Jack-Up Rigs" are designed for shallow-water drilling, making them ideal for regions with high oil and gas potential. These rigs feature automated drilling systems, which improve efficiency and reduce operational costs.

CLICK HERE for link to BORR chart.

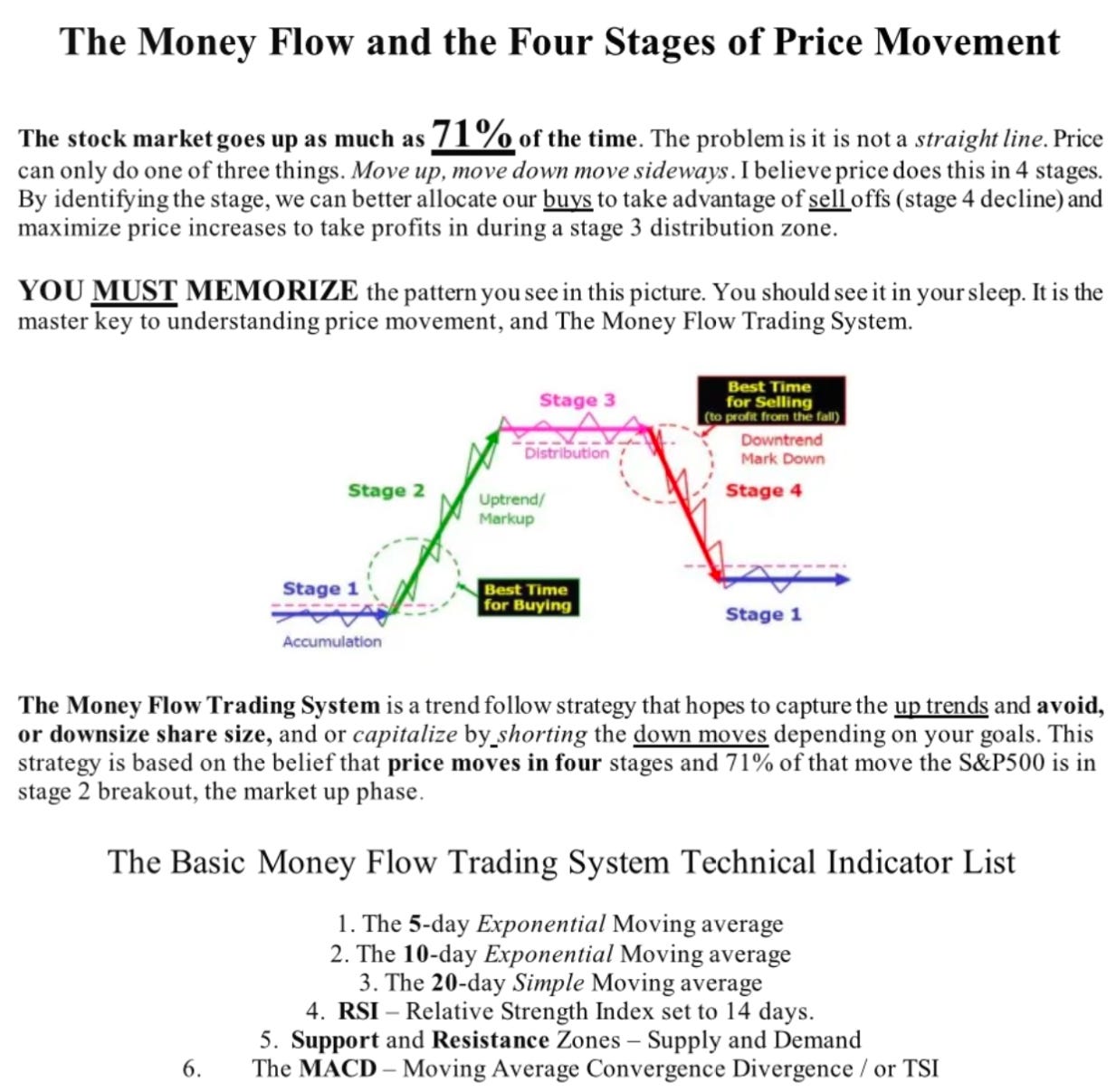

The Money Flow & The 4 Stages of Price Movement Review ‼️✍️‼️

Hey MFG Traders, it’s super important you memorize page 10 of The Peters Report. It’s absolutely critical to your success. Price moves in four stages and only moves up, down, or sideways. The Money Flow Trading System is a trend following strategy.👈

It uses six technical indicators that you must understand and be able to apply to price action. When there’s confluence of the Money Flow indicators, that usually signals a trade is in a buy zone or ready to breakout! Remember though, price is the only indicator that pays!! PRICE IS KING!!!👑

Keep in Flow🏄🏄♀️👇

TRADING TIPS ‼️

Define your edge— the 4 stages of price movement and the stock market goes up 70% of the time!!👈

Create a detailed trading plan with stop loss, entry, targets, and exits.👈

Execute your plan accordingly. Straight line!!👈

Always do your Sunday homework!!👈

“If you want to help the poor, demonstrate to them that they can become rich; prove it by getting rich yourself.” - Wallace Wattles, The Science of Getting Rich 🌊

Always remember, whatever you think about comes about, whatever you focus on grows. - G 🐼

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.🤘

🌊🌊We never know where the market is going to go. We do know the stock market climbs higher 70% of the time. Check your charts everyday and keep in flow.

🌊🌊If you need help with this, consider Gerald's course, "Getting Started with Stock Charts the Money Flow Way" and you will be ready to add shares to your portfolios on stage 1 when the markets are about to possibly rotate and trim profits when opportunities arise.

🌊🌊They say that you can’t buy bottoms or sell tops; The Money Flow Trading System can show you how to buy ALL the tops and the bottoms and stay in the flow.

🌊🌊That is what the Money Flow Trading System is all about. Being in flow with the stock market. Simple? YES! Easy? NO, but what in life that is worth having is? Stay the course, don't give up and don't get shaken out by wars, the Fed raising rates, rumors of recession, or any other event that may come.

Don't forget, 70% of the time the stock market climbs higher and the other 30% sets up for good buying opportunities. 👈

LFG!! In NVDA and BORR!!

Great catch. Ain't buying this "deepseek does it for a fraction of the cost"... as if silicone valley nerds haven't worked on this for 15+ years, just to be beaten by a hedge fund.. Cmon now 🤣🤣