MFG STATE OF THE MARKET 9-1-24

The major indexes were mostly flat last week, except for the Dow Jones (DIA), which reached a new all-time high. This likely reflects positive economic data, easing inflation, and expectations of an interest rate cut in September.

Remember, the market is "forward-looking," and the interest rate cut is already priced in, illustrating the "buy the rumor, sell the news" phenomenon.

The S&P 500 (SPY) rose slightly and remains in a solid stage 2 uptrend, with most of its 11 sectors hitting extreme-high RSI readings. Gold (GLD) is in a stage 3 consolidation zone above its 200-day SMA after hitting a new all-time high last month.

The Nasdaq (QQQ) is still in a stage 2 uptrend; stay bullish here. Bonds (TLT) have entered a confirmed stage 4 decline, with price below the 20-day SMA and the 5-day EMA crossed below it. Ideally, it would be nice to see TLT drop to its 200-day SMA, presenting an opportunity to buy more shares.

Oil (USO) has returned to a stage 1 accumulation zone right near its 200-day SMA. Most oil stocks (XLE) have been outperforming the commodity itself.

Bitcoin (BTC) and Bitcoin Cash (BCH) are also back in stage 1 accumulation zones, trading below their 200-day SMA, but still holding their anchor points. I'm watching BTC closely to see if it holds or rolls over. Be patient and stay in flow.

Grab a free copy of Gerald’s life-changing ebook “You Don’t Have To Die Broke!” CLICK HERE!

Last week was another amazing week for the MFG portfolio!!

SO, KO, PM, WMT, JPM, and IBM are trading at extreme-high RSI readings and hitting new all-time highs. 3M (MMM) is trading overvalued and currently on a runaway. Lock in gains, but let your winners run!

I’m still holding swing positions in SNOW, CELH, MRNA, GOOX, and TSLR. I have stop loss zones for each of these swing trades plotted. Discipline is key!

View the FULL LENGTH of The Peters Report! CLICK HERE!

This week, I’m keeping a close eye on BTC, BCH, BCHG, WBA, CLSK, CONL, ENVX, CELH, CRM, HSY, and DG.

I’m looking to accumulate shares of CVS, GOOG, MPW, OXY, ABNB, AI, TSLR, GOOX, BITX, SNAP, BORR, MBLY, AGQ, UCO, RDDT, AMZU and INTC on any weakness, and extreme-yield funds ABNY, BITO, YBIT, AIYY, GOOY, SNOY, and USOY.

-GP a.k.a Fullauto11 🧙🐼

The Peters Report - Stock & Crypto Trader’s Resource

Always remain bullish and follow The Money Flow.

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

NEW ANNOUNCEMENTS!!

🐼 The Online MFG Store is OPEN TIL MONDAY, SEPTEMBER 2ND!!

Get your limited edition collectible MFG merchandise before the store closes Monday, September 2nd!! Link to store CLICK HERE!!

🚀 Upgrade to The Peters Report – Now Monetized!

Unlock exclusive insights and advanced strategies by becoming a paid subscriber to The Peters Report. Stay one step ahead of the market with in-depth analysis and actionable tips designed to help you succeed as a trader and investor. Support the work that keeps you informed and ahead of the curve.

MFG HW ASSIGNMENT!! 3 PARTS!!

THIS WEEK’S HOMEWORK VIDEO 1: THE PETERS REPORT LIVE!! LAST FRIDAY’S LIVE SHOW!! CLICK HERE!!

THIS WEEK’S HOMEWORK PART 2: SEPTEMBER NET WORTH CALCULATION!! STEP-BY- STEP INSTRUCTIONS CLICK HERE!!

THIS WEEK'S HOMEWORK PART 3: THE LATEST EPISODE OF MASTERING THE TRADE PODCAST: CREATING ORDER OUT OF CHAOS

Help Support the Newsletter!

Buy a signed physical copy of both Gerald’s books for only $87! $127 for international. Consider purchasing a copy for a friend and spreading the wealth.

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 to join.

Donations: Cashapp: $fullauto11 Venmo:

The Peters Report - Stock & Crypto Trader’s Resource

Bitcoin (BTC) isn’t set up yet. I have no intention to add to any crypto trades this week as of yet. Oil is back in a stage 1 and could be a play this week.

Most oil stocks are running above their 20-day SMA, but oil the commodity can’t seem to get going. I’m watching both BTC and USO closely here.

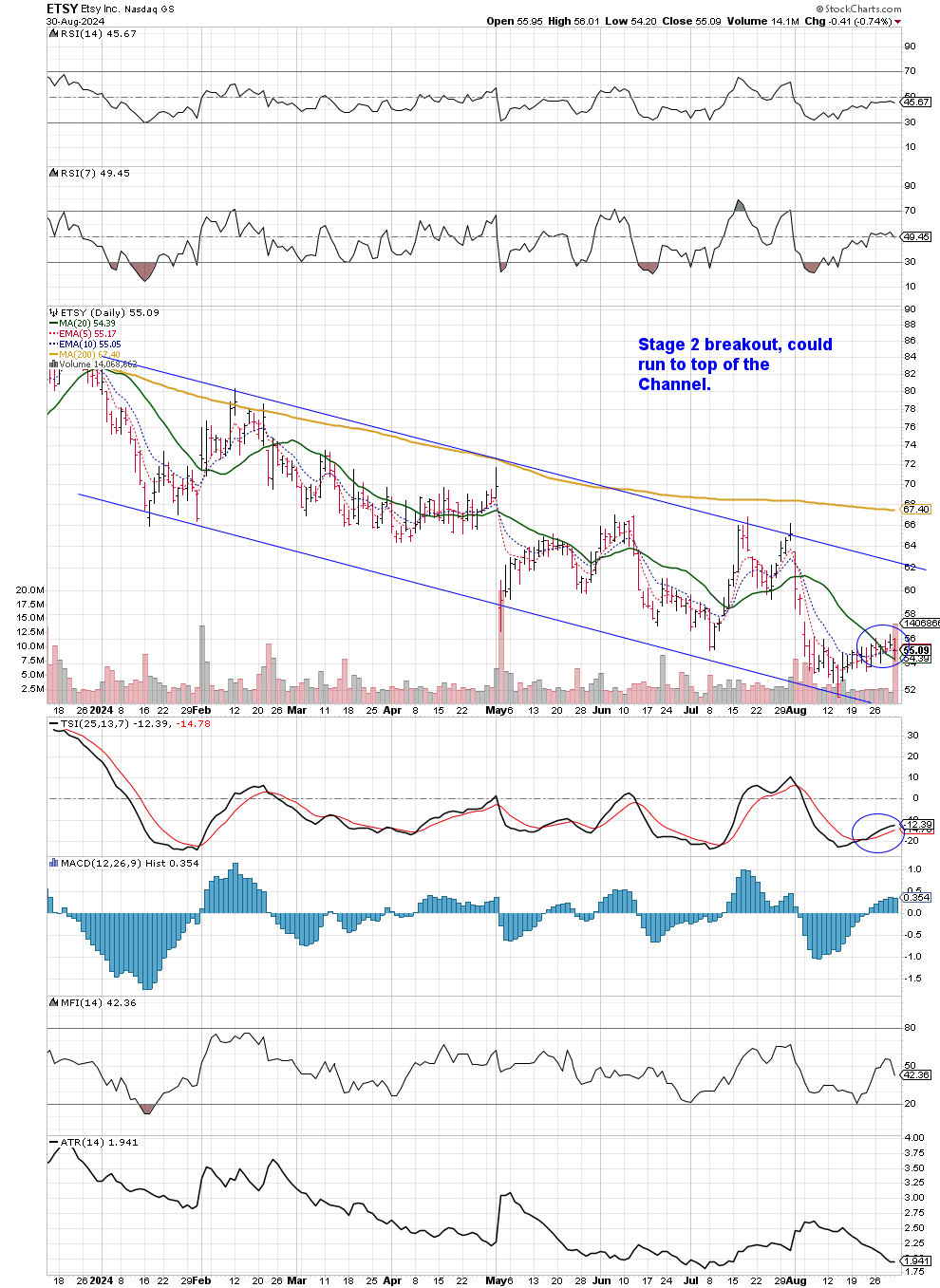

I really like ETSY as a play here.

[See trade idea ETSY chart below.]

ETSY is in a stage 2 breakout and could easily run to the top of the channel. Notice the downward-sloping channel price is in and how many times it ran up to tag the top of it. Price has memory.

Trade ideas this week: ABNB, AI, AGQ, ETSY, RDDT, AMZU (on any weakness), SNAP, GOOX, BORR, MBLY, OXY, OILU, UCO, AMDL (you could look to put shares back on or enter the trade here.)

B&B trade ideas: CVS, KSS, DNUT, INTC

[See trade idea ABNB chart below.]

ABNB is in a stage 1 accumulation zone. Notice the doji bar from Friday’s close. ✝️

Crypto trade ideas: BCHG, CLSK, RIOT, BITX, MSTX, WGMI, CONL

Dividend ideas: CVS, MPW, WBA, KSS, OXY

Top yielders I’m watching closely: BITO, YBIT, CONY, AIYY, ABNY, GOOY, SNOY, USOY

New tickers: USOY, LLYX, MBLY

Get access to my “MFG Trade Ideas of The Week” chart pack CLICK HERE!!

View the FULL LENGTH of The Peters Report! CLICK HERE!

As always, MFG- do your fucking homework! If you need help with getting started on your homework watch this video above and read my latest article about my step by step guide to completing your Money Flow Playbook! No more excuses!!

Always remember, whatever you think about comes about, whatever you focus on grows. - GP

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

NEW to trading and investing in stocks? Want a crash course? 12 videos and a 50 page manual- Getting Started with Stock Charts- The Money Flow Way: The Swing & Position Trading and Investment Blueprint. CLICK HERE

Yes yes yes

Thanks GP 💎💎