The Peters Report 6-1-25

The Sunday Edition of The Money Flow Newsletter & GP’s Playbook for The Week Ahead

MFG STATE OF THE MARKET 6-1-25

The markets were thrilling last week—especially for the MFG portfolio!!

All three major indexes are catching The Wind, with the Nasdaq (QQQ) leading the pack, followed by the S&P 500 (SPY).

The QQQ remains the top-performing index of the Big Three, while the Dow Jones (DIA) continues to lag.

The overall setups look strong here as each index is trading above its 5-day EMA.

Gold (GLD) is still in the same trading range it's been in since mid April, but closed right above its 20-day SMA on Friday. This week will show us if GLD regains some momentum or not.

A stage 2 breakout is underway in Bonds (TLT) below its 200-day SMA.

The stage 2 breakout in Oil (USO) has lost some momentum, but still closed above its 20-day SMA with a doji on Friday. We will see if price holds here or rolls over this week.

Bitcoin (BTC) had entered a possible stage 4 decline, but price slightly bounced back and is now stalling right below its 5-day EMA.

The Russell 2000 Index (IWM) is still holding its 20-day SMA. Price has tested it a couple times and closed back above it; however, the money flow indicators are rolling over here.

Real Estate (XLRE) was the best performing sector of the S&P 500 (SPY), while Energy (XLE) was the worst. Be patient and stay in flow.

Last week was an electrifying week for the MFG portfolio!!

I collected a lucrative amount of weekly dividends and was profitable day trading NVIDIA Corp. (NVDA).

CVNA, X, ETSY, and SNOW—four of my hottest Trade of the Week picks—all banged extreme-high RSI readings, and we locked in profits across the board!

Just as exciting, one of my top speculative plays, Joby Aviation, Inc. (JOBY), surged over 28% last Wednesday after announcing a $250 million investment from Toyota Motor Corp. (TM)—the first half of a $500 million deal to help certify and produce its electric air taxis!

Congratulations to the MFG in the CVNA, X, ETSY, JOBY, and SNOW trades!!

I trimmed MMM and added to AGNC, PEP, CVX, TGT, and my triple-leveraged bonds trade in TMF. I also opened new swing trades in AMGN and JNJ. I’m still in my futures contracts in BTC, gold, silver, and oil.

This week, I’m keeping a close eye on BTC, XOP, XHB, ARKK, KRE, FXI, KWEB, HD, NKE, HBI, GIL, MPW, DOW, ALB, DAL, DNUT, CPB, KLG, ET, OXY, XOM, SLB, CRM, MSTR, UBER, LYFT, ABNB, CART, SNAP, CAVA, CMG, BABA, HLLY, CLSK, RIVN, MBLY, VKTX, TRUE, WGMI, UBRL, BABX, MSTX, NAIL, DPST, and BITX.

I’m looking to accumulate shares of TLT, XLE, XLV, CVX, COP, MRK, LLY, BMY, PEP, KHC, HSY, NUE, SBUX, BX, RKT, PCN, REM, AAPL, SOFI, TREE, BORR, CRSP, AAPU, LLYX, HIMZ, SOFX, PILL, CURE, TMF, UGL, and OILU.

-GP a.k.a Fullauto11 🧙🐼

The Peters Report - Stock & Crypto Trader’s Resource

Always remain bullish and follow The Money Flow.

JOIN THE MFG DISCORD!!🚨🐼

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

GAIN EXCLUSIVE ACCESS TO GP’S TRADE OF THE WEEK PRODUCT!!🔥

Unlock exclusive insights and advanced strategies by becoming a paid subscriber to The Peters Report. Stay one step ahead of the market with in-depth analysis and actionable tips designed to help you succeed as a trader and investor. Support the work that keeps you informed and ahead of the curve.

MFG HOMEWORK ASSIGNMENT!! 2 PARTS📚

The Peters Report - Stock & Crypto Trader’s Resource

First Quarter Earnings Season is Coming to An End

These companies are scheduled to report earnings this week.

Monday: CPB

Tuesday: DG, CRWD

Wednesday: BARK, DLTR, CHPT

Thursday: WOOF, AVGO

🚨Bitcoin (BTC) Update🚨

After Bitcoin (BTC) reached a record high of $111,934, it attempted to enter a stage 4 decline towards the end of last week.

BTC is currently trading in what I call a gray area.

Price closed below its 20-day SMA twice, confirming the stage 4 decline. However, it quickly bounced back and held its stage 3 zone, trading just below its 5-day EMA.

Price is also holding possible support around $102,000 and the RSI is above 50.

Also, notice how the 20-day SMA (green line) is flat. Once the moving averages go flat, they’re no longer relevant to me.

Most of the Money Flow indicators are pointing down. The TSI hasn’t started to curl yet and the MACD histogram has been on a downward slope on the bearish side.

However, it's worth noting that the MACD histogram flattened and ticked slightly upward for the first time today—a subtle, but important signal that momentum could be shifting to the upside.

I would like to see some confluence of the Money Flow indicators before making any moves here.

My current stop loss zone is $104,000. If price breaks through support at $102,000, I would assume a stage 4 decline is underway.

This week will tell us more if price holds its possible new anchor point and gets back above its 5-day EMA. Also, watch the MACD histogram for momentum direction.

Right now, the move is to do nothing; just watch price and wait.

I’m also watching CLSK, MSTX, BITX, CONL, and WGMI.

Trade Ideas This Week from The Peters Report Trading Desk 🐼🐼🐼

LendingTree, Inc. (TREE)

[See TREE chart below.]

LendingTree, Inc. TREE 0.00%↑ is building out a stage 1 accumulation zone below its 200-day SMA.

Price never hit an extreme-low RSI reading, but if you look left on the chart, you'll see it rarely does. So, it's more likely that price will hover near a low RSI reading, rather than dip into extremes.

Price put in an anchor point, moved sideways for 3-4 days, dropped an “in the box” doji, and just put in a doji anchor point, which indicates a possible bottom is in and a reversal is underway.

When price puts in multiple dojis in the same box, it reinforces the stage its building.

The MACD histogram has been ticking upwards displaying the momentum is in favor, but I’m still watching for the curl on the TSI and for price to close above its 5-day EMA (the trigger) before adding shares or entering the trade.

TREE is one of my top speculation plays right now. I’m already in it.

I like the setup here and plan to add more shares once price gets above its 5-day EMA and confirms this stage 1 accumulation zone.

TREE is included in the Financial sector XLF 0.00%↑ and the Mortgage Finance sub-sector of the S&P 500 SPY 0.00%↑ .

According to Morningstar, TREE has a fair value of $48.18 and is currently trading undervalued.

🐼🐼Trade ideas this week: TLT, XLE, XLV, MRK, BMY, LLY, CVX, COP, LVMUY, SBUX, KHC, PEP, HSY, ED, FE, DUK, AEP, NUE, BX, RKT, AAPL, SOFI, CAVA, CMG, BORR, TREE, CRSP, AAPU, LLYX, HIMZ, SOFX, DRN, NAIL, OZEM, PILL, CURE, OILU, TMF, UGL, and RDDT (on any weakness)

🐼🐼B&B trade ideas: BMY, LLY, MRK, KHC, CPB, PEP, HSY, TGT, CVX, OXY, XOM, COP, BX, NUE, DOW, SBUX, NKE

🐼🐼Dividend ideas: CVX, REM, EIC

🐼🐼Crypto trade ideas: watching BITX, WGMI, CONL, CLSK, MSTX

🐼🐼New tickers: LVMUY, TEN, CURE, OZEM, CVNX

🐼🐼Options plays: BX, BMY, PEP

🐼🐼Speculation plays: BORR, TREE, CRSP, VKTX

CLICK HERE to access GP’s Trade Ideas chart pack for FREE on StockCharts!!

Occidental Petroleum Corp. (OXY)

[See OXY chart below.]

Occidental Petroleum Corp. OXY 0.00%↑ is on my watchlist this week as it's trading at a 31% discount below its 200-day SMA, which presents us with a great opportunity to put on a Bread & Butter (B&B) trade.

Price tagged an extreme-low RSI reading, dropped an anchor point, went sideways, got above its 5-day EMA confirming the stage 1 zone, and then jumped above its 20-day SMA signaling a stage 2 breakout was underway.

Shortly after breaking out and establishing its uptrend, price hit its first target—resistance, and turned back down.

Notice how previous support became resistance, which was used as the first target.

The breakout has lost its momentum and price is back underneath its 20-day SMA. This is an example of a stage 2 breakout coming back into a stage 1 accumulation zone, which is typically considered bearish.

You might think price hit its target, turned back down, entered a stage 4 decline, and the trade is over; however, this is an example of an incomplete move.

A complete Money Flow move is when price goes from one extreme RSI to another. That’s a completed Money Flow swing trade.

Price never actually hit its true profit targets, its 200-day SMA and an extreme-high RSI reading, so this move is incomplete.

The MACD histogram has rolled over to the bearish side and is pointing downwards showing us that the momentum is to the downside. The TSI has also crossed over to the bearish side.

Now, I’m watching to see if price holds its anchor point, or establishes a new one, and gets back above its 5-day EMA before adding any shares here. I’m also looking for confluence of the Money Flow indicators.

OXY is on my radar here. I’ll notify you when its time to make a move.

For now, keep an eye on price and remember price is the only indicator that pays!!

OXY is included in the Energy sector XLE 0.00%↑ and the Exploration & Production sub-sector of the S&P 500 SPY 0.00%↑ .

According to Morningstar, OXY has a fair value of $59 and is currently trading undervalued.

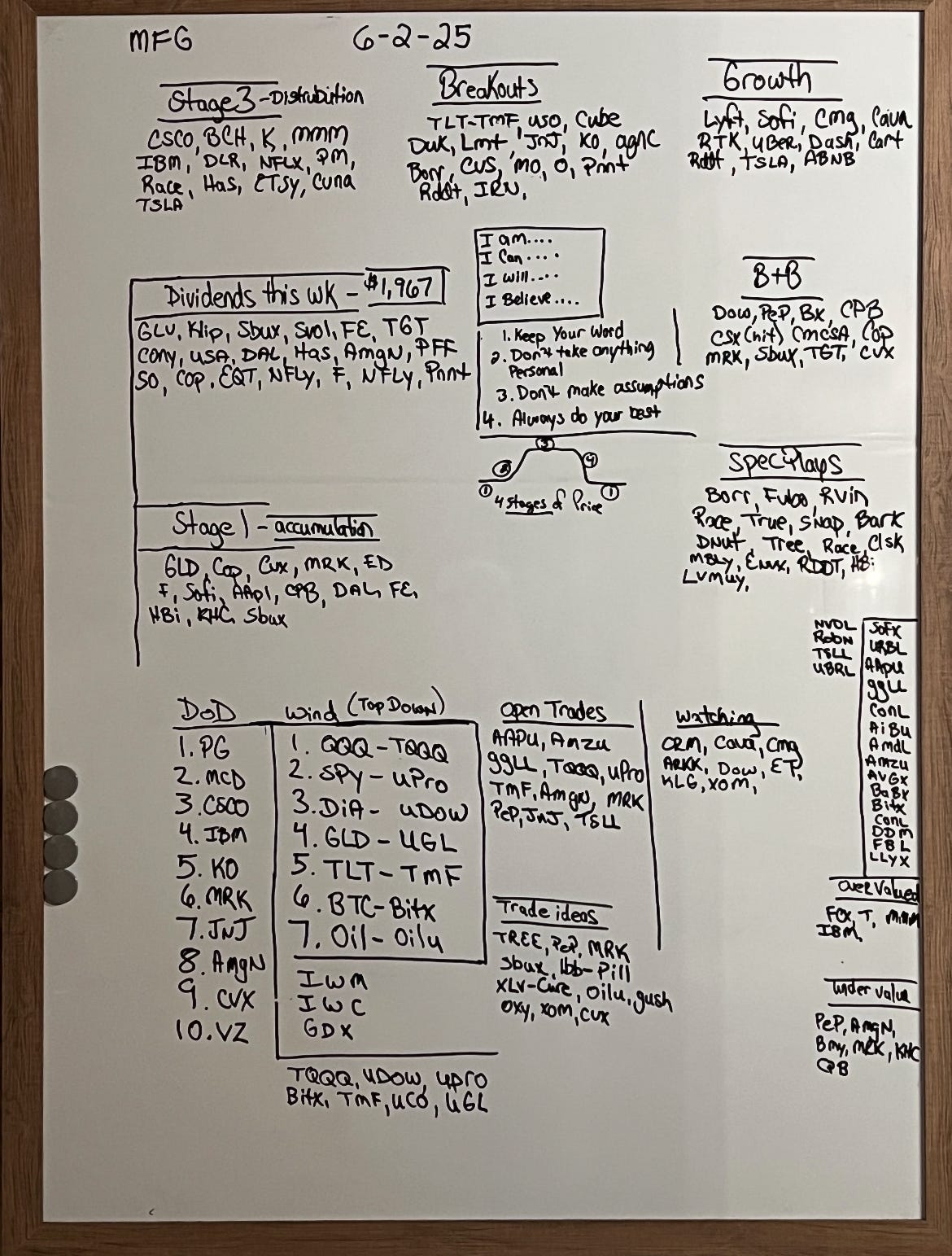

GP’s Whiteboard Homework🐼

🚨SUPER IMPORTANT!!‼️👇

I do my Sunday homework every weekend. Sometimes it takes me hours to complete it. I thoroughly enjoy following the markets, checking my charts, counting my dividends, scanning my portfolios, and tracking my trades.👈

👉I can’t stress the importance of doing your Sunday homework enough. This is at the cornerstone of your success as a trader and an investor.👈

👉I highly encourage you to follow my format— The Money Flow way.👇

Let’s go, MFG!!!

It’s time to get RICH!!💰

The stock market goes up 71% of the time.

Where two or more are gathered there is power!💥

To achieve the results that the top 5% of people in the world achieve, you must be willing to do what 95% of others won’t. 👈👈

👉This is how you become an ELITE MFG TRADER!!👈

Trading requires you to be disciplined and study the markets everyday. 💪

Let’s get a little bit richer everyday together. I appreciate you and believe in you. 🐼🐼

As always, MFG- do your fucking homework!!👈

No more excuses!!👈

Always remember, whatever you think about comes about, whatever you focus on grows. - GP 🐼🧙🤘

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

IMPORTANT RESOURCES CRITICAL TO YOUR SUCCESS AS A MONEY FLOW TRADER!!👇👇👇

A Step-By-Step Guide to Complete Your Sunday Homework CLICK HERE!!

GP’s Exclusive Video of Doing Your Sunday Homework The Money Flow Way CLICK HERE!!

Get Access to GP’s “MFG Trade Ideas of The Week” Chart Pack CLICK HERE!!

View the FULL LENGTH of The Peters Report! CLICK HERE!

Purchase GP’s Trading Book The Money Flow Trading System CLICK HERE!!

If you need help with getting started on your homework, watch the video above and read my latest article about my step by step guide to completing your Money Flow Playbook!

Stay Up To Date 👇🌊

Mastering The Trade The Money Flow Way Podcast with Gerald Peters on Spotify

The Science of Getting Rich Podcast with Gerald Peters on Spotify

NEW to trading and investing in stocks? Want a crash course? 12 videos and a 50 page manual- Getting Started with Stock Charts- The Money Flow Way: The Swing & Position Trading and Investment Blueprint. CLICK HERE

🙌🏼🙌🏼🙌🏼🙌🏼🙌🏼

Thanks GP!! 💪💪💪