The Peters Report 5-4-25

The Sunday Edition of The Money Flow Newsletter & GP’s Playbook for The Week Ahead

MFG STATE OF THE MARKET 5-4-25

The markets were on fire again last week!!

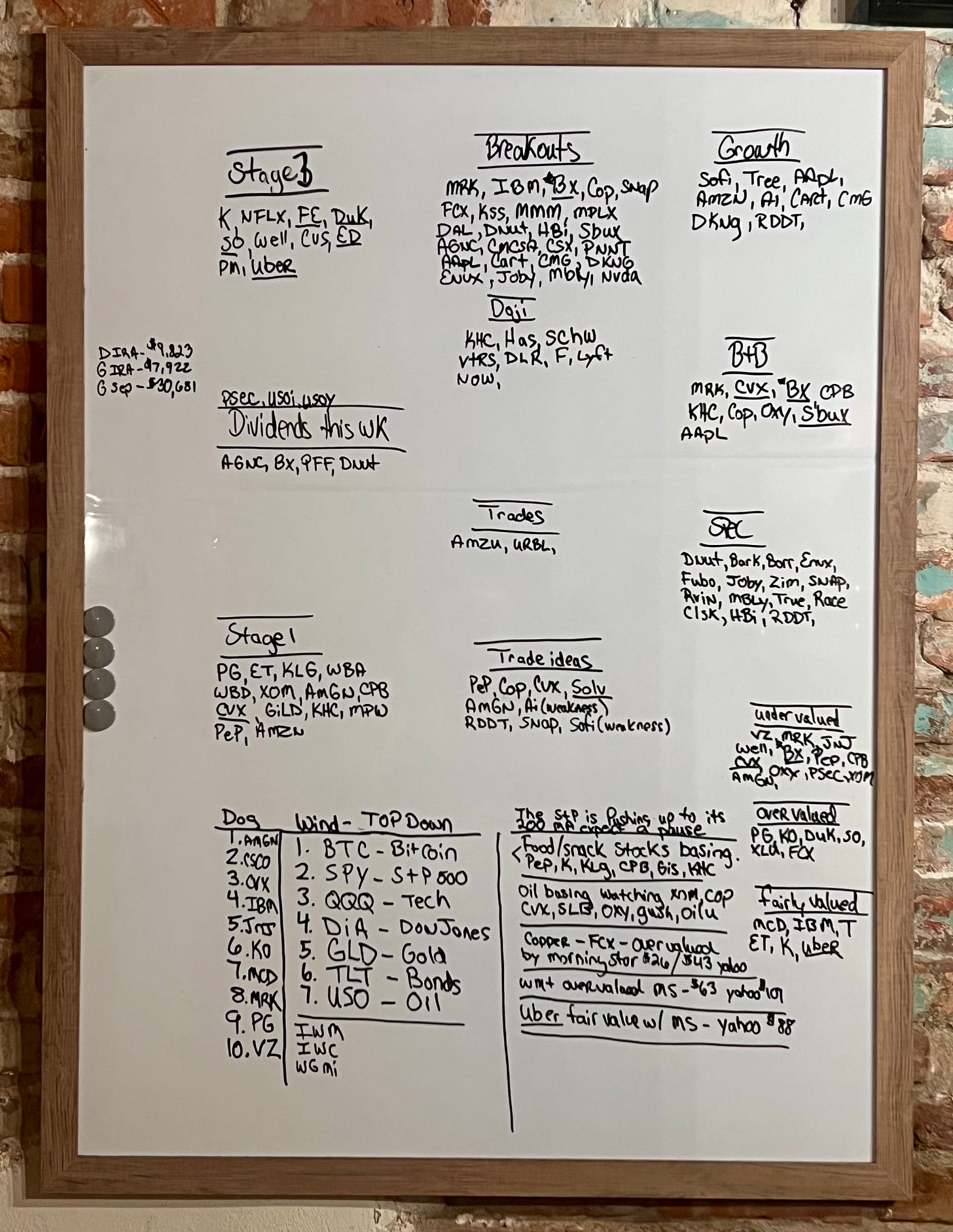

The stage 2 uptrends in the major indexes continued to move higher. The Nasdaq (QQQ) tagged its 200-day SMA, while the S&P 500 (SPY) and the Diamonds (DIA) are following right behind and approaching their 200-day SMA.

There’s still plenty of room on these indexes for the RSI to keep climbing higher.

The Nasdaq (QQQ) is the top performer out of The Big 3, while the Dow Jones (DIA) is the lagging index.

The stage 2 uptrend in Bitcoin (BTC) above its 200-day SMA has seemed to lost some momentum. This week will tell us more if price rolls over here or not.

Gold (GLD) is entering a possible stage 4 decline after closing below its 20-day SMA. Bonds (TLT) have come back into an a stage 1 accumulation zone after a failed stage 2 breakout attempt, which is typically pretty bearish.

Oil (USO) is in a stage 1 accumulation zone and still holding its anchor point, but is trading below its 5-day EMA. I’m watching oil plays closely here for entries.

The Russell 2000 Index (IWM) is in a stage 2 uptrend below its 200-day SMA with plenty of room to run on the RSI. Industrials (XLI) was the best performing sector of the S&P 500 (SPY), while Energy (XLE) was the worst. Be patient and stay in flow.

Last week was an exciting week for the MFG portfolio!!

I was profitable day trading NVDA again and collected even more lucrative weekly dividends!! I locked in profits in my double leveraged UBER trade in UBRL.

Hasbro, Inc. (HAS) completed its Bread & Butter trade! We saw strong breakout moves in CUBE, CART, CSCO, DAL, HIMZ, and KRE, just to name a few.

Besides trimming UBRL, I didn’t make many moves last week. I’m still long futures contracts in BTC, oil, and $silver.

This week, I’m keeping a close eye on GLD, TLT, SLV, GDXU, AGQ, TMF, PEP, KHC, CPB, DG, ROKU, XYZ, BORR, FUBO, BARK, and RKT.

I’m looking to accumulate shares of XLE, XLV, AMGN, MRK, JNJ, SOLV, GILD, NKE, CVX, OXY, XOM, COP, ET, PSEC, GOF, AGNC, AAPL, KLG, PEP, CPB, KHC, HBI, SBUX, TREE, ROKU, RDDT, SNAP, ENVX, DNUT, AAPU, AMZU, CURE, GUSH, and OILU.

-GP a.k.a Fullauto11 🧙🐼

The Peters Report - Stock & Crypto Trader’s Resource

Always remain bullish and follow The Money Flow.

JOIN THE MFG DISCORD!!🚨🐼

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

GAIN EXCLUSIVE ACCESS TO GP’S TRADE OF THE WEEK PRODUCT!!🔥

Unlock exclusive insights and advanced strategies by becoming a paid subscriber to The Peters Report. Stay one step ahead of the market with in-depth analysis and actionable tips designed to help you succeed as a trader and investor. Support the work that keeps you informed and ahead of the curve.

MFG HOMEWORK ASSIGNMENT!! 2 PARTS📚

The Peters Report - Stock & Crypto Trader’s Resource

First Quarter Earnings Season is Underway

These companies are scheduled to report earnings this week.

Monday: F, CE, O, PLTR, HIMS

Tuesday: AMD, RACE, DUK, AEP, ET, MPLX, RIVN, CELH, KLG, MFA

Wednesday: UBER, DASH, CVNA, JOBY, OXY, GOLD, NVO, BROS

Thursday: CLSK, LYFT, DNUT, HBI, COP, SHOP, COIN, BUD, RKT, WBD, PINS, DKNG, SOLV, TAP, VTRS, YOU, PZZA, PLUG, FDUS, EB, EGAN, PLBY, PET

Federal Open Market Committee (FOMC) Meeting This Week

The spotlight this week is on the Federal Reserve’s policy meeting, happening Tuesday and Wednesday.

Interest rates are expected to stay unchanged, but Powell’s press conference will be key. He’s staying patient as the Fed watches how Trump’s tariffs play out.

🚨Bitcoin (BTC) Update🚨

Bitcoin (BTC) is still in a stage 2 uptrend above its 200-day SMA.

The breakout has seemed to have lost some momentum and the indicators look like they may rollover here.

The MACD histogram is ticking downwards on the bullish side and the TSI is about to cross; however, price is king! It hasn’t rolled over yet and if price gets back above its 5-day EMA the stage 2 regained its strength.

Price could also move sideways here, build out a consolidation zone, and form a new breakout. The RSI is only 60.

I have BTC futures contracts on and have been accumulating shares of BITO to increase my monthly income. I’m also long CLSK.

Trade Ideas This Week from The Peters Report Trading Desk 🐼🐼🐼

Enovix Corporation (ENVX)

[See ENVX chart below.]

Enovix Corporation ENVX 0.00%↑ is in a stage 2 buy zone below its 200-day SMA.

Price is tested its 20-day SMA, but still closed above it. That’s pretty bullish.

The MACD histogram is on the bullish side, the TSI is still open, and the RSI is only 48 giving us more time to add to this stage 2 breakout or enter the trade.

ENVX is still buyable here.

Once stocks break out, I watch for any price weakness or RSI pullback below 50 to add to the trade.

ENVX is a position trade for me.

ENVX is included in the Industrial sector XLI 0.00%↑ and the Industrial Suppliers sub-sector.

According toMorningstar, ENVX has a fair value of $8.20 and is currently trading fairly valued.

🐼🐼Trade ideas this week: TLT, AAPL, KLG, PEP, CPB, KHC, HBI, SBUX, TREE, ROKU, RDDT, SNAP, ENVX, DNUT, AAPU, AMZU, CURE, GUSH, OILU, TMF

🐼🐼B&B trade ideas: XOM, CVX, SLB, OXY, COP, ALB, AMGN, MRK, NKE, CE, TGT, PEP, CPB, KHC, SBUX

🐼🐼Crypto trade ideas: Crypto trades are running right now.

🐼🐼Dividend ideas: PSEC, GOF, ET, NKE, AGNC

🐼🐼Options plays: JNJ, AMGN, XOM, CVX

🐼🐼Speculation plays: FUBO, ENVX, BORR, BARK, JOBY, CLSK

🐼🐼New tickers: MST, WNTR, SOLV

CLICK HERE to access GP’s Trade Ideas chart pack for FREE on StockCharts!!

PepsiCo, Inc. (PEP)

[See PEP chart below.]

PepsiCo, Inc. PEP 0.00%↑ is forming a stage 1 accumulation zone below its 200-day SMA, which gives us another amazing opportunity to put on a B&B trade or establish a new buy & hold position here.

I’m watching PEP closely for an entry. Price has dropped an anchor point and gone sideways, but hasn’t closed above its 5-day EMA yet. The RSI also didn’t hit an extreme-low reading indicating the bottom might not even be in yet.

Patience is the best move here. We might be able to get shares lower if price doesn’t hold. I’m watching for price to get over its 5-day EMA before adding any shares.

These food companies have gotten hit hard with the recent food dyes drama; however, PEP announced plans to remove artificial ingredients from some of its popular food items by the end of 2025.

This initiative aligns with the company's ongoing efforts to offer healthier products and meet evolving consumer preferences, so we may have some time here to build out this nice PEP position. Again, patience is the move right now.

PEP is one of my largest buy & hold positions.

PEP is included in the Consumer Staples sector XLP 0.00%↑ and the Soft Drinks sub-sector.

According to Morningstar, PEP has a fair value of $170 and is currently trading undervalued.

Trades I’m Looking To Add On Any Weakness🐼🤘

Lots of trades have entered stage 2 breakouts.

I’m going to keep watching my charts and look out for any price weakness or RSI pullbacks below 50 for possible adds to the trades below:

AMZU, AAPU, AGNC

COP, OXY, XOM, CVX

SOFI, AI, ENVX

RDDT, SNAP

SBUX, NKE

JNJ, MRK, AMGN

GP’s Whiteboard Homework🐼

🚨SUPER IMPORTANT!!‼️👇

I do my Sunday homework every weekend. Sometimes it takes me hours to complete it. I thoroughly enjoy following the markets, checking my charts, counting my dividends, scanning my portfolios, and tracking my trades.👈

👉I can’t stress the importance of doing your Sunday homework enough. This is at the cornerstone of your success as a trader and an investor.👈

👉I highly encourage you to follow my format— The Money Flow way.👇

Let’s go, MFG!!!

It’s time to get RICH!!💰

The stock market goes up 71% of the time.

Where two or more are gathered there is power!💥

To achieve the results that the top 5% of people in the world achieve, you must be willing to do what 95% of others won’t. 👈👈

👉This is how you become an ELITE MFG TRADER!!👈

Trading requires you to be disciplined and study the markets everyday. 💪

Let’s get a little bit richer everyday together. I appreciate you and believe in you. 🐼🐼

As always, MFG- do your fucking homework!!👈

No more excuses!!👈

Always remember, whatever you think about comes about, whatever you focus on grows. - GP 🐼🧙🤘

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

IMPORTANT RESOURCES CRITICAL TO YOUR SUCCESS AS A MONEY FLOW TRADER!!👇👇👇

A Step-By-Step Guide to Complete Your Sunday Homework CLICK HERE!!

GP’s Video of Doing Your Sunday Homework The Money Flow Way CLICK HERE!!

Get Access to GP’s “MFG Trade Ideas of The Week” Chart Pack CLICK HERE!!

View the FULL LENGTH of The Peters Report! CLICK HERE!

Purchase GP’s Trading Book The Money Flow Trading System CLICK HERE!!

If you need help with getting started on your homework, watch the video above and read my latest article about my step by step guide to completing your Money Flow Playbook!

Stay Up To Date 👇🌊

Mastering The Trade The Money Flow Way Podcast with Gerald Peters on Spotify

The Science of Getting Rich Podcast with Gerald Peters on Spotify

NEW to trading and investing in stocks? Want a crash course? 12 videos and a 50 page manual- Getting Started with Stock Charts- The Money Flow Way: The Swing & Position Trading and Investment Blueprint. CLICK HERE

LFG!!

LFG!!!