Achieving Financial Freedom: 10 Key Terms Every Astute Investor Must Master

Boost your portfolio with strategies that compound wealth over time.

Hey, MFG!

Financial independence is a common goal for traders and investors in the Money Flow Gang (MFG), many of whom are working to build wealth through smart and strategic dividend investing.

Understanding important investment terms and strategies can greatly enhance your ability to maximize returns while minimizing risks.

This article highlights 10 essential terms that every sophisticated investor should know to increase passive income and build significant wealth in the stock market.

-GP a.k.a Fullauto11 🧙🐼

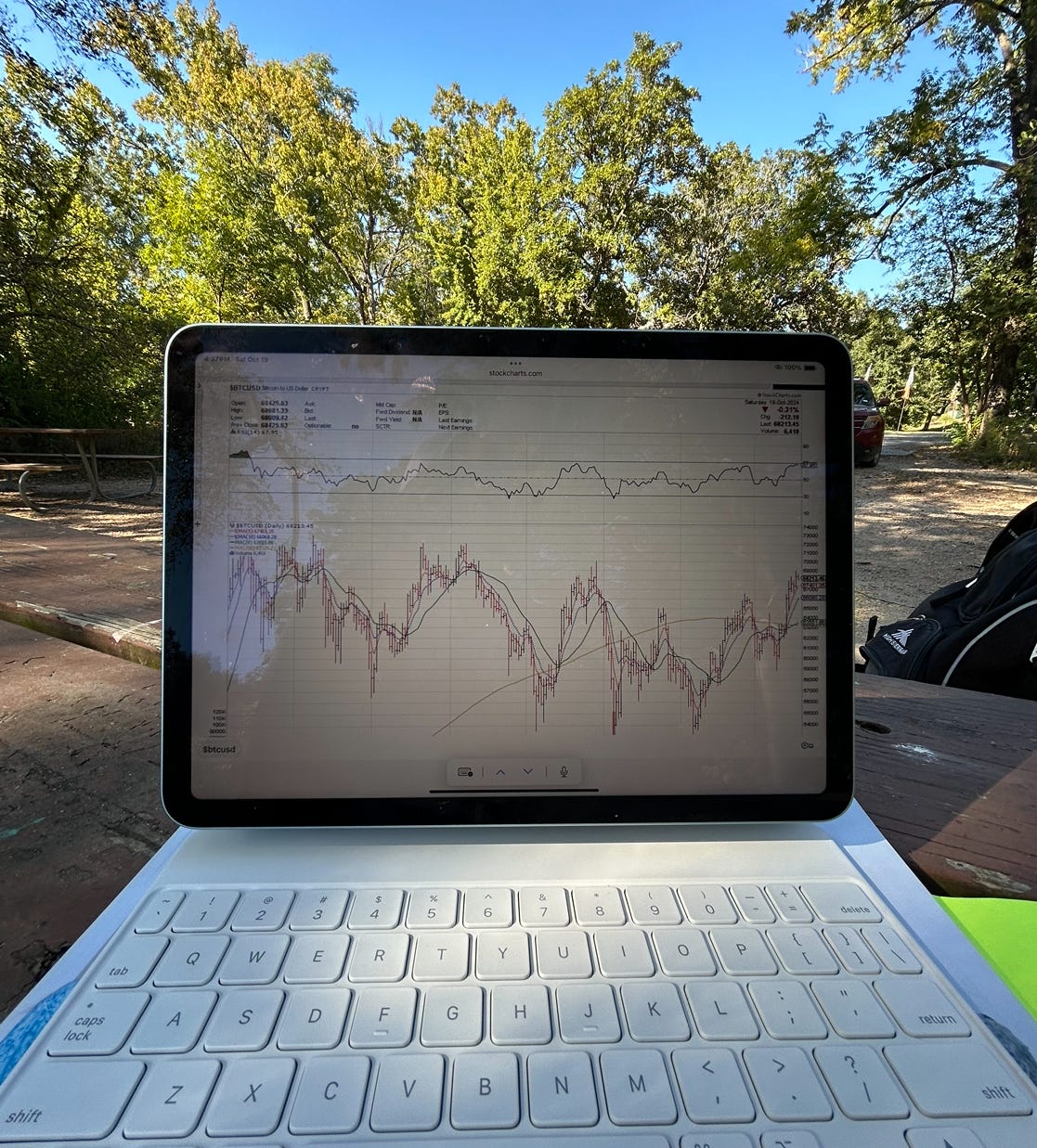

The Peters Report - Stock & Crypto Trader’s Resource

Always remain bullish and follow The Money Flow.

👉JOIN THE MFG DISCORD!!

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

NEW ANNOUNCEMENT!!

🚀 Upgrade to The Peters Report – Now Monetized!

Unlock exclusive insights and advanced strategies by becoming a paid subscriber to The Peters Report. Stay one step ahead of the market with in-depth analysis and actionable tips designed to help you succeed as a trader and investor. Support the work that keeps you informed and ahead of the curve.

Achieving Financial Freedom: 10 Key Terms Every Astute Investor Must Master

1. Margin

Explanation: Margin involves borrowing money from your broker to buy additional shares, using those shares as collateral. This method enables you to invest more than you could with just your own capital.

Relevance: While margin can magnify gains by increasing your investment, it also amplifies losses. It’s a powerful tool for sophisticated investors aiming to accelerate wealth-building, but must be handled with care to prevent significant losses.

2. REITs (Real Estate Investment Trusts)

Explanation: REITs are companies that own, manage, or finance income-generating real estate, offering investors the chance to gain real estate exposure without owning physical property.

Relevance: REITs are legally required to distribute at least 90% of their taxable income as dividends, making them an attractive option for passive income seekers. They allow you to diversify your portfolio while capitalizing on the real estate market's potential for growth.

3. BDCs (Business Development Companies)

Explanation: BDCs are firms that invest in small to mid-sized businesses by providing them with capital through loans or equity investments.

Relevance: BDCs are known for their high dividend yields, as they are required to distribute a large portion of their income to shareholders. Although they provide a great income source, BDCs also carry higher risk due to their investments in smaller, less stable companies.

4. ETFs (Exchange-Traded Funds)

Explanation: ETFs are funds that hold a diversified basket of assets and trade on stock exchanges like individual stocks.

Relevance: ETFs provide a cost-effective way to diversify your portfolio, spread out risk, and access various sectors or markets without picking individual stocks. Their liquidity and lower fees compared to mutual funds make them a popular choice for both novice and experienced investors.

5. MLPs (Master Limited Partnerships)

Explanation: MLPs are publicly traded entities, typically in the energy sector, that provide infrastructure services such as oil and gas pipelines.

Relevance: MLPs offer high yields thanks to their structure, which combines the tax benefits of a partnership with the liquidity of a publicly traded company. These investments can be an excellent source of stable income, but come with sector-specific risks, such as regulatory changes and market volatility.

6. CEFs (Closed-End Funds)

Explanation: CEFs are funds with a fixed number of shares that trade on exchanges, unlike mutual funds that issue or redeem shares as needed.

Relevance: CEFs often trade at a discount to their net asset value (NAV), offering potential opportunities for both income and capital appreciation. Investors looking for higher yields should understand how CEFs use leverage to enhance returns, but also be aware of the associated risks.

7. DRIP (Dividend Reinvestment Plan)

Explanation: A DRIP allows investors to automatically reinvest their dividends to purchase additional shares of the stock rather than receiving the dividend in cash.

Relevance: By reinvesting dividends, you leverage the power of compounding to grow your portfolio faster over time. It’s a strategy for building wealth incrementally without needing extra cash investments, making it ideal for long-term growth and passive income accumulation.

8. NAV (Net Asset Value)

Explanation: The net asset value (NAV) represents the per-share value of a fund’s assets minus liabilities, calculated by dividing the total assets by the outstanding shares.

Relevance: Investors use NAV to assess the fair value of funds, particularly CEFs. Knowing when to buy below NAV and avoid premiums can help maximize returns and ensure you're making smart investment decisions.

9. DRIP at The NAV

Explanation: This is the practice of reinvesting dividends at the fund’s net asset value (NAV), avoiding premiums that can inflate the cost of additional shares.

Relevance: By reinvesting dividends at NAV, investors maximize their share purchases and overall returns. This strategy is particularly effective in funds that trade at a premium, as it allows investors to avoid paying above-market prices for additional shares.

10. Tax-Advantaged Accounts

Explanation: Tax-advantaged accounts, such as IRAs and 401(k)s, offer significant tax benefits, including tax-deferred growth or tax-free withdrawals.

Relevance: These accounts are crucial tools for reducing tax liabilities, which can significantly improve your long-term returns. A well-structured retirement plan within these accounts is essential for efficient tax planning and wealth building.

Start Your Journey Toward Financial Independence Today

Taking control of your wealth through smart stock market investments is one of the most powerful ways to achieve financial freedom.

By mastering these key terms and strategies, you can build a diversified, income-generating portfolio that grows your wealth over time. Your future financial freedom starts with the knowledge and decisions you make today.

GP’s Wrap-Up

Mastering these 10 fundamental terms is crucial for investors aiming to build passive income and reach financial independence. By leveraging strategies like dividends, margin, REITs, BDCs, and DRIP, you can create a diversified, robust income portfolio.

Remember, financial independence is a long-term journey, requiring patience, discipline, and ongoing education, but with the right knowledge and strategy, the path to financial freedom is within your reach!!

Let’s keep growing, MFG!!

Always remember, whatever you think about comes about, whatever you focus on grows. - GP

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

NEW to trading and investing in stocks? Want a crash course? 12 videos and a 50 page manual- Getting Started with Stock Charts- The Money Flow Way: The Swing & Position Trading and Investment Blueprint. CLICK HERE

Yes yes yes

YES YES YES 🙌 started following GP aka @fullauto11 4 yrs ago , joined the money flow discord 2 yrs ago , the tools that I have learned from him in that time has given me the confidence to take control of my pension+ personal trading and investment portfolios , I’m not paying someone else anymore to do this ,

I’ve gone from 1 rental property to 3 properties , following GP’s straight line attitude to achieving these results , The greatest investment I’ve ever made was purchasing “The Money Flow Trading System “book and now being part of a like minded community in “The Money Flow” “MFG” Discord , every one of us are getting Richer , Thank you GP and Team for all that you do for us Brother 🙌🙌🙌🙌🙌🙌🐼