New Year, New Goals!! How a Net Worth Calculation Sets the Stage for Financial Growth!!

Set the tone for financial success in 2025 by calculating your net worth this January.

Hey, MFG!

Do you know your exact financial standing and net worth today? For swing traders, scanning stock charts and identifying trade setups is second nature. But one of the most important metrics for trading success often gets overlooked: your net worth.

Regular net worth assessments provide a clear snapshot of your overall financial health, helping you manage risk, allocate trading capital wisely, and stay motivated to grow your portfolio.

By understanding your financial foundation, you can make smarter swing trades that align with your long-term wealth-building goals

This simple, but impactful and insightful practice not only shows you your current financial standing but, when done regularly, naturally helps your money grow as you focus on building wealth.

-GP a.k.a Fullauto11 🧙🐼

The Peters Report - Stock & Crypto Trader’s Resource

Always remain bullish and follow The Money Flow.

👉JOIN THE MFG DISCORD!!

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

New Year, New Goals!! How a Net Worth Calculation Sets the Stage for Financial Growth!!

What Is Net Worth and Why Does It Matter for Us Swing Traders?

Net worth is the difference between your assets (like cash, stocks, and real estate) and your liabilities (like loans and credit card debt).

For swing traders, tracking net worth isn’t just about measuring wealth—it’s about maintaining a solid financial base to support your trading activities. Your net worth tells you how much capital you can safely allocate to trades, whether you’re scaling into a new position or managing margin accounts.

Without this clarity, you risk overextending yourself financially, which can lead to poor emotional decisions and unnecessary losses.

Benefits of Regular Net Worth Tracking for Swing Traders🤘

Risk Management:

Knowing your net worth helps you set appropriate risk levels for each trade. For example, if your net worth is $500,000 and you follow the 1% rule, you’d risk no more than $5,000 per trade.Capital Allocation:

Understanding your financial standing allows you to allocate capital strategically—whether that’s increasing exposure to high-conviction trades or diversifying across multiple setups.Long-Term Perspective:

Swing trading can be volatile, but tracking your net worth reminds you to focus on overall growth and the bigger picture rather than short-term wins or losses.Motivation to Improve:

Watching your net worth grow as a result of successful trades reinforces discipline and encourages better decision-making.

Steps to Calculate and Track Your Net Worth👇

To incorporate a monthly net worth calculation into your swing trading routine to become automatic:

List Your Assets:

Include cash, brokerage accounts, retirement funds, real estate, and any other assets.

For swing traders, break down your trading accounts separately for better visibility.

List Your Liabilities:

Include all debts, such as margin loans, credit card balances, and personal loans.

Be sure to account for trading-related liabilities, like leveraged positions or pending taxes.

Calculate Net Worth:

Subtract liabilities from assets to determine your net worth.Review Monthly or Quarterly:

Sync your net worth updates with your swing trading reviews to track progress and adjust strategies.Use Tools:

Financial apps like Personal Capital or Excel spreadsheets can simplify the process and help you spot trends over time.

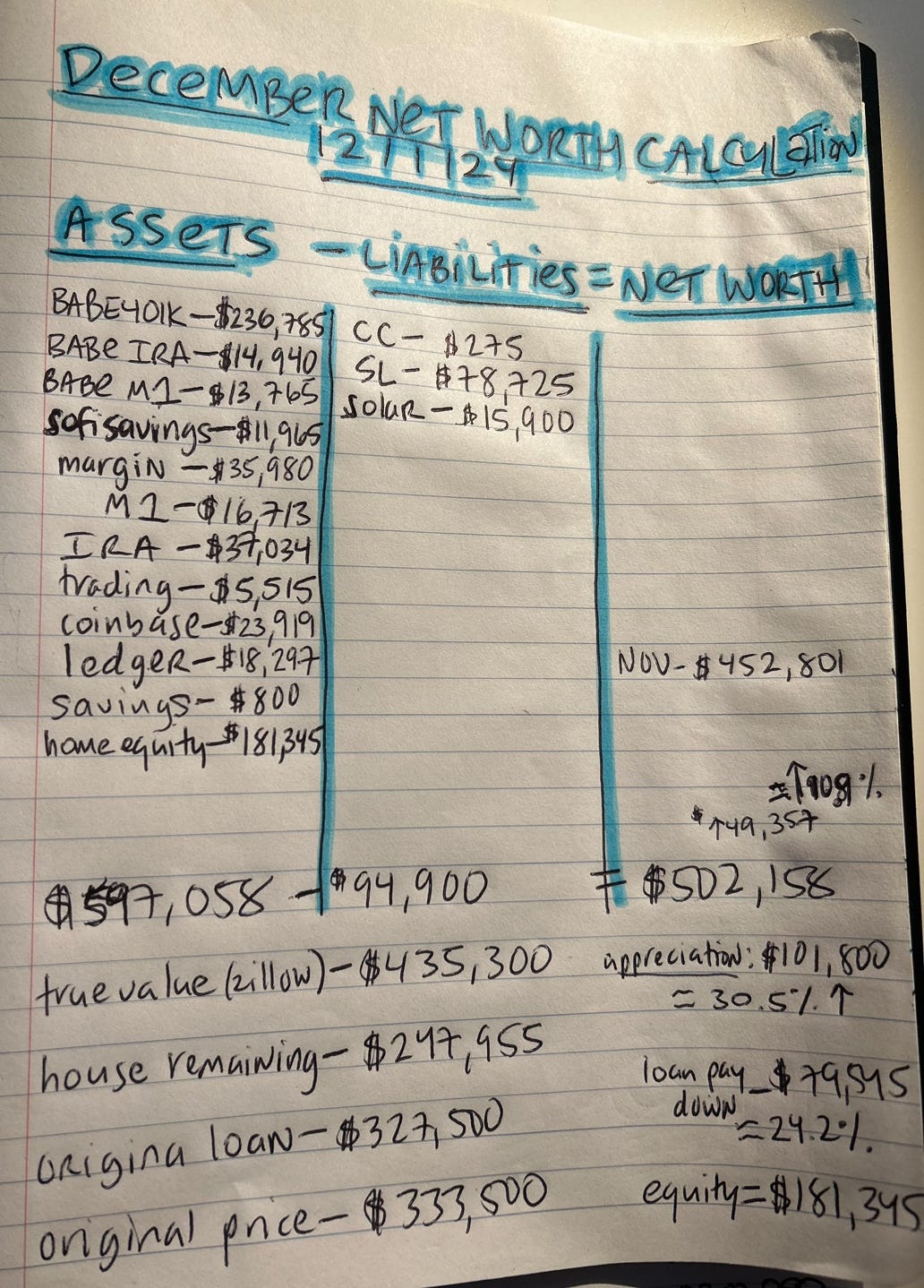

Real-Life Example: Net Worth Tracking for Swing Trading Success💰

Imagine this: A swing trader with a $200,000 net worth notices their margin usage is creeping up to dangerous levels.👇

By recalculating their net worth, they realize their liabilities (margin loans) are growing faster than their assets. 👇

They decide to reduce their margin exposure and focus on high-probability setups, preserving their financial health.👇

Three months later, their net worth is back on track, and their trading performance improves due to reduced stress and better decision-making.👈

🚨Many students have sent me their net worth every month for years now.‼️

[A net worth calculation example from last month below] 👇

👉ASSETS - LIABILITIES = NET WORTH👈

How to perform your net worth calculation: 👇

List Your Assets: Write down everything you own.

Cash in bank accounts; checking & savings

Cash in Cash app, PayPal, Venmo, etc.

401ks and IRAs

Brokerage accounts

Crypto portfolios

Bitcoin & U.S.D.C.

Personal homes

Rental properties

Art & Jewelry

Antiques & Sports Memorabilia, etc.

List Your Liabilities: Write down everything you owe:

Car loans

Credit card balances

Student loans

Any other debts

Calculate Total Assets: Add up all items in your assets list.

Calculate Total Liabilities: Sum up all items in your liabilities list.

Find Your Net Worth: Subtract total liabilities from total assets:

Net Worth=Total Assets−Total Liabilities👈Track Monthly: Write down your net worth each month to see how it changes over time. Identifying trends early helps you make better financial decisions, whether that means increasing savings, reducing debt, or building investments.

👉ASSETS - LIABILITIES = NET WORTH

Relating Net Worth to Swing Trading Strategy👇

Scaling Into Trades:

Swing traders often scale into positions to manage risk. Your net worth can guide how much capital to allocate at each stage, ensuring you don’t overcommit to a single trade.Margin Management:

Using margin can amplify gains, but it also increases risk. Tracking your net worth helps you stay within safe leverage levels and avoid overexposure.Evaluating Performance:

Combine net worth tracking with your trade reviews to evaluate how well your trading strategy allows you to self-reflect, gain mental clarity, and contributes to overall financial growth. If your net worth isn’t increasing, it may be time to reassess your approach or increase your income.Setting Profit Goals:

Your net worth can serve as a benchmark for setting swing trading profit targets. For example, aim to grow your net worth by a specific percentage through disciplined trades.

🚨Common Mistakes to Avoid as a Swing Trader👇

Over-Leveraging Margin:

Excessive use of margin can erode your net worth quickly during market downturns.Ignoring Overall Financial Health:

Focusing solely on trading accounts without considering liabilities can give a false sense of financial security.Reinvesting Without a Plan:

Blindly rolling profits into new trades without assessing your net worth can lead to overexposure and unnecessary risk.

GP’s Wrap-Up🐼

Your financial future starts with clarity and intention.

👉As we start 2025, take charge of your wealth by performing your first net worth calculation of the year.👈

Let this simple, but powerful habit guide you into a year of growth, focus, and success!! 💥

👉Tracking your net worth should become automatic.👈

👉Remember: wealthy people count their money, and you’re on your way to joining them.👈

Always remember, whatever you think about comes about, whatever you focus on grows. - GP

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

Stay Up To Date🏄🌊

NEW to trading and investing in stocks? Want a crash course? 12 videos and a 50 page manual- Getting Started with Stock Charts- The Money Flow Way: The Swing & Position Trading and Investment Blueprint. CLICK HERE

I need to get on this right now!! I’m behind already!!

Yes yes yes GP, thank you for this substack ❤️❤️