Hey, MFG!

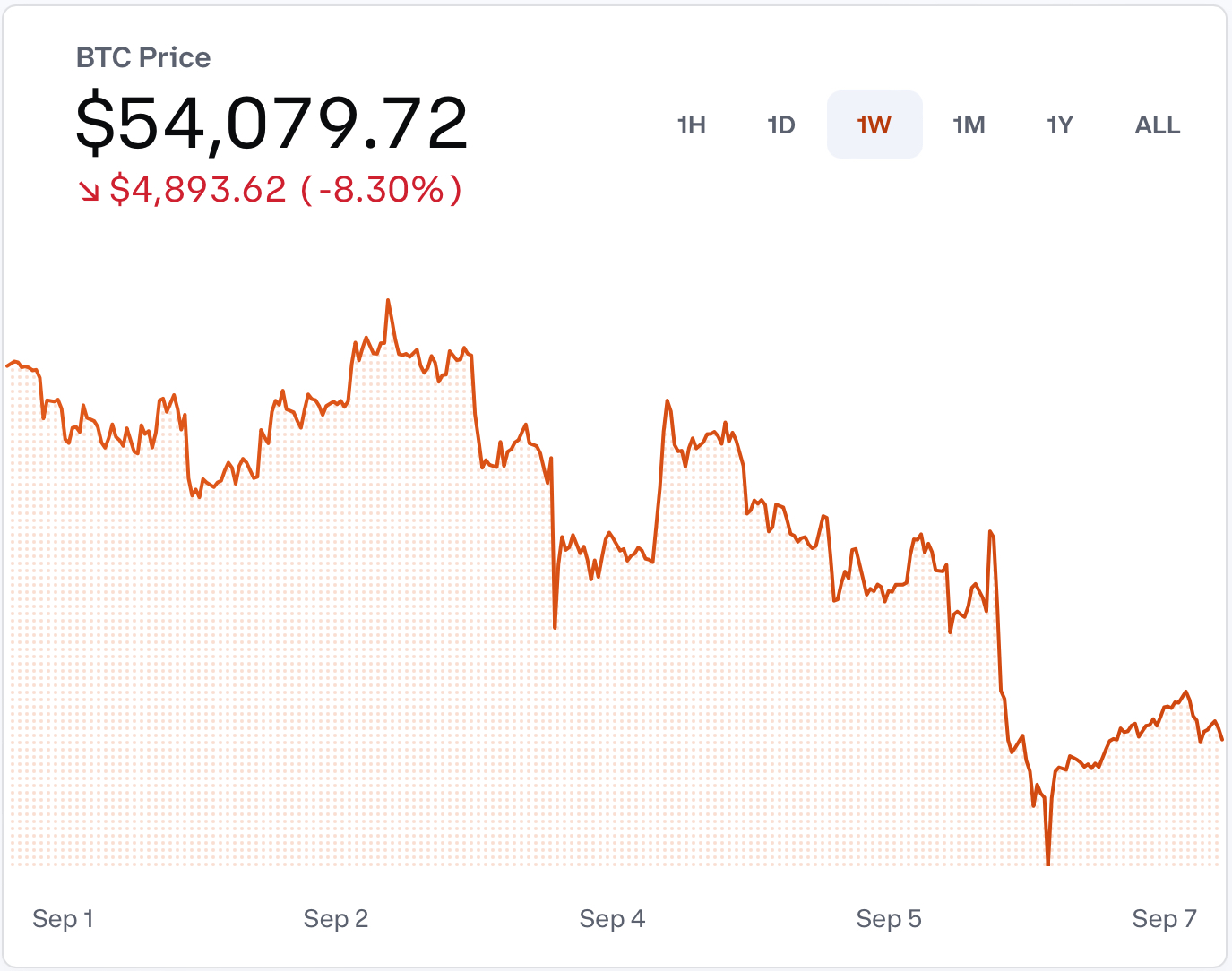

As of September 6, 2024, Bitcoin's (BTC) market has been significantly impacted by broader economic signals and recent downturns.

The cryptocurrency, which typically positions itself as a digital equivalent to traditional safe havens like gold, has shown volatility in response to the unexpected surge in the Japanese yen and general market apprehensions.

This has highlighted the necessity for investors to adopt diversified and resilient trading strategies in the face of global financial interconnectivity and unpredictability.

So far this month, BTC has been experiencing a downward trend, recently dipping below $56,000.

This movement reflects wider market sentiments, influenced by global economic uncertainties and anticipation of US economic data which could sway Federal Reserve policy decisions.

Despite this, some traders remain optimistic, suggesting the potential for BTC’s price to rebound above $60,000 soon, challenging the bearish trends typical of September.

Here are five powerful ways to play the BTC trade, whether you're looking to buy and hold, day or swing trade, write futures contracts, trade with leverage, or generate passive income.

In this article, we'll dig into the various strategies to play the BTC trade, whether you're looking to buy and hold, day or swing trade, write futures contracts, trade with leverage, or earn passive income.

For those who are serious about elevating their Bitcoin investment strategy, stay tuned until the end of this article for an exclusive opportunity.

For our valued subscribers, we have a special announcement: we're offering an in-depth recorded Bitcoin webinar that covers advanced market strategies and insights.

This webinar is designed not only to enhance your understanding, but also to refine your approach to investing in BTC.

Available exclusively to our paid subscribers, this webinar promises over two hours of expert guidance on mastering the art of BTC trading and investment.

👉👉If you've been considering upgrading your subscription, this is the perfect opportunity to gain access to premium content that could significantly influence your investment outcomes.

Let’s dig into the different ways to play BTC!!

-GP a.k.a Fullauto11

The Peters Report - Stock & Crypto Trader’s Resource

Looking for a group of likeminded people to trade with? Text alerts and the MFGDiscord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

The Ultimate Bitcoin Strategy Guide: Building Your Crypto Portfolio

Bitcoin (BTC) has grown from a specialized digital asset into a widely recognized investment, attracting attention from investors and traders around the world.

With its notable volatility and potential for significant gains, there are various ways to engage in the Bitcoin market, suited to different levels of risk tolerance and investment strategies.

Here are five strategies for participating in the BTC trade, whether you're interested in holding long-term, earning passive income, or actively trading.

1. Direct Purchase and Hold Bitcoin ($BTCUSD)

One of the simplest and most direct ways to invest in Bitcoin (BTC) is to buy and hold it directly on the blockchain. Using an exchange like Coinbase, you can purchase BTC with U.S. dollars through $BTCUSD.

This method gives you full ownership of the cryptocurrency, allowing you to store it in a digital wallet of your choice. By holding BTC, you're betting on its long-term potential to appreciate in value.

This strategy, often referred to as "HODLing," is ideal for those who believe in the long-term growth of Bitcoin and are willing to weather its short-term volatility.

The key advantage here is direct exposure to Bitcoin's price movements. You control your BTC and can move it off the exchange to a secure wallet, reducing the risk of exchange-related issues.

It's important to realize that BTC is a very volatile asset and remember that the value of your investment can fluctuate significantly, and you should be prepared for both the ups and downs of the market.

👉👉If you're new to Bitcoin or looking to shift your trading platform, Coinbase offers a user-friendly interface with robust features to help you buy, sell, and manage your cryptocurrency portfolio.

For those interested, I've provided my referral link for Coinbase, and with it, you can start your journey into BTC and other crypto trading, and open an account and receive $10 in BTC.

Using Coinbase allows you to directly apply many of the strategies discussed in this article, such as buying and holding BTC, trading on leverage, and even participating in the futures market.

Each step you take on Coinbase can be a learning experience that helps solidify your trading strategies and enhances your understanding of the market dynamics.

Sign up with Coinbase using my referral link CLICK HERE!!

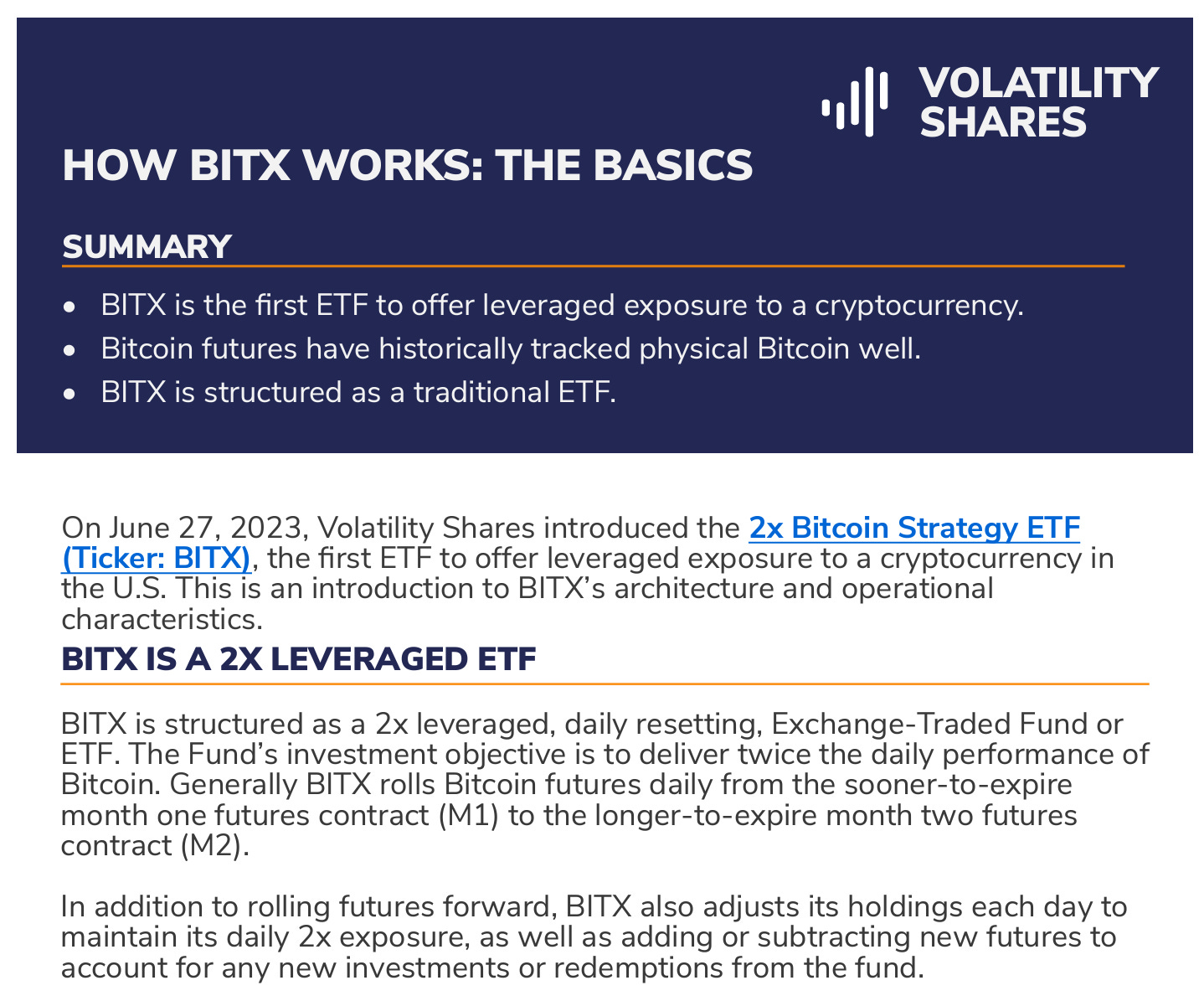

2. Leveraged Bitcoin ETFs (BITX)

For more aggressive traders looking to amplify their returns, leveraged Bitcoin ETFs like BITX BITX 0.00%↑ offer a compelling option. These funds are designed to deliver multiples of Bitcoin's daily performance—typically 2x or 3x—through the use of financial derivatives and debt.

Leveraged ETFs like BITX allow you to take a larger position in BTC with a smaller amount of capital also while collecting a dividend.

For example, if BTC rises by 10% in a day, a 2x leveraged ETF would aim to return 20%. You must be aware, this leverage also works in the opposite direction, meaning losses are magnified as well.

These funds are best suited for short-term trading rather than long-term investing, as the compounding effect of daily leverage can lead to performance that diverges from the underlying asset over time.

Leveraged ETFs can be powerful tools for experienced traders who are confident in their market timing, but come with increased risks and should be used with caution.

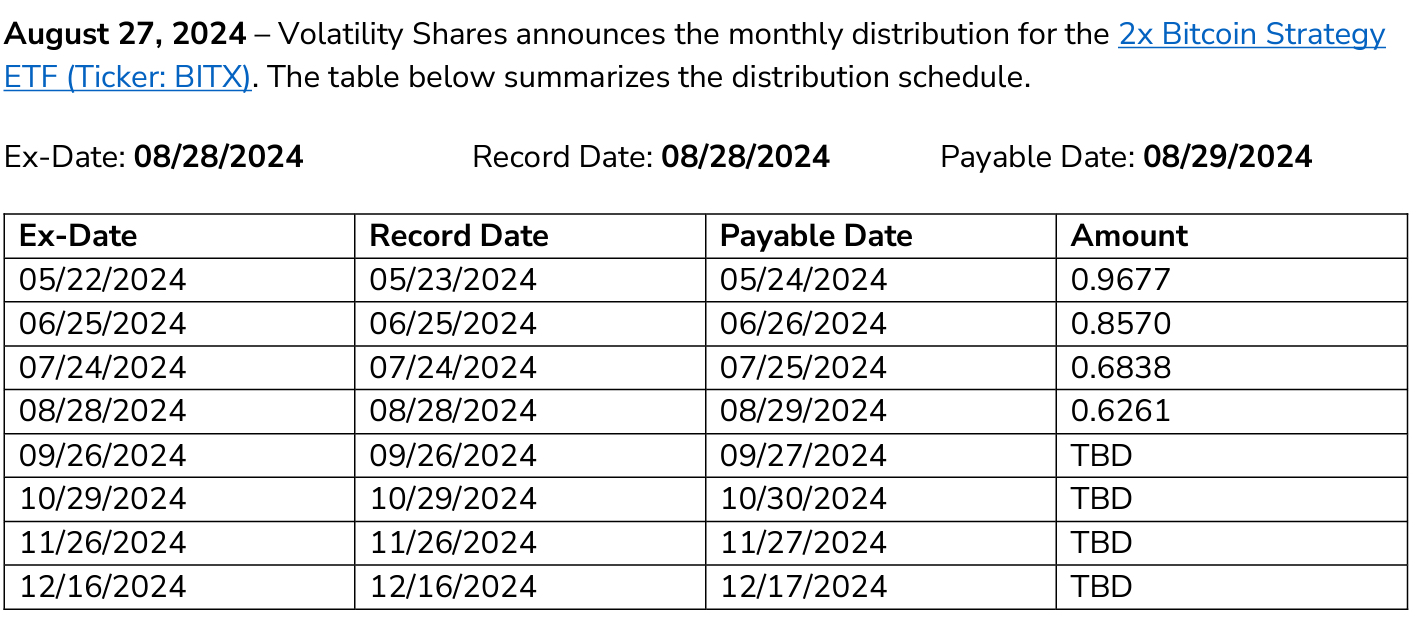

BITX also just recently announced a new monthly dividend. See the BITX distribution schedule above. You can purchase BITX on most trading platforms, E-trade, Fidelity, Charles Schwab, Robinhood, and Interactive Brokers.

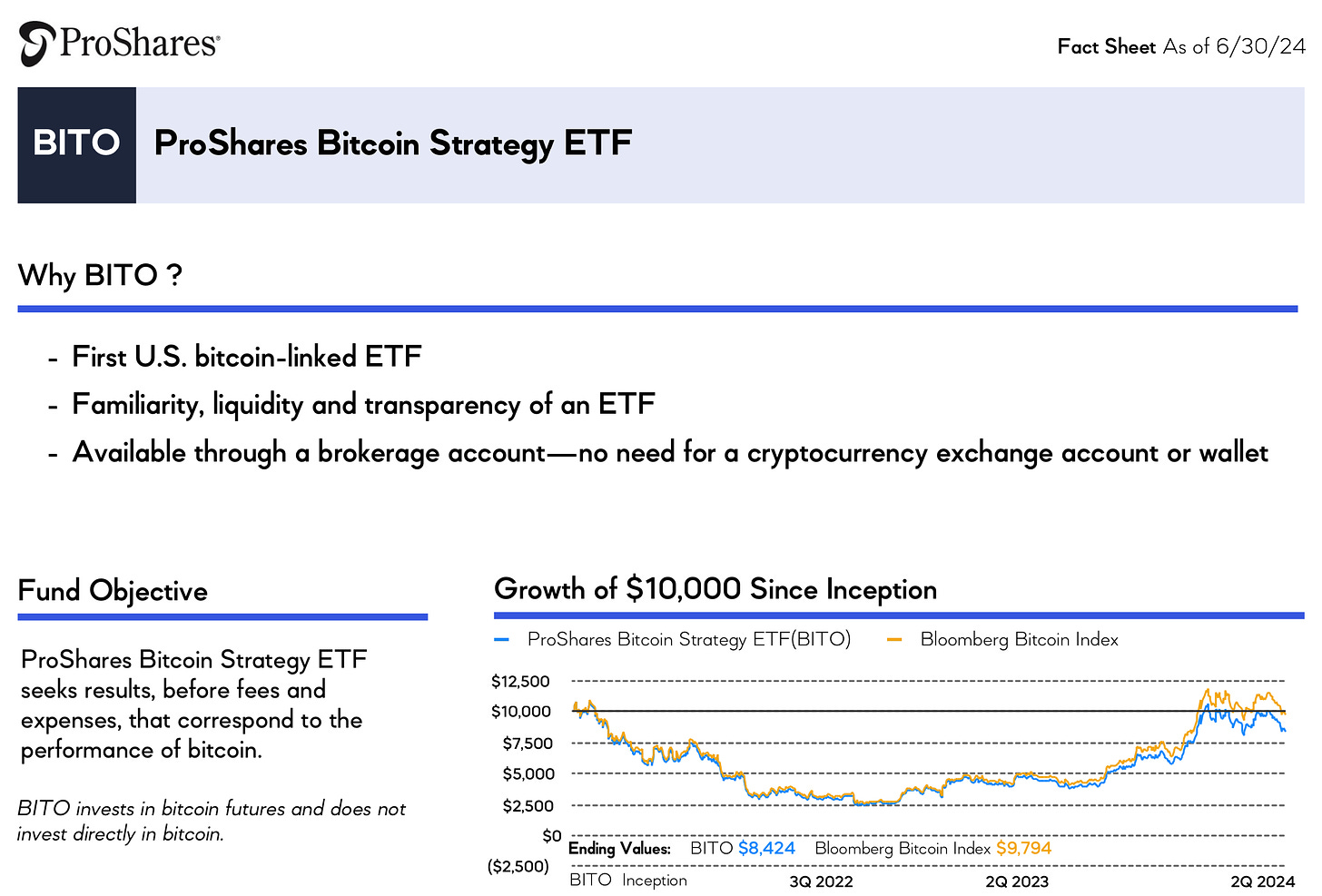

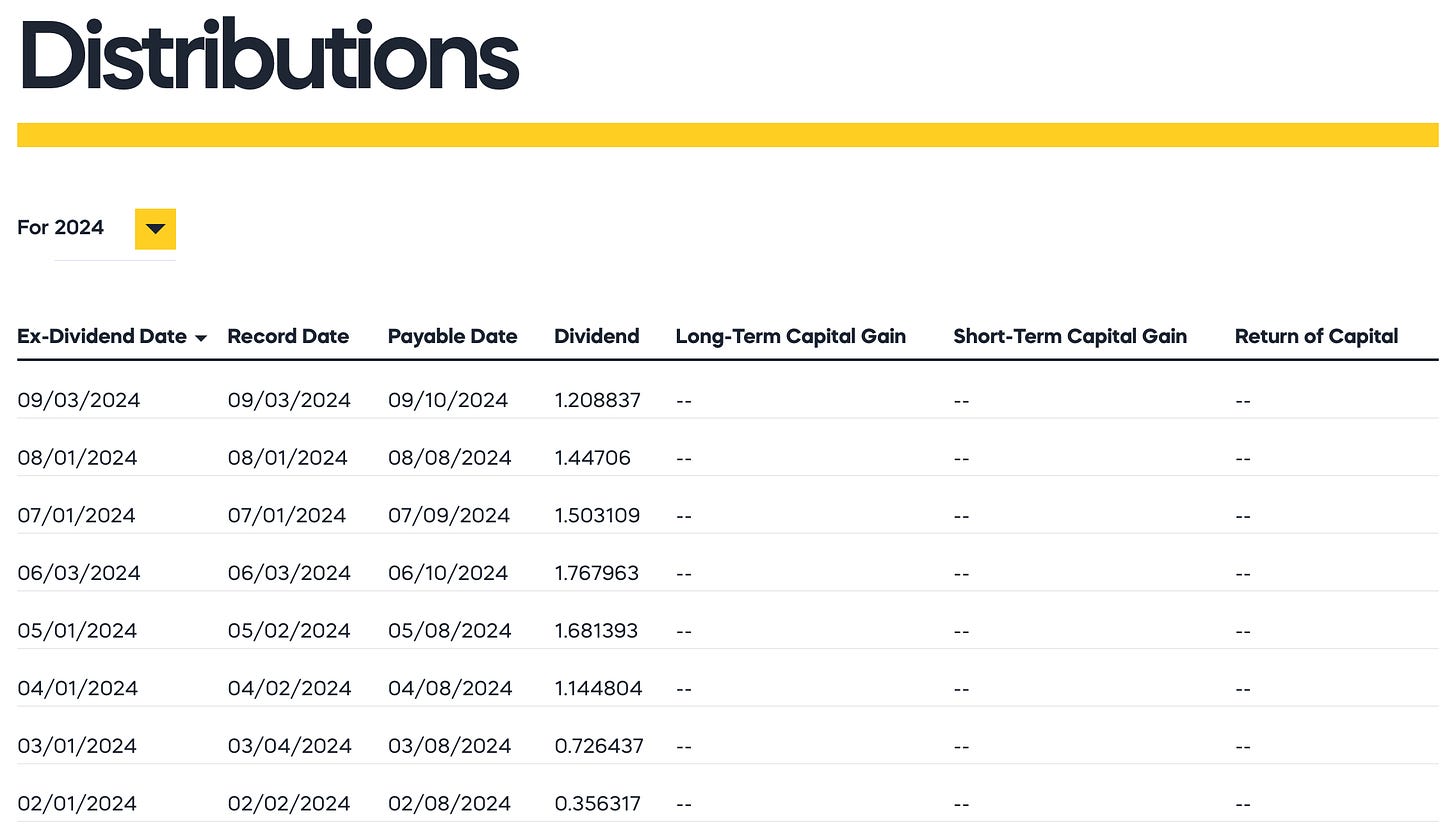

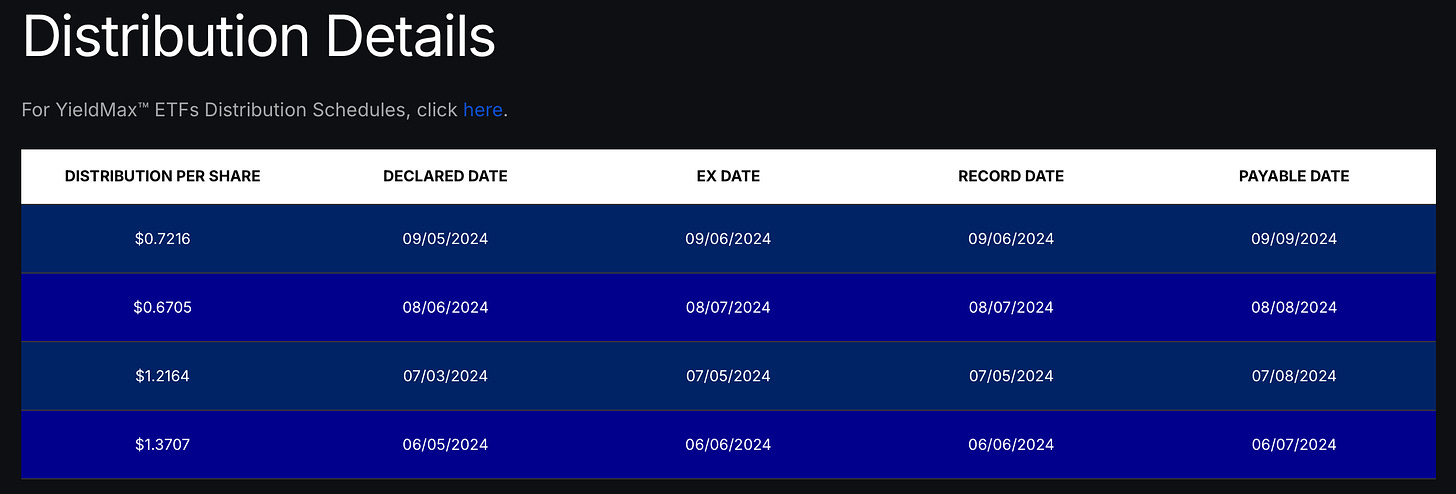

3. Options Income Funds (BITO & YBIT)

If you're looking for a way to earn passive income from Bitcoin, options income funds like BITO and YBIT could be an attractive option.

These funds generate monthly income by employing strategies such as writing covered calls and selling puts on Bitcoin futures. By selling options, these funds earn premiums, which are then distributed to investors as income.

This strategy can provide a steady stream of passive income, making it appealing for those who want to benefit from BTC’s volatility without the need to actively trade; however, it's important to note that while these strategies can reduce volatility and provide regular income, they also limit the upside potential.

If BTC’s price explodes, the returns from an options income fund might be lower than holding BTC directly.

Additionally, there are risks associated with the underlying options strategies, and these funds are not immune to losses if the market moves against them.

BITO BITO 0.00%↑ and YBIT YBIT 0.00%↑ pay monthly dividends. Below are the monthly distributions for BITO and YBIT.

ProShares Bitcoin Strategy ETF (BITO):

👆👆Monthly distributions for BITO so far.

YieldMax™ Bitcoin Option Income Strategy ETF (YBIT):

👆👆Monthly distributions for YBIT so far.

4. Bitcoin in a Retirement or Brokerage Account (GBTC & Other Spot Bitcoin ETFs)

For those who prefer to invest in Bitcoin within a traditional financial framework, investing through a retirement or brokerage account is a viable option.

Products like the Grayscale Bitcoin Trust (GBTC) GBTC 0.00%↑ and iShares Bitcoin Trust ETF (IBIT) IBIT 0.00%↑ or other newly approved spot Bitcoin ETFs allow investors to gain exposure to Bitcoin without directly holding the cryptocurrency.

These investment vehicles are available through 401(k)s, standard brokerage accounts and can be held in tax-advantaged accounts like IRAs, making them convenient for long-term investors.

GBTC or IBIT, for instance, trades like a stock and represents ownership in Bitcoin, though it may trade at a premium or discount to its underlying assets.

Spot BTC ETFs, which are becoming more common, track the price of BTC and can be bought and sold like any other ETF.

These options are ideal for investors who want to incorporate BTC into their retirement portfolio or who prefer the simplicity of holding Bitcoin-related assets within their existing financial accounts.

5. Trading Bitcoin Futures on Coinbase

Finally, for those who are comfortable with more advanced trading strategies, Bitcoin futures contracts offer another way to play the Bitcoin trade.

Available through Coinbase's Derivatives Exchange on their advanced trading platform, futures contracts allow traders to speculate on the future price of Bitcoin.

With futures, you don't need to own Bitcoin directly.

Instead, you enter into a contract to buy or sell BTC at a predetermined price on a specific date in the future. Futures contracts can be leveraged, meaning you can control a large amount of Bitcoin with a smaller capital outlay.

Futures trading is often used by speculators looking to profit from short-term price movements or by investors looking to hedge their existing BTC positions; however, this method is complex and comes with significant risks, including the potential for large losses if the market moves against your position.

Futures trading is best suited for experienced traders who understand the mechanics of the derivatives market and are prepared for the high risk involved.

GP’s Wrap Up

There are multiple ways to participate in the BTC trade, each with its own set of benefits and risks.

Whether you're a long-term investor looking to buy and hold, a trader seeking leveraged gains, or someone interested in generating passive income, there's a strategy that can fit your goals.

As with any investment, it's important to do your research, understand the risks, and choose the approach that aligns with your financial objectives and risk tolerance.

Unlock Exclusive Insights with Our Bitcoin Webinar!!

👉👉For those intrigued by these strategies and seeking deeper insights, our BTC webinar will explore these topics in greater detail.

👉👉This exclusive session is designed for our paid subscribers, offering over two hours of expert guidance on how to effectively navigate and profit from the BTC market.

👉👉This webinar is your gateway to mastering advanced techniques and uncovering new opportunities within the realm of BTC trading.

👉👉If you're not yet a paid subscriber, this is your chance to upgrade and access cutting-edge insights that could transform your approach to cryptocurrency investing.

What You'll Learn:

In-depth Analysis: Understand the core principles that drive Bitcoin's value and market behavior.

Diverse Investment Strategies: From basic buying and holding to more sophisticated techniques like leveraged ETFs and futures trading.

Risk Management: Learn how to manage risks associated with different trading methods.

Future Predictions: Gain insights into potential future movements of Bitcoin based on historical data and market trends.

👉👉This webinar is a must-watch if you're serious about leveraging Bitcoin to its full potential.

👉👉Don't miss this opportunity to transform your understanding of Bitcoin and enhance your investment strategy.

👉👉Upgrade now and take your Bitcoin investment skills to the next level!

👉👉Remember, investing in cryptocurrency requires understanding and adaptability.

👉👉Let us guide you through the complex market landscape with proven strategies and expert insights.

👉👉Join our community of paid subscribers today and start making more informed investment and trading decisions. Click below to subscribe and access the webinar!👇