MFG STATE OF THE MARKET 8-4-24

The three major indexes tracked by the MFG, the Dow Jones (DIA), the Nasdaq (QQQ), and the S&P 500 (SPY) have entered stage 4 declines. We saw a rotation out of industrial stocks into utilities this past week. I trimmed 15% of my 2x leveraged utilities trade UTSL.

Bonds (TLT) was the leading asset class of "The Wind" and are now trading at an extreme-high RSI reading. Bonds are finally doing what they're supposed to do- go up while the markets go down.

Typically, bonds and the stock market have an inverse relationship. Economic and political uncertainty, talks of interest rate cuts, inflation, market sentiment, and economic news can affect the dynamic relationship between bonds and the stock market.

A stage 4 decline is underway in Bitcoin (BTC) and is now trading at an extreme-low RSI reading below its 200-day SMA. BTC blew through its downside target of $57,000. I'm a buyer of BTC and Bitcoin Cash (BCH) on all stage 1 setups. Oil (USO) is also in a stage 4 decline right below its 200-day SMA. Be patient and stay in flow.

Make sure to get on the NEW PLATFORM email list! CLICK HERE!

Last week was another awesome week for the MFG portfolio! Utilities stocks (XLU/USTL) banged an extreme-high RSI and we trimmed UTSL and some of our buy and hold positions.

We also saw beautiful moves in consumer staples stocks (XLP) and MCD completed its B&B trade! I trimmed 1/4 of my position last week. I'm still watching tech stocks and their leveraged funds closely for entries.

View the FULL LENGTH of The Peters Report! CLICK HERE!

This week, I'm keeping a close eye on QQQ/TQQQ, SPY/UPRO, DIA/UDOW, USO/OILU, $BTCUSD/BITX, ARKK, CRWD, SNOW, AMZN, GOOG, RDDT, CART, ABNB, SNAP, UBER, LYFT, DAL, F, MRNA, FCX, INTC, MRK, USA, ASG, GLV, REM, and extreme-yield funds YBIT/BITO, ULTY, QQQY, JEPY, IWMY, SNOY, ABNY, AIYY, MRNY, MSTY, and CONY.

I'm looking to accumulate shares of DOW, WBA, ALB, DNUT, BXMT, DLR, NKE, DASH (on any weakness), AGQ, SBUX, and extreme-yield funds APLY, FBY, AMDY, KLIP, and GOOY.

Grab a free copy of Gerald’s life-changing ebook “You Don’t Have To Die Broke!” CLICK HERE!

Always remain bullish and follow The Money Flow.

The Peters Report - Stock & Crypto Trader’s Resource

-GP a.k.a Fullauto11 🧙🐼

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

NEW ANNOUNCEMENT!!

My newest e-book, The Bread-And-Butter Trading System will be available for sale soon!! I’m not sure where that term came from, but bread and butter are staple American foods.

This strategy became my staple food- my go to strategy to add “alpha” to my buy and hold stock dividend portfolio. It literally became my bread-and-butter trading method.

Stay tuned for the release date and be among the first to get your copy. Don't miss out on this opportunity to step up your buy and hold portfolios and advance your trading skills.

Follow the MFG Substack: The Peters Report: The Ultimate Resource for Traders to receive an exclusive discount and be notified as soon as the ebook is available!

MFG HW ASSIGNMENT!! 2 PARTS!!

THIS WEEK'S HOMEWORK VIDEO PART 1: MONEY FLOW GANG SUNDAY SERVICE!! IT’S TIME FOR CHURCH!!

This week’s video is The Money Flow Sunday Service. Join me while I give a MFG market & portfolio update and run through my Sunday homework.

THIS WEEK'S HOMEWORK PART 2: MY NEWEST EPISODE OF THE SCIENCE OF GETTING RICH PODCAST!!

Help Support the Newsletter!

Buy a signed physical copy of both Gerald’s books for only $87! $127 for international. Consider purchasing a copy for a friend and spreading the wealth.

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 to join.

Donations: Cashapp: $fullauto11 Venmo:

The Peters Report - Stock & Crypto Trader’s Resource

Understanding the Inverse Relationship Between Bonds and the Stock Market

Bonds typically trade upwards when the stock markets are going down. Usually, bonds and the stock market have an inverse relationship. Here are some key points to understand this dynamic:

Safe-Haven Investment: During periods of political and economic uncertainty or stock market downturns, investors often shift their money from stocks to bonds. This flight to safety increases the demand for bonds, pushing their prices up and yields down.

Interest Rates: Central banks, like the Federal Reserve in the United States, may lower interest rates to stimulate the economy during downturns. Lower interest rates make existing bonds with higher coupon rates more attractive, increasing their prices.

Economic Indicators: Positive economic news can lead to higher stock prices as companies are expected to perform better, while bond prices may fall because investors anticipate rising interest rates or better returns from stocks. Conversely, negative economic news can result in higher bond prices and lower stock prices.

Inflation Expectations: Inflation affects bonds and stocks differently. Rising inflation expectations can hurt bond prices because the fixed payments from bonds lose purchasing power, while stocks may benefit if companies can pass on higher costs to consumers.

Diversification and Risk Management: Investors diversify their portfolios to manage risk. When stocks are underperforming, the demand for bonds increases as a risk management strategy, leading to higher bond prices.

It’s important to realize that this inverse relationship is not always perfect. There can be periods when both stocks and bonds move in the same direction due to unique economic conditions, policy changes, or market sentiment. Diversification between stocks and bonds helps investors manage risk and stabilize their portfolios.

Trade ideas this week: AGQ, DNUT, AMZU, SNAP, AMDL, CELH, LYFT

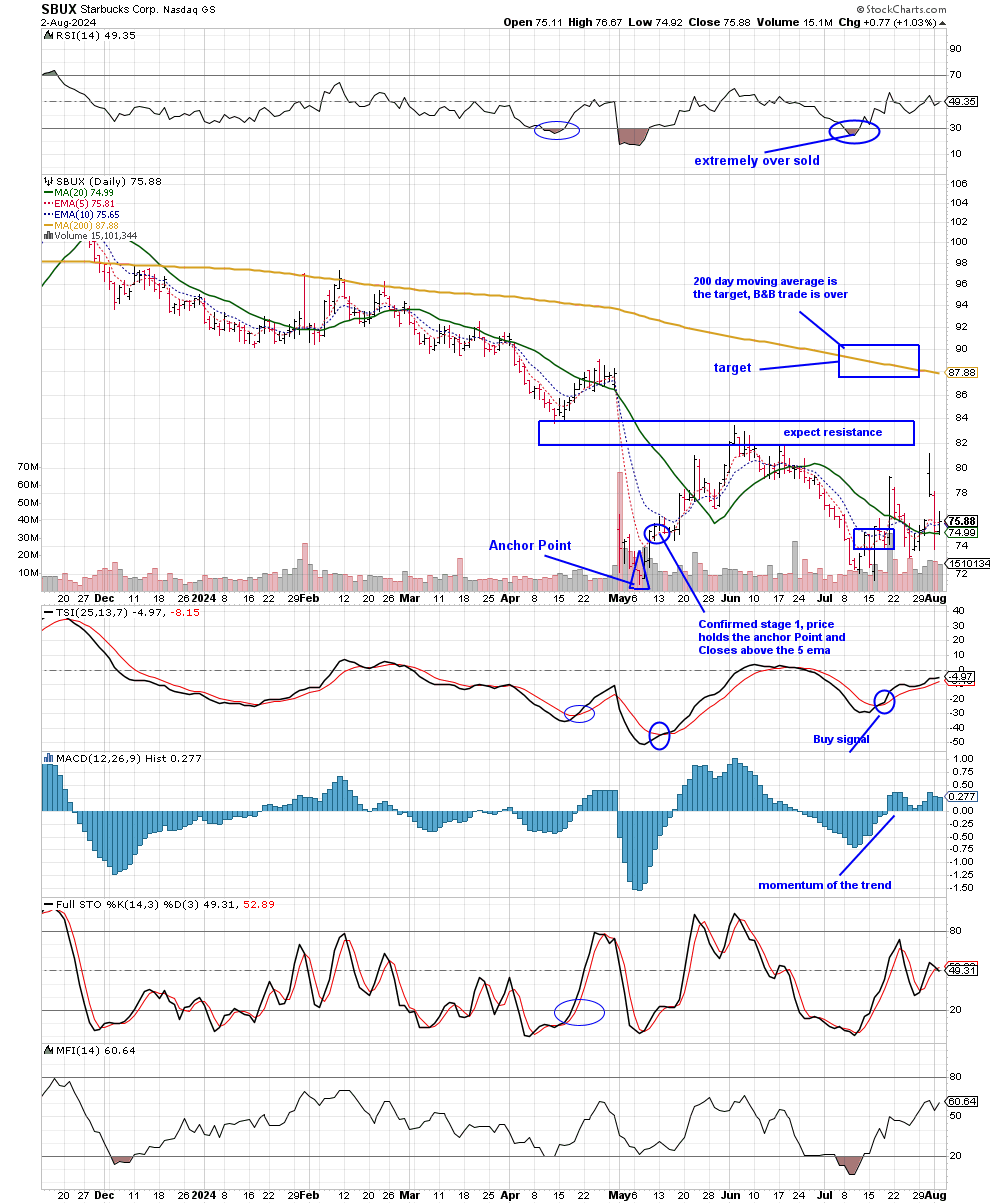

B&B trade ideas: F, DAL, SBUX

B&B trades that could be trimmed here are BMY, GILD, and MCD.

[See trade idea SBUX chart below.]

SBUX is still holding its 20-day SMA. It could be good trade if the market can at least hold its ground. If the market continues lower SBUX will likely lose its support.

I’m also watching SNAP closely here, which gapped down and stopped in a demand zone.

Crypto trade ideas: CLSK, BITX, BCHG, BITU, WGMI, CONL

Dividend ideas: SBUX, DOW, NKE, WBA, BXMT, AGS, USA, GLV, FCX, DLR

AAPL, LMT, MMM, and ED are trading above true value and could be trimmed here.

Top yielders I’m watching closely: KLIP, BITO, YBIT, ULTY, AMDY

New tickers: ASGI, HTD, BIGZ, BXMT

Get access to my “MFG Trade Ideas of The Week” chart pack CLICK HERE!!

View the FULL LENGTH of The Peters Report! CLICK HERE

As always, MFG- do your fucking homework! If you need help with getting started on your homework watch this video above and read my latest article about my step by step guide to completing your Money Flow Playbook! No more excuses!!

Always remember, whatever you think about comes about, whatever you focus on grows. - GP

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

NEW to trading and investing in stocks? Want a crash course? 12 videos and a 50 page manual- Getting Started with Stock Charts- The Money Flow Way: The Swing & Position Trading and Investment Blueprint. CLICK HERE

🎯👌🏼💎

be patient and stay in flow🙏🔥