Gain An Emotional Edge in The Stock Market By Mastering Crowd Psychology

Leverage market sentiment and emotional cycles to transform your trading.

Investing in the stock market is not just a financial pursuit—it’s a psychological one.

Market fluctuations often mirror the collective emotions of investors, creating patterns of behavior that can be both predictable and profitable for those who understand them.

By mastering crowd psychology, traders and investors can gain a crucial emotional edge, enabling them to make informed, rational decisions while others are driven by fear or greed.

-GP a.k.a Fullauto11 🧙🐼

The Peters Report - Stock & Crypto Trader’s Resource

Always remain bullish and follow The Money Flow.

👉JOIN THE MFG DISCORD!!

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

👉GAIN EXCLUSIVE ACCESS TO GP’S TRADE OF THE WEEK!!👇

Unlock exclusive insights and advanced strategies by becoming a paid subscriber to The Peters Report. Stay one step ahead of the market with in-depth analysis and actionable tipsdesigned to help you succeed as a trader and investor. Support the work that keeps you informed and ahead of the curve.

Unlocking Stock Market Success: Gaining an Emotional Edge By Mastering Crowd Psychology

Understanding Crowd Psychology in the Market

Crowd psychology, often referred to as herd behavior, is the tendency for individuals within a group to make decisions based on collective sentiment rather than independent analysis.

In the stock market, this phenomenon can trigger trends where large numbers of investors act in unison, often amplifying market movements.

Common Biases to Recognize and Manage 🐑

Herd Behavior: Following the majority can lead to impulsive decisions driven by FOMO. Breaking free from this mindset allows you to focus on sound strategies.

Fear and Greed: Panic selling during downturns or speculative buying during bubbles can derail long-term plans. Understanding these emotions helps maintain discipline.

Overreaction and Underreaction: Emotional extremes often create price swings, presenting opportunities for astute investors to capitalize on over valued assets.

Confirmation Bias: Seeking information that aligns with existing beliefs can blind investors to new opportunities. Balancing perspectives leads to smarter decisions.

Sentiment Indicators: Tools like the $VIX and put/call ratios provide insights into market mood, helping traders stay ahead of shifts in sentiment.

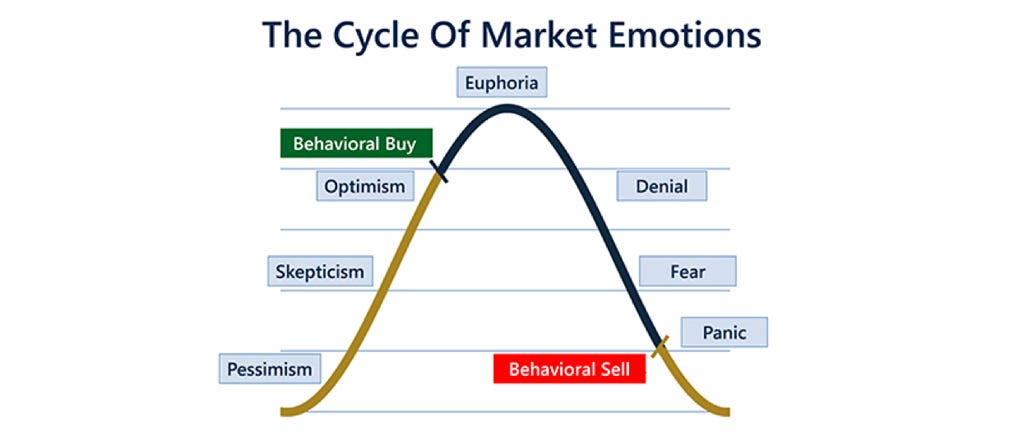

Navigating the Emotional Cycle of the Market 🌊

The market’s emotional cycle mirrors the psychological stages investors experience during uptrends and downtrends. Recognizing these phases can help you stay rational amidst volatility.

Disbelief: Skepticism after a downturn.

Hope: Tentative optimism returns.

Optimism: Confidence grows as the market rises.

Belief: Investors commit heavily, expecting sustained growth.

Thrill: Rapid gains fuel excitement and risk-taking.

Euphoria: Overconfidence leads to speculative bubbles.

Complacency: Instability arises, but risks are dismissed.

Anxiety: Declines trigger concern.

Denial: Refusal to acknowledge worsening conditions.

Panic: Fear drives widespread selling.

Capitulation: Losses are accepted, marking market bottoms.

Anger: Frustration follows poor decisions.

Depression: Despondency takes hold, and participation wanes.

Disbelief: Recovery is met with skepticism.

Hope: The cycle begins again with new cautious optimism.

Understanding this cycle allows you to step back from the crowd, identify opportunities, and avoid emotional traps. 👆👆

Market Sentiment: A Vital Trading Tool 🧐

Market sentiment reflects the collective mood of investors, influencing market movements and offering critical insights into potential reversals.

Key Components of Market Sentiment:

Bullish Sentiment: Optimism drives buying and rising prices.

Bearish Sentiment: Pessimism leads to selling and falling prices.

Sentiment Indicators: Metrics like the $VIX or sentiment surveys gauge prevailing attitudes.

Contrarian Indicators: Extreme optimism or pessimism often signals an upcoming reversal, offering independent-thinking investors profitable opportunities.

The Link Between Crowd Psychology and Market Sentiment 🧠

Crowd psychology shapes market sentiment, with collective emotions driving trends.

During optimistic periods, bullish sentiment prevails, while fear during downturns cultivates bearish sentiment.

By understanding this connection, you can anticipate market shifts and position yourself strategically. 👈👈

**Crowd psychology- collective emotions and behaviors of investors. 👈

**Market sentiment- overall mood of the market. 👈

Key Takeaways for Traders & Investors 🔑

Spot Market Trends: Recognize when the crowd becomes overly optimistic or pessimistic to identify opportunities and risks.

Control Emotions: Stay grounded by acknowledging the emotional cycle, developing disciplined decisions.

Adopt Contrarian Strategies: Use sentiment indicators to buy when others are fearful and sell when others are overly confident. 👈👈

GP’s Wrap-Up 💎

The stock market operates like a living, breathing organism, with emotions driving its rhythm and momentum.

By understanding crowd psychology and market sentiment, you align yourself with this dynamic system, gaining a powerful advantage.

Staying adaptive, informed, and emotionally grounded isn’t just a strategy—it’s essential for long-term success. 👈👈

Consider upgrading to a premium subscription to dive deeper into actionable insights, market updates, and advanced strategies that keep you one step ahead. 👈👈

Let’s navigate the market together and grow stronger with each trade!! 🏄🏄♀️

“Be fearful when others are greedy and be greedy only when others are fearful.” - Warren Buffet

Always remember, whatever you think about comes about, whatever you focus on grows! - GP

👉JOIN THE MFG DISCORD!!

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

👉GAIN EXCLUSIVE ACCESS TO GP’S TRADE OF THE WEEK!!👇

Unlock exclusive insights and advanced strategies by becoming a paid subscriber to The Peters Report. Stay one step ahead of the market with in-depth analysis and actionable tipsdesigned to help you succeed as a trader and investor. Support the work that keeps you informed and ahead of the curve.

If you need help with setting up your charts and want a mini crash course in the Money Flow, consider GP's course:

"Getting Started with Stock Charts the Money Flow Way" and you will be ready to add shares to your portfolios on stage 1 when the markets are about to possibly rotate and trim profits when opportunities arise. CLICK HERE!

FINANCIAL DISCLAIMER

This is not financial advice, but education to increase awareness. Before making investment decisions, always do thorough research and possibly consult with a financial advisor. The above descriptions are a broad overview and may not capture all nuances associated with each asset.

🛡️⚔️🛡️🔝

Follow the flow