10 Trade Updates Inside The MFG Portfolio🐼

A snapshot of the MFG's latest trades with chart annotations and analyses.🤘

Hey, MFG!

YES! YES! YES!

This weekend, I want to share with you 10 high-quality MFG portfolio updates! The purpose of these is to help you keep informed, stay one step ahead, and achieve success in the markets!!

Whether you’re tracking past trades or watching new ones, this is your chance to dig into the Money Flow trading strategy, learn from real-time chart mark-ups, and build the wealth you and your family deserve.

👉👉The market doesn’t sleep, and neither should your ambition. 👈👈

👉👉Read up, stay disciplined, and let’s make this week prosperous!! Come Friday you should have more shares than you did Monday!! 🏄♀️🏄

Let me know in the comments if you like these trade updates. I appreciate you. 👈👈

Always remember, whatever you think about comes about, whatever you focus on grows. - G 🐼

10 Trade Updates Inside The MFG Portfolio🐼

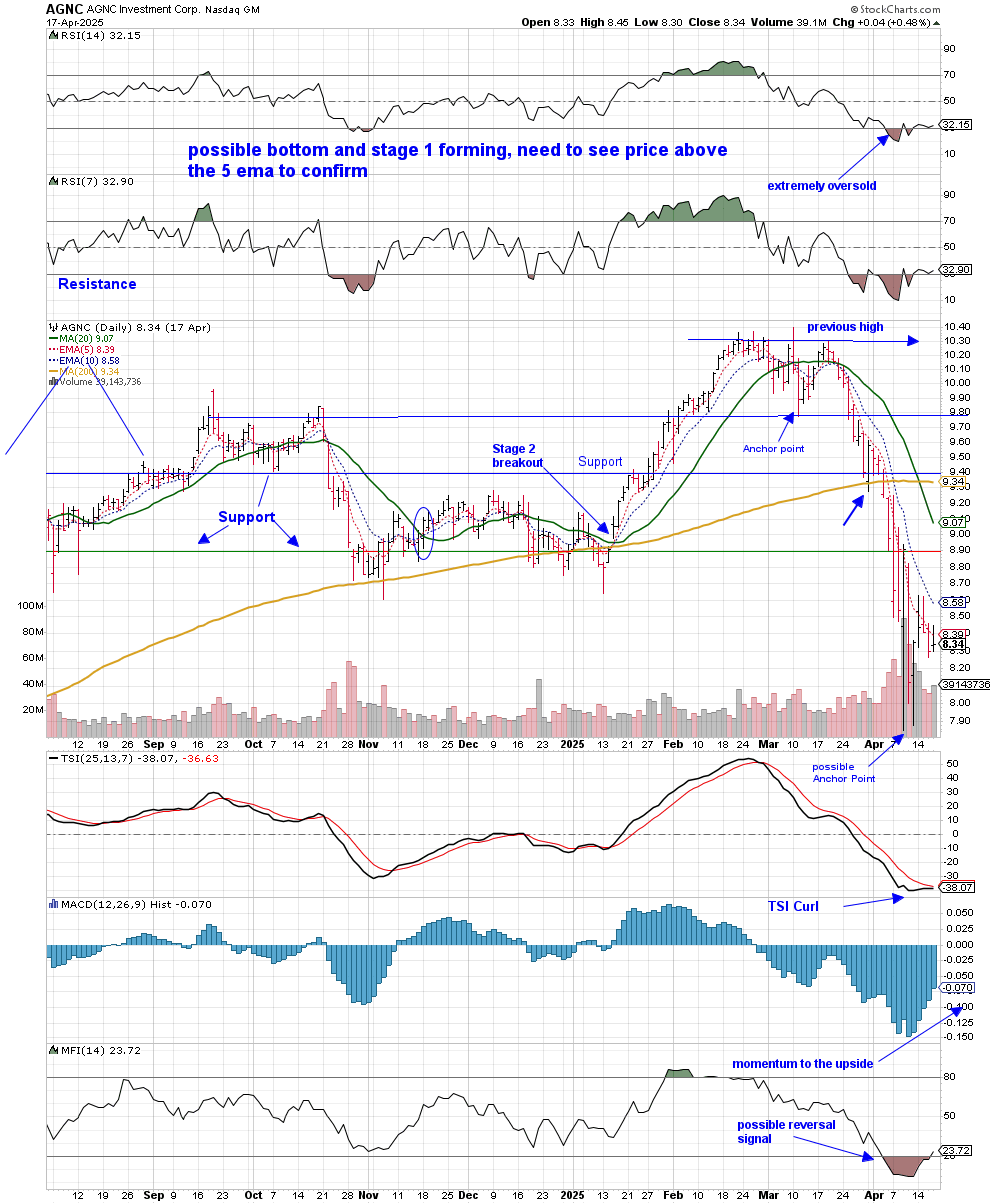

1. AGNC Investment Corp. (AGNC)

AGNC Investment Corp. AGNC 0.00%↑ is forming a stage 1 accumulation zone and a possible bottom below its 200-day SMA here.

Price banged an extreme-low RSI reading and dropped a possible anchor point. Price has moved sideways and held its anchor point. The MACD histogram has been ticking upwards displaying momentum is to the upside and the TSI has curled, but price hasn’t closed above it’s 5-day EMA.

I have no problem with drip adding here, but I would like to see price close above its 5-day EMA before adding a chunk of shares.

AGNC a real estate investment trust (REIT) that invests primarily in agency residential mortgage-backed securities (MBS). These securities are backed by U.S. government-sponsored enterprises like Fannie Mae and Freddie Mac, providing a level of credit protection.

The company employs leverage to enhance returns, financing its investments mainly through repurchase agreements. AGNC aims to provide substantial monthly dividend income to its shareholders, making it attractive to income-focused investors.

I’ve been in AGNC in my buy & hold account for over 10 years and collected many lucrative monthly dividends. I also like AGNC as a trade here.

2. Zim Integrated Shipping Services Ltd. (ZIM)

Zim Integrated Shipping Services Ltd. ZIM 0.00%↑ is in a stage 1 accumulation zone below its 200-day SMA.

I’ve been buying shares here.

The first target is $18.25 and the second target is $21.25.

ZIM has a fair value of $14.68 and is currently trading fairly valued.

ZIM is a global container shipping company headquartered in Israel. It operates a fleet of container vessels, providing logistics and transportation solutions across key trade routes, including Asia, Europe, the Americas, and Africa.

The company gained attention during the pandemic-driven shipping boom, delivering massive dividends due to record-high freight rates; however, as global shipping demand normalized and freight rates declined, ZIM’s earnings and dividends have become more volatile.

ZIM is considered a high-risk, high-reward stock, influenced by global trade dynamics, supply chain disruptions, and freight rate fluctuations.

I’ve been in ZIM for almost two years now and I love the company and dividend payouts.

3. CleanSpark, Inc. (CLSK)

CleanSpark, Inc. CLSK 0.00%↑ is in a stage 1 accumulation zone below its 200-day SMA.

I’ve been buying shares. I would expect a stage 2 breakout be underway here soon if Bitcoin (BTC) continues moving higher.

CLSK is a BTC mining company focused on sustainable and energy-efficient mining operations. The company uses a mix of renewable energy sources, such as solar and microgrid technology, to power its mining facilities, making it stand out in the crypto mining sector.

CLSK has aggressively expanded its BTC mining capacity, acquiring new mining sites and hardware to increase its hashrate. This strategy has positioned it as one of the leading publicly traded Bitcoin miners in the U.S.

CLSK is considered a high-growth, high-risk play on the future of BTC, with the added benefit of energy-efficient mining practices.

CLSK is included in the Technology sector XLK 0.00%↑ and the Software sub-sector.

According to analyst Mark from Morningstar, CLSK has a fair value of $22 and is currently trading undervalued.

4. ProShares Ultra Silver (AGQ)

iShares Silver Trust SLV 0.00%↑ has entered a stage 2 breakout above its 200-day SMA along with the continuous daily contract $silver.

The breakout is usually the last chance to add. Once the RSI gets above 50, the trade is past a buy point. You could still look to add shares here.

I’m in ProShares Ultra Silver AGQ 0.00%↑ , a double leveraged play on SLV. I’m also long silver futures contracts on Coinbase.

Targets are an extreme-high RSI reading and previous high around $47.

Remember, while trading leveraged funds, make sure to use the un-leveraged chart for your trade analysis and moves. In this case, $silver and SLV 0.00%↑ .

See below chart for AGQ:

Previous high of $47 becomes the target.

5. United States Oil Fund, LP (USO)

Oil (USO) is in a stage 1 accumulation zone below its 200-day SMA.

Price hit an extreme-low RSI reading, dropped an anchor point, moved sideways, and jumped above its 5-day EMA giving me the confirmation to enter the trade.

The MACD histogram has been ticking upwards and the TSI has curled and is about to cross signaling the momentum is to the upside. There’s confluence of the Money Flow indicators here.

USO is The Wind for oil stocks. I use this chart to track the price of oil and make my leveraged trades moves.

The United States Oil Fund, LP USO 0.00%↑ is an exchange-traded fund (ETF) designed to track the daily price movements of West Texas Intermediate (WTI) light, sweet crude oil.

USO primarily invests in near-month WTI crude oil futures contracts traded on the New York Mercantile Exchange (NYMEX). It aims to reflect the daily percentage changes in the spot price of WTI crude oil delivered to Cushing, Oklahoma.

As a commodity pool, USO holds a portfolio of oil futures contracts and other oil-related derivatives. The fund rolls its futures contracts monthly, selling contracts nearing expiration and purchasing contracts with later expiration dates.

I’m in oil futures contracts on Coinbase. I’m also in a simple, triple-leveraged oil swing trade in OILU and a Bread & Butter Trade in Exxon Mobil Corp. XOM 0.00%↑ .

OILU 0.00%↑ is the MicroSectors™ Oil & Gas Exploration & Production 3X Leveraged ETN is an exchange-traded note (ETN) designed to provide investors with three times the daily performance of the Solactive MicroSectors™ U.S. Oil & Gas Exploration & Production Index.

See below chart for OILU:

Remember to look at the un-leveraged chart, USO, for your trading plan and market moves.

6. SPDR S&P Regional Banking ETF (KRE)

SPDR S&P Regional Banking ETF KRE 0.00%↑ is in a stage 1 accumulation zone below its 200-day SMA.

This is a textbook Money Flow stage 1 accumulation zone. Price tagged an extreme-low RSI reading and dropped a doji anchor point. A doji with an extreme-low RSI reading usually indicates the bottom is in and price will reverse soon.

The Money Flow Indicator (MFI) also hit an extreme-low, the MACD histogram has crossed over to the bullish side, and the TSI has curled and crossed. There’s confluence of the Money Flow indicators here.

The MFG portfolio has had a lot of success trading KRE and its triple leveraged fund— Direxion Daily Regional Banks Bull 3X Shares DPST 0.00%↑ . KRE and DPST are a couple of the MFG’s favorite trades.

I’m in KRE as a swing trade here.

Profit targets:

200-day SMA

$61.50

$64

$68

7. GraniteShares 2x Long UBER Daily ETF (UBRL)

GraniteShares 2x Long UBER Daily ETF UBRL 0.00%↑ is a new double leveraged fund that tracks Uber Technologies, Inc. UBER 0.00%↑ , which is in a stage 2 uptrend above its 200-day SMA.

UBER is currently trading fairly valued so I put on a swing trade in UBRL.

The trade is past a buy point and I’m watching for my profit targets now. Once the RSI gets above 50, the trade is past a buy point.

UBER is my favorite stock and a core holding of the MFG portfolio.

UBER is included in the Technology sector XLK 0.00%↑ and the Software sub-sector.

According to analyst Mark from Morningstar, UBER has a fair value of $79 and is currently trading fairly valued.

8. Amgen, Inc. (AMGN)

Amgen, Inc. AMGN 0.00%↑ is in a stage 1 accumulation zone below its 200-day SMA, which poises a great opportunity to add your buy & hold portfolio or put on a B&B trade.

Price just tagged an extreme-low RSI reading, dropped an anchor point, went sideways, and got above its 5-day EMA, giving me my trigger to enter the trade. The MACD histogram has been ticking upwards and the TSI curled, but hasn’t crossed yet.

Price last closed with an imperfect doji and held its anchor point. This is still a stage 1 buy zone. I’m looking to add shares here.

AMGN is a global biotechnology company specializing in the development and commercialization of innovative therapies for serious illnesses, including cancer, autoimmune disorders, cardiovascular diseases, and osteoporosis. AMGN is one of the world's largest biotech firms.

As a dividend-paying blue-chip stock and Dog of The Dow, AMGN appeals to both growth and income investors, benefiting from recurring revenue streams, strong cash flow, and strategic acquisitions, such as its 2023 purchase of Horizon Therapeutics.

AMGN is included in the Health Care sector XLV 0.00%↑ and the Biotechnology sub-sector.

According to analyst Karen from Morningstar, AMGN has a fair value of $333 and is currently trading fairly valued.

9. Ford Motor Co. (F)

Ford Motor Co. F 0.00%↑ is in a stage 1 accumulation zone below its 200-day SMA.

I’m accumulating shares here. I added to both my trading account and buy & hold portfolio.

The first target zone is $10.50 or an extreme-high RSI reading.

Founded in 1903, F remains one of the largest family-controlled companies in the world. The Ford family has maintained a controlling interest for over a century, with William Clay Ford Jr., Henry Ford's great-grandson, currently serving as Executive Chair.

Henry Ford and inventor Thomas Edison shared a close friendship. Edison's encouragement played a pivotal role in F’s pursuit of developing the gasoline-powered automobile, leading to the creation of the Ford Motor Company.

F has a storied history in racing, including victories in the 24 Hours of Le Mans and significant contributions to NASCAR and Formula One. The company's performance division continues to develop high-performance vehicles and racing technologies.

F has been a leader in incorporating sustainable materials into its vehicles. The company uses soybean-based foam in seat cushions and is exploring other renewable resources like wheat straw, coconut, and even algae to reduce its environmental footprint.

F is included in the Consumer Discretionary sector XLY 0.00%↑ and the Automobiles sub-sector.

According to analyst David from Morningstar, F has a fair value of $16 and is currently trading undervalued.

10. iShares 20+ Year Treasury Bond ETF (TLT)

iShares 20+ Year Treasury Bond ETF TLT 0.00%↑ is in a stage 1 accumulation zone below its 200-day SMA.

I added to TLT here and my triple leveraged bonds trade in TMF.

TLT is an exchange-traded fund (ETF) that seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than twenty years. It provides exposure to long-term U.S. Treasury bonds, allowing investors to target a specific segment of the U.S. Treasury market.

TLT comprises U.S. Treasury bonds with maturities exceeding 20 years, offering targeted access to long-duration government securities.

TLT is sensitive to interest rate changes; as rates rise, the value of existing bonds typically falls, and vice versa. The ETF's performance can be influenced by macroeconomic factors and Federal Reserve policies.

Get access to my “MFG Trade Ideas of The Week” chart pack CLICK HERE!!

G’s Quick Notes🐼🤘

G’s Wrap-Up🐼

As we wrap up these swing trade updates, it's important to remember that each of these trades is rooted in disciplined analysis and timing— watching and waiting for the perfect Money Flow stage 1 setup to enter the trade.

Whether you're already positioned in these trades or watching for new opportunities, staying informed and patient is key.

Continue following along as we navigate waves of the markets together, keeping our focus on point and ready for the next move!

Iron sharpens iron.

Stay in flow!!

Thank you, MFG!!

👉Let me know in the comments if you like these MFG portfolio trade updates.

I appreciate you. 👈🙏🖤

Always remember, whatever you think about comes about, whatever you focus on grows. - G 🐼

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

Get access to my “MFG Trade Ideas of The Week” chart pack CLICK HERE!!

🐼🐼🐼🐼

Damn this is 🔥🔥🔥Yes GP 💎🙌