Gold Hits A New All-Time High; Can It Sustain Its Momentum? Copper Surges by 7%!

Exploring the dynamics behind the precious and industrial metals' remarkable gains in a fluctuating market.

Hey, MFG!

Gold GLD 0.00%↑ is currently leading The Wind and reaching new all-time highs. The shiny metal has been surging and is one of the best performing assets of the year!

GLD is now trading at an extreme-high RSI reading and keeps climbing higher. It has been on a beautiful run that certainly doesn’t look over. Let’s take a look at the chart.

[See GLD chart below]

[The RSI is greater than 70, price is above the 5-day EMA, the moving averages are in numerical alignment, and the MACD histogram is ticking upwards on the bullish side.]

Let’s dig into why gold is on the rise, along with another precious metal, copper.

-GP a.k.a Fullauto11 🧙🐼

The Peters Report - Stock & Crypto Trader’s Resource

Always remain bullish and follow The Money Flow.

👉JOIN THE MFG DISCORD!!

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

🚀 Upgrade to The Peters Report – Trade of The Week!!

Unlock exclusive insights and advanced strategies by becoming a paid subscriber to The Peters Report. Stay one step ahead of the market with in-depth analysis and actionable tips designed to help you succeed as a trader and investor. Support the work that keeps you informed and ahead of the curve.

Gold Hits A New All-Time High; Can It Sustain Its Momentum? Copper Surges by 7%!

As we navigate through turbulent market waters, the dazzling ascent of gold continues to captivate investors.

Recently, Gold GLD 0.00%↑ soared to new all-time highs, demonstrating its status as a robust asset. This year alone, gold has outshone major market indexes with a nearly 28% increase in value.

Why gold continues to shine.

Gold's impressive performance can largely be attributed to the Federal Reserve's recent monetary policy actions.

The Fed's decision to cut interest rates by half a point last week not only boosted the stock market, but also significantly enhanced gold prices, with further reductions expected through 2025.

This easing of monetary policy typically weakens the U.S. dollar, making gold—an asset priced in dollars—more attractive.

Additionally, gold's historical role as a safe haven during geopolitical tension and economic uncertainty has never been more relevant. Current global events, including conflicts in the Middle East and the ongoing Russia-Ukraine crisis, have propelled investors toward the safety of gold.

Financial experts like Chris Gaffney from EverBank World Markets and Ryan McIntyre from Sprott are bullish on gold’s prospects. They forecast that gold could rise another 10% to 15% in the near term, potentially reaching around $3,000 an ounce.

The ripple effect of China’s stimulus.

Adding to the complexity of the global economic environment, China's recent stimulus measures have sent shockwaves through commodity markets, notably impacting copper.

After China unveiled plans to inject more liquidity into the economy and support property markets, copper CPER 0.00%↑ prices exploded by 7%, demonstrating the metal's sensitivity to economic policies in the world’s top consumer of the metal.

This surge in copper prices also positively affected Freeport-McMoRan Inc. FCX 0.00%↑, one of the trades we track daily in The Peters Report.

FCX saw a significant uptick, which is a direct testament to the strategic foresight of our trading approach.

Congratulations to all who are in the FCX trade!!

As the U.S. approaches a major election season, the political climate may lead to more fiscal stimulus, potentially resulting in higher deficits traditionally beneficial for gold.

With such dynamics at play, maintaining a keen eye on these developments is crucial for sophisticated investors.

Gold's proven track record as a hedge against inflation and uncertainty solidifies its position as a key component of diversified investment strategies.

The interconnectedness of gold and copper in the broader commodity market highlights the need for astute investors to stay informed about global economic policies and market responses.

Now let’s dig into different ways I like to trade gold, silver, and copper.

Multiple Ways To Play The Precious Metals Trade

Investing in or trading precious metals like copper, gold, and silver can be done in multiple ways, each with different levels of exposure, risk, and complexity.

If you know me, I’m always looking for different ways to make money in the stock market down to each specific trade and you know I like leverage.

These are some of my favorite ways to play the precious metals trade. I once had a an unforgettable trade in silver that I rolled profits forward into a rental property.

Gold

Gold GLD 0.00%↑ SPDR Gold Shares ETF offers direct exposure to gold price movements by holding physical gold. This is one of the seven asset classes we track in The Wind every day.

UGL UGL 0.00%↑ ProShares Ultra Gold provides leveraged exposure, aiming to deliver twice the daily performance of gold. (2X leveraged fund of gold). I like to trade UGL.

Silver

Silver SLV 0.00%↑iShares Silver Trust tracks the price of silver. I use this chart for my trade analysis and plan when trading a leveraged silver fund.

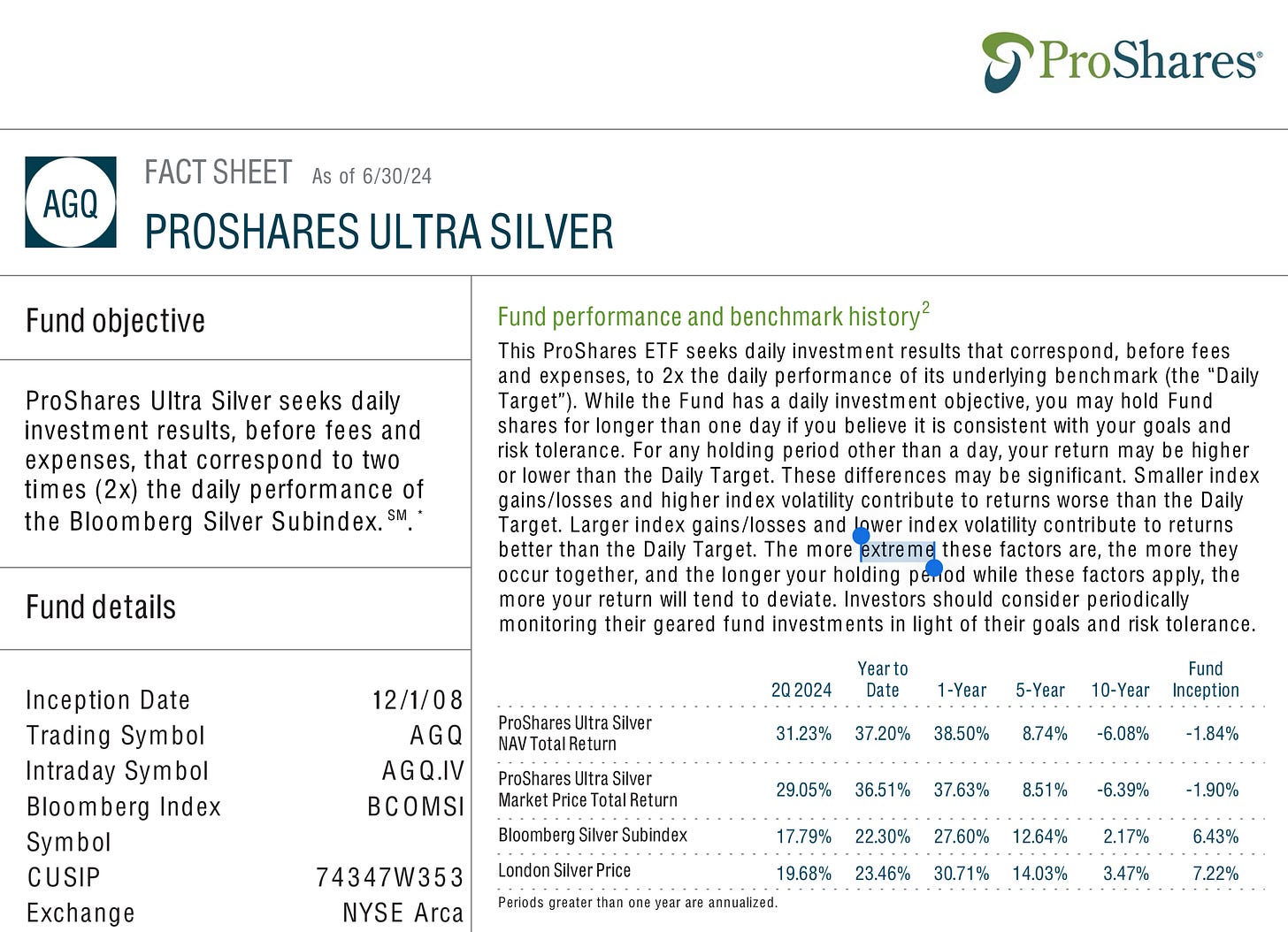

AGQ AGQ 0.00%↑ ProShares Ultra Silver is a leveraged ETF designed to double the daily performance of silver. (2x leveraged fund of silver). AGQ is one of my favorite leveraged funds to trade.

Copper

Copper CPER 0.00%↑ United States Copper Index Fund tracks the price of copper through futures contracts, providing direct exposure to copper price fluctuations.

My favorite way to play the copper trade is swing trading the mining stock Freeport-McMoRan Inc. FCX 0.00%↑.

Gold Miners

GDX GDX 0.00%↑VanEck Gold Miners ETF I use this chart to track gold miners and make my trade analysis and moves from.

GDXJ GDXJ 0.00%↑VanEck Junior Gold Miners ETF You would use this chart for you trade analysis for JNUG.

NUGT NUGT 0.00%↑Direxion Daily Gold Miners Index Bull 2X Shares ETF The MFG Discord is currently in this trade.

GDXU GDXU 0.00%↑Microsectors Gold Miners 3X Leveraged ETN

JNUG JNUG 0.00%↑ Direxion Daily Junior Gold Miners Index Bull 2X Shares ETF

XME XME 0.00%↑ SPDR S&P Metals & Mining ETF

Passive Monthly Dividend Income from Gold Miners

GDXY GDXY 0.00%↑ YieldMax Gold Miners Option Income Strategy ETF

Buy & Hold / Dividend Investing

Barrick Gold Corp GOLD 0.00%↑

Newmont Corporation NEM 0.00%↑

Freeport-McMoRan Inc. FCX 0.00%↑

GP’s Wrap-Up

I hope this helps you understand gold market trends and the dynamics of the precious metal markets, MFG!

I’m currently letting my 2x leveraged gold trade UGL run here. I trimmed my 2x leveraged silver trade AGQ this week since price hit its first target. I also haven’t trimmed NUGT yet.

Thank you from the bottom of my heart for your continued support and belief in me. I believe in you.

Always remember, whatever you think about comes about, whatever you focus on grows! - GP

Grab a free copy of Gerald’s ebook You Don’t Have To Die Broke! CLICK HERE!

If you need help with setting up your charts and want a mini crash course in the Money Flow, consider GP's course:

"Getting Started with Stock Charts the Money Flow Way" and you will be ready to add shares to your portfolios on stage 1 when the markets are about to possibly rotate and trim profits when opportunities arise. CLICK HERE!

FINANCIAL DISCLAIMER

This is not financial advice, but education to increase awareness. Before making investment decisions, always do thorough research and possibly consult with a financial advisor. The above descriptions are a broad overview and may not capture all nuances associated with each asset.

That’s beautiful chart, hopefully silver can play catch up 🦅

🐼🐼🐼🐼🐼🐼🐼🐼🐼🐼