How To Get Paid in The Stock Market Every Friday

A simple way to earn weekly income from the stock market—No trading knowledge required.

Hey, MFG!

Imagine waking up every Friday, not just excited for the weekend, but knowing it’s also payday—from the stock market!

While most people only think about payday from their job, I want to share a strategy that can turn every Friday into a consistent pay day from your investments.

And the best part? It’s so simple that all you need is a smartphone and a brokerage account.

Whether you’re an experienced trader, a beginner investor, or even someone who has never thought about the stock market before, this strategy is accessible to everyone.

In fact, it’s so easy to implement that someone without any knowledge of options trading could start today.

Even if you’re just looking to generate passive income with minimal effort, this strategy can help make your Fridays more rewarding—financially.

Let’s dig into this simple way to collect money every Friday.

-GP a.k.a Fullauto11 🧙🐼

The Peters Report - Stock & Crypto Trader’s Resource

Always remain bullish and follow The Money Flow.

👉JOIN THE MFG DISCORD!!

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

🚀 Upgrade to The Peters Report – Trade of The Week!!

Unlock exclusive insights and advanced strategies by becoming a paid subscriber to The Peters Report. Stay one step ahead of the market with in-depth analysis and actionable tips designed to help you succeed as a trader and investor. Support the work that keeps you informed and ahead of the curve.

How To Get Paid in The Stock Market Every Friday

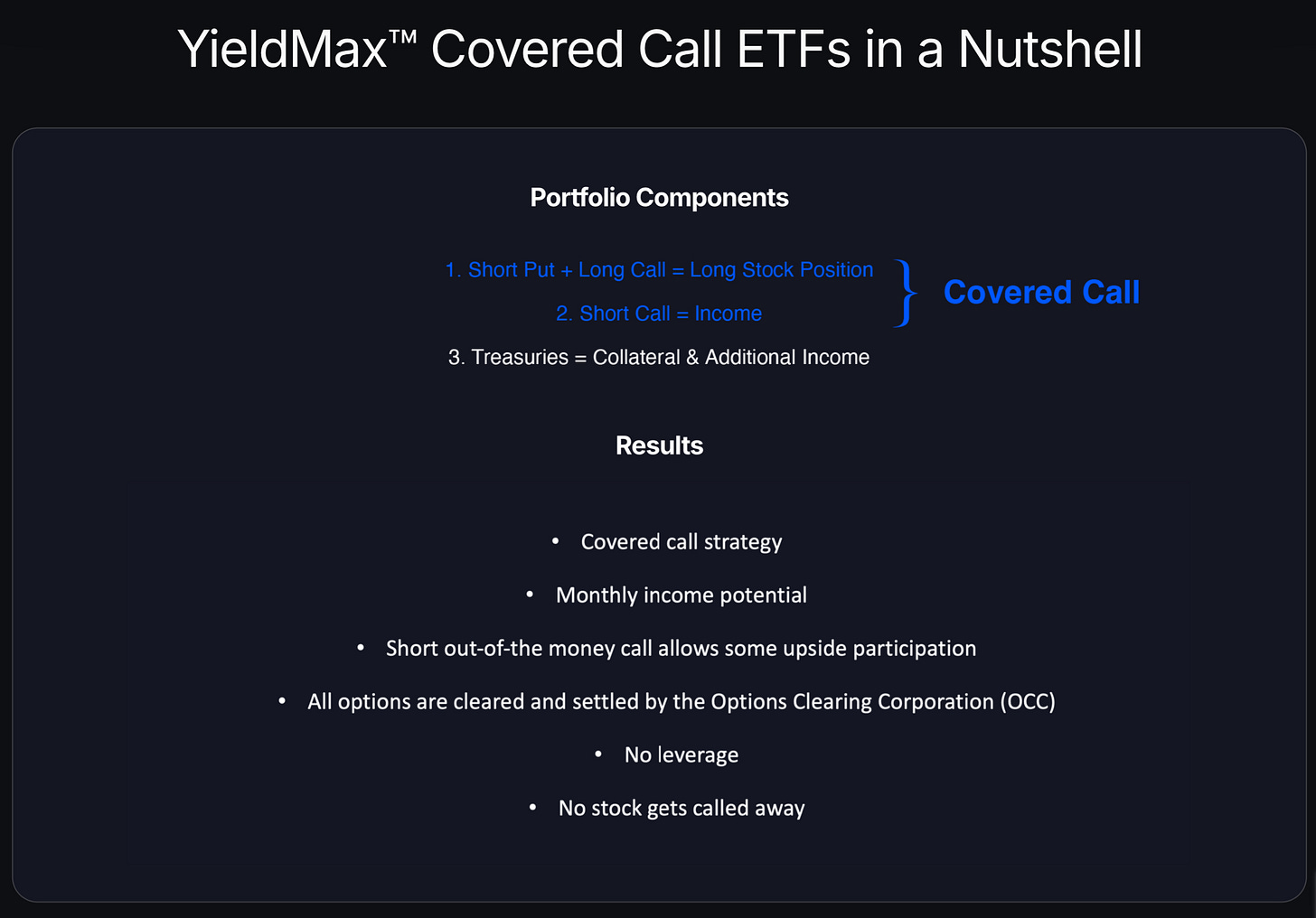

Options income funds are investment products designed to generate regular income by employing options strategies, primarily covered call writing.

They emerged as a way for investors to capitalize on option premiums while mitigating the risk associated with individual stock options trading.

These funds typically focus on generating consistent cash flow rather than capital appreciation, making them popular among income-seeking investors.

Over the years, they've become a reliable tool for both novice and experienced investors looking for steady payouts in volatile markets.

The Strategy: Buying Options Income Funds with Weekly Payouts

So, what exactly is the strategy that can make every Friday a payday?

It’s all about buying options income funds.

These are special types of funds that generate income by selling options on the stocks they hold.

The income generated from selling these options is passed on to you, the investor, in the form of regular payouts.

Now, here’s where the magic happens: many of these funds pay out their distributions on a weekly basis—often on Fridays.

This means that by holding these funds, you’re essentially setting yourself up to receive weekly income from the stock market without having to actively manage your investments or understand the complexities of options trading.

You might be thinking, “BuT GeRaLD!! I don’t know anything about options.”

That’s the beauty of this strategy: you don’t need to know anything about options trading to profit from these funds.

The fund managers do all the heavy lifting by selecting the stocks, executing the options strategies, and ensuring the income flows to you. All you need to do is own the fund and have the courage to hold it over time.

Who Is This Strategy For?

This strategy is truly for anyone.

Here’s a breakdown of who can benefit from it:

Beginners: If you’re new to investing, options income funds are a fantastic way to dip your toes into the market without having to navigate complicated trading strategies. You’re essentially letting the professionals handle the options trades, while you enjoy the payouts.

Experienced traders: Even if you’re already familiar with the market, this strategy can be a low-maintenance addition to your portfolio. You can benefit from regular cash flow without having to actively monitor your positions or manage trades. For traders who want to diversify their income streams, this approach adds a passive element that works in the background.

Anyone with a smartphone and a brokerage account: And I really mean anyone. As long as you have a smartphone and access to a brokerage account, you can take advantage of this strategy. You don’t need a fancy trading setup or extensive knowledge of the market—just the willingness to get started. In fact, this strategy is so simple that even homeless individuals with a smartphone could begin generating passive income. All it takes is the ability to buy and hold these funds. It’s that accessible.

No matter your situation, as long as you have a phone, a brokerage account, and a desire to create passive income, this strategy can work for you.

Options Income Funds That Pay Every Friday

I absolutely love receiving fat, juicy dividends. There's nothing better than waking up to see hundreds or even thousands of dollars in dividend income that accumulated while I slept.

I have been investing in YieldMax funds for over a year now.

If you want to learn more about options income funds, check out my article:

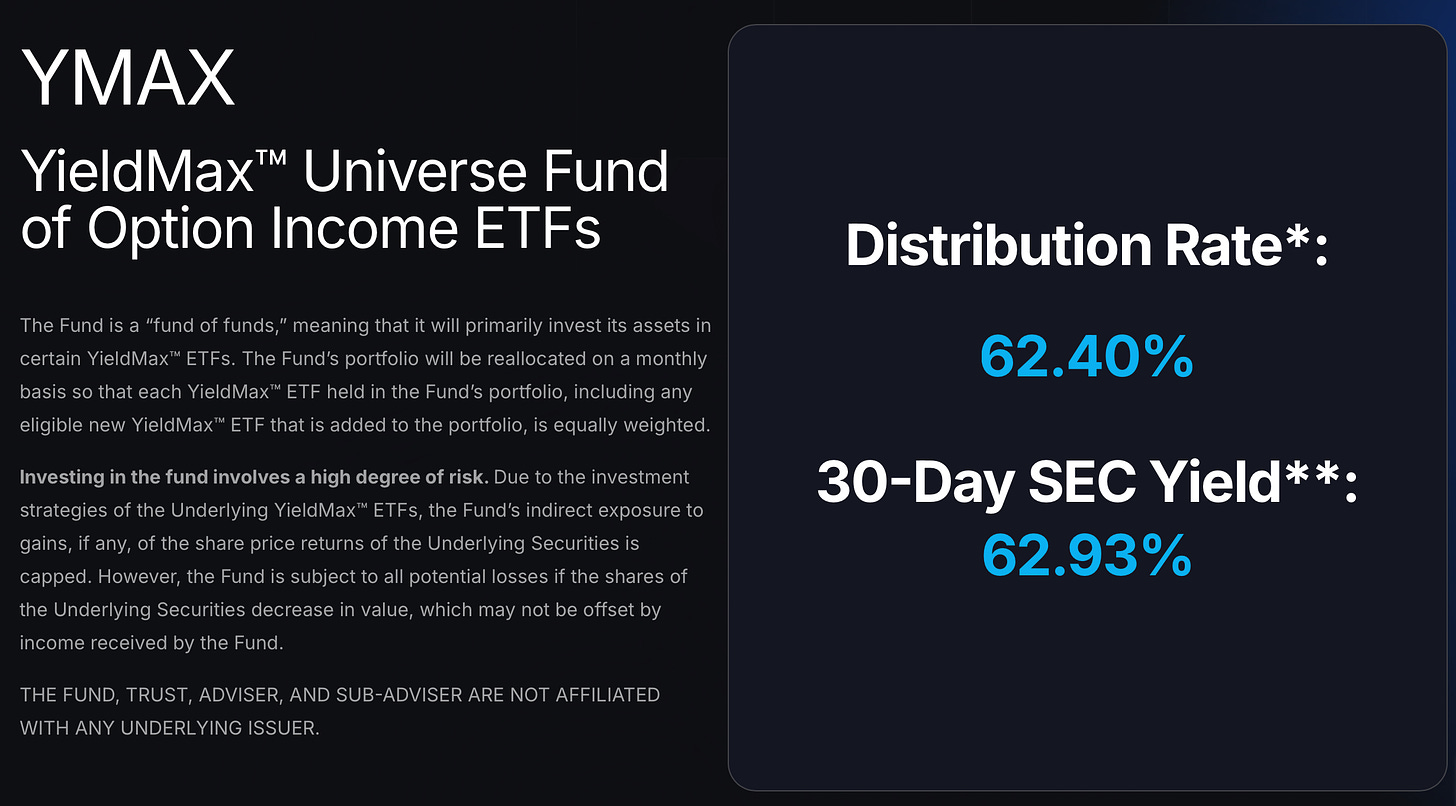

The investment team at YieldMax recently switched some of the funds from monthly to weekly distributions. These include YieldMax™ Universe Fund of Option Income ETFs YMAX 0.00%↑ and YieldMax™ Magnificent 7 Fund of Option Income ETFs YMAG 0.00%↑ . I personally own YMAX.

Investors can now collect weekly dividends on Friday from these two funds plus other single-stock ETFs.

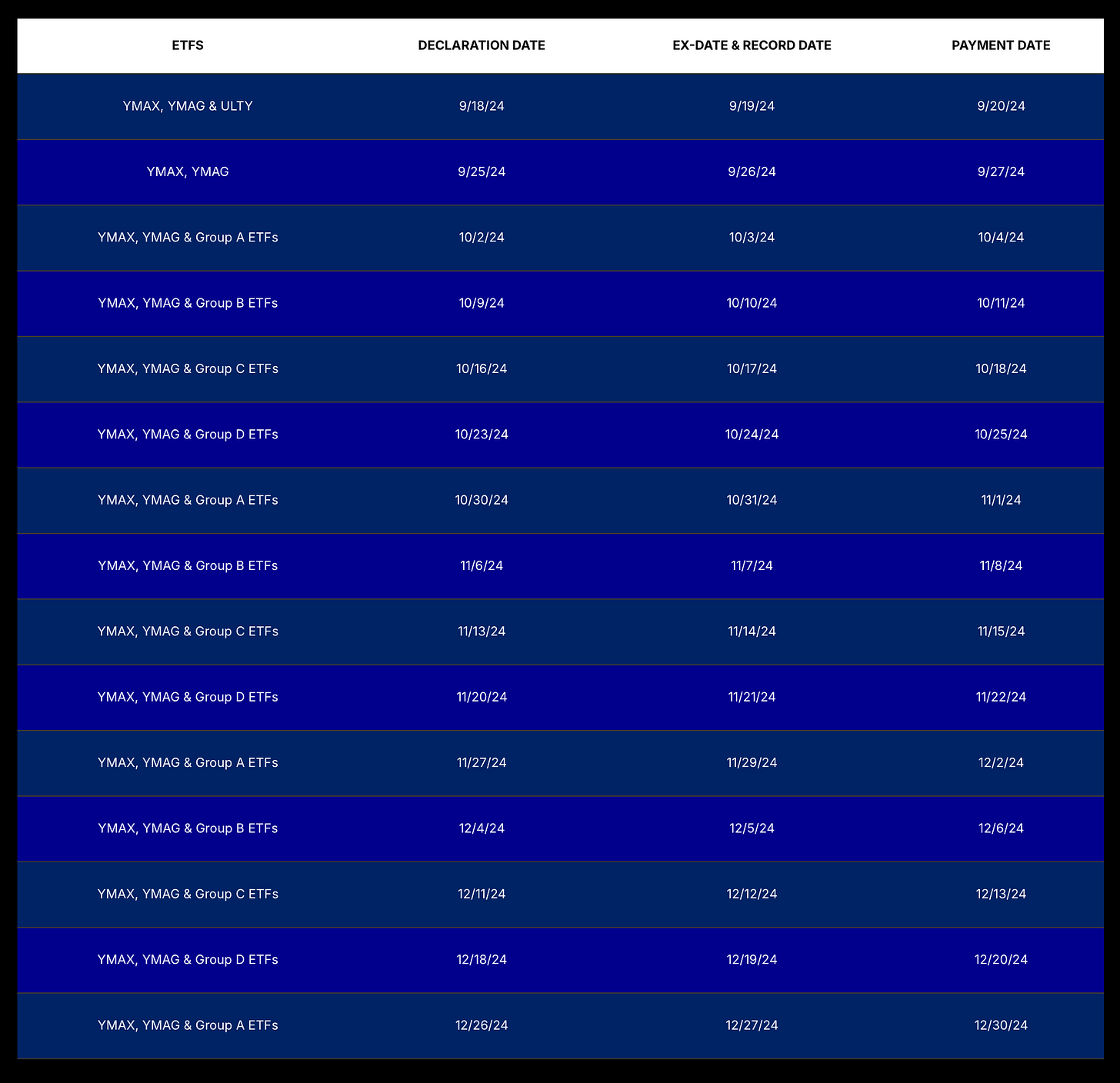

Let’s take a look at this distribution schedule for YieldMax ETFs:

YMAG and YMAX pay weekly along with each groups of ETFs. So you could collect multiple dividends every Friday.

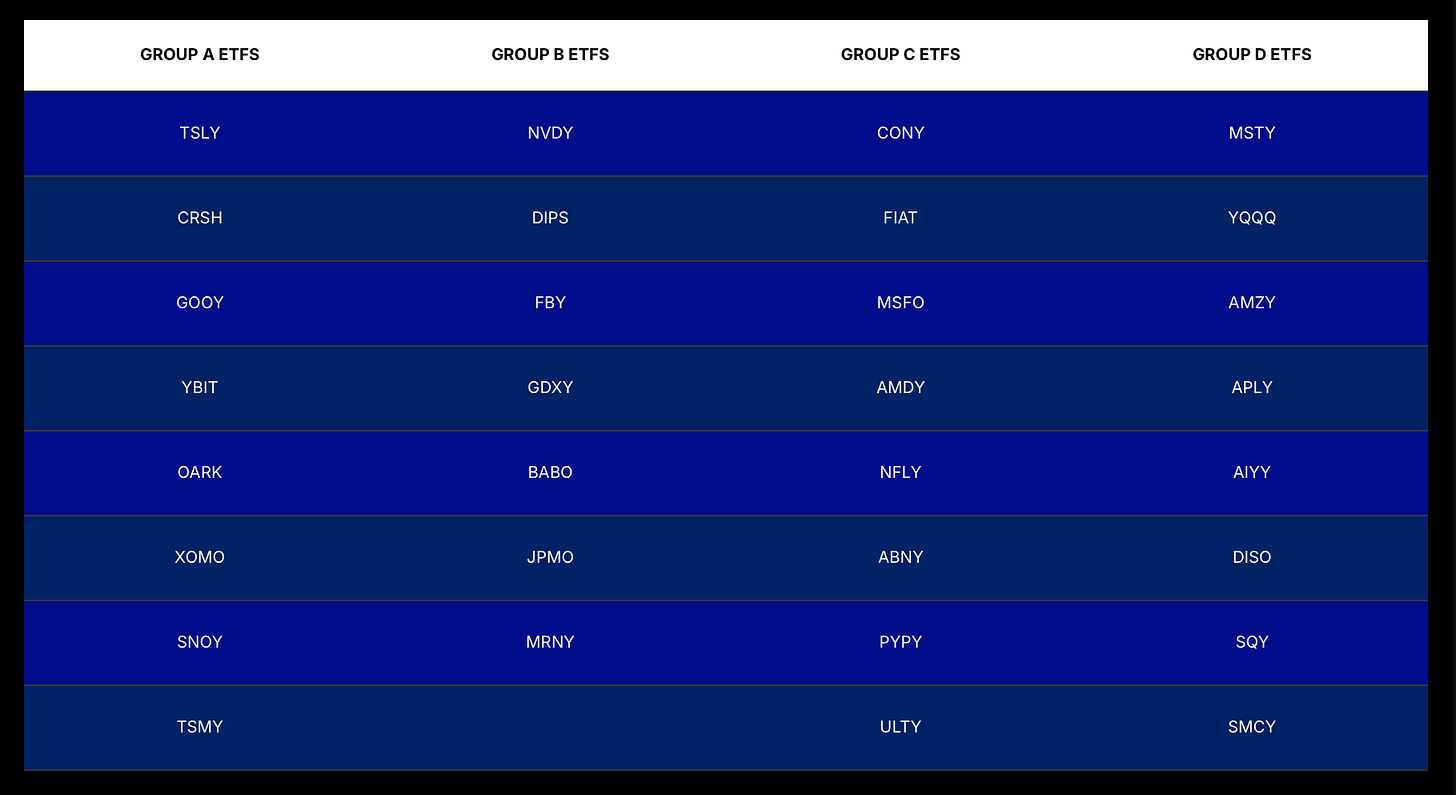

Let’s take a look at which single-stock ETFs are in each group:

This last Friday, October 4th, was payday for Group A. So if you’re in YMAX, YMAG, and all group A funds—TSLY, CRSH, GOOY, YBIT, OARK, XOMO, SNOY, and TSMY.

That’s 10 dividend payouts every Friday that has nothing to do with your job!!

Dividends are the only true passive income.

If you’re new to options funds and just want to get it going to collect weekly dividends, you could start with YMAG and YMAX.

Now let’s take a look at the weekly distributions for YMAX:

The distribution for each share of YMAX on October 4th was $0.2076.

If you owned a 100 shares, your payout would have been $20.76.

These new, modern day options income funds have been a game changer in the stock market world!

By leveraging yourself, you’re able to make money with options without having to know anything about how to write options contracts.

That’s the beauty of these funds.

A Deeper Look into YieldMax’s Options Strategies

Grab a free copy of Gerald’s ebook You Don’t Have To Die Broke! CLICK HERE!

Why This Strategy Works: Here’s why this strategy is so effective:

Weekly cash flow: Instead of waiting for quarterly or monthly dividends, you can receive distributions every week, often on Fridays. That means a steady stream of income flowing into your account, helping you to live off of or reinvest for faster growth.

No knowledge of options required: The beauty of options income funds is that they remove the barrier of needing to understand options trading. While trading options directly can be complex and risky, these funds use conservative strategies like covered calls to generate income. The best part? You don’t have to worry about any of the details because the fund managers handle it all. You just collect the cash flow!!

Simplicity and accessibility: This strategy is about as straightforward as it gets. You don’t need to be glued to your trading screen or even know what options are. All you need is a smartphone and a brokerage account, and you can get started today! Whether you’re a college student, a homeless person, retiree, or someone just looking to supplement their income, this strategy is within reach for anyone. It’s an incredibly accessible way to take advantage of the stock market.

Steps to Get Started

Step 1: Research Options Income Funds. Take a look at some of the funds mentioned above (YMAG, YMAX, YBIT, TSLY TSLY 0.00%↑ , etc.) and others that might fit your investment goals or are some of your favorite companies.

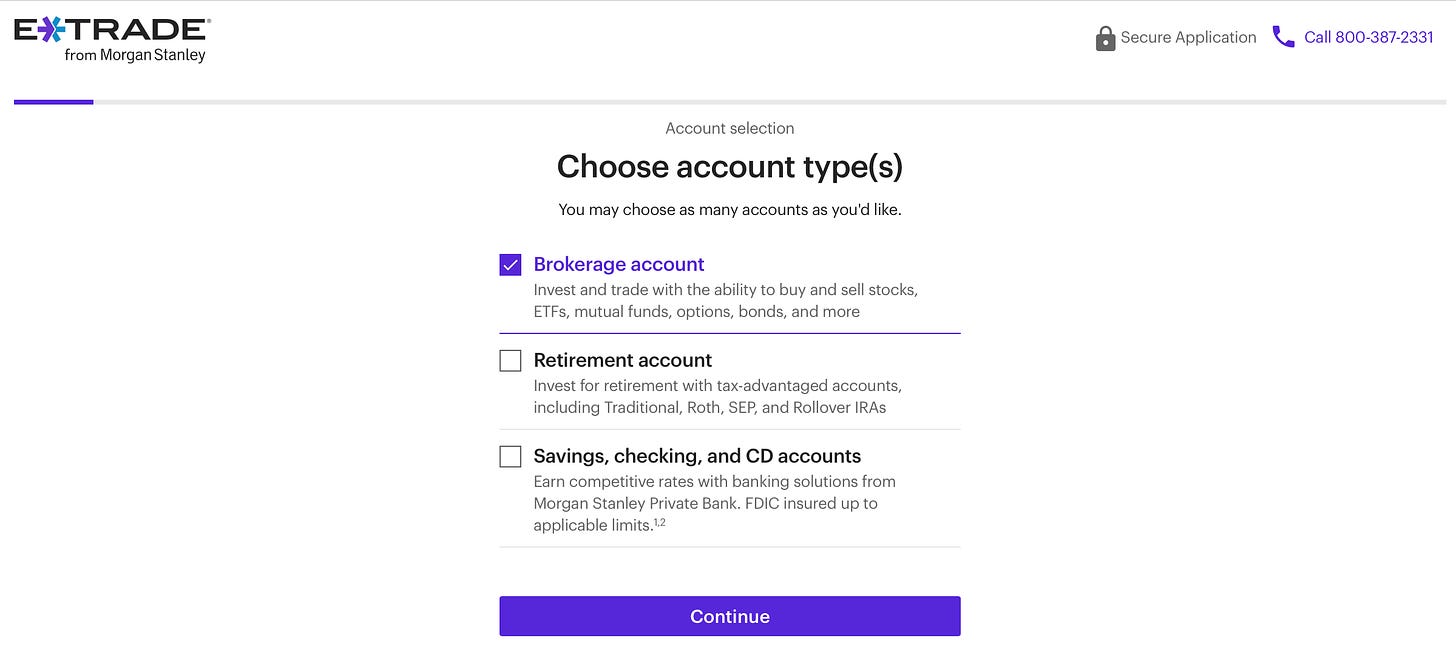

Step 2: Set up a brokerage account. If you don’t already have one, setting up a brokerage account is as simple as downloading an app, like E*Trade, Charles Schwab, or Fidelity on your phone. Most of these platforms are user-friendly, and many offer commission-free trades on ETFs. I use E*Trade and have for over 20 years.

Step 3: Buy and hold. Once you’ve gotten your account setup and funded, all that’s left is to purchase shares of YMAX YMAX 0.00%↑ or YMAG YMAG 0.00%↑ , or both, and hold them. You’ll start receiving payouts on a weekly basis, and those funds will automatically deposit into your account. It really is that simple—no extra work required. You can choose to have your dividends go to cash or set them to DRIP.

Link to YieldMax ETFs website CLICK HERE.

Link to E*Trade website CLICK HERE.

GP’s Wrap-Up

One of my investing goals is to get my annual dividend income to at least $100,000 per year in my margin account.

I add money and drip buy shares everyday. Every week my dividend income increases steadily. I love dividends!!

This strategy is one of the easiest ways to turn every Friday into payday.

Whether you’re a beginner investor, an experienced trader, or just someone with a smartphone looking to generate passive income, buying options income funds can set you on the path to consistent cash flow.

The best part? You don’t need to be a financial expert to make it work—all you need is a desire to start building wealth, one Friday at a time.

Always remember, whatever you think about comes about, whatever you focus on grows! - GP

👉Looking for a group of likeminded people to trade with? Text alerts and the MFG DISCORD. Text GP 1-936-661-7786 to join.

👉If you need help with setting up your charts and want a mini crash course in the Money Flow, consider GP's course:

"Getting Started with Stock Charts the Money Flow Way" and you will be ready to add shares to your portfolios on stage 1 when the markets are about to possibly rotate and trim profits when opportunities arise. CLICK HERE!

FINANCIAL DISCLAIMER

This is not financial advice, but education to increase awareness. Before making investment decisions, always do thorough research and possibly consult with a financial advisor. The above descriptions are a broad overview and may not capture all nuances associated with each asset.

💧💧

Going to share this with my baby adult children. I own these ETFs. I tell me friends about these ETFs. They are like owning trailers in a trailer park.