The Peters Report: Midweek Market Update 9-19-24

A midweek market update to keep you in flow!!

Hey, MFG!

If you've been a long time follower or friend of mine, you know that every Sunday, I rank The Wind on my whiteboard, organizing the 7 asset classes tracked by the MFG from best to worst performing.

It's an awesome way to spot market rotation and see the bigger picture—something I highly recommend.

Need help ranking The Wind? Check out my step-by-step guide for a deeper dive. CLICK HERE!!

As I track these asset classes daily, I wanted to bring you a midweek market update, along with insights from the recent FOMC meeting and the Fed’s decision on interest rates.

Let me know if these updates help you stay one step ahead. I truly appreciate your support and can’t thank you enough.

-GP a.k.a Fullauto11 🧙🐼

The Peters Report - Stock & Crypto Trader’s Resource

Always remain bullish and follow The Money Flow.

👉JOIN THE MFG DISCORD!!

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

🚀 Upgrade to The Peters Report – Trade of The Week!!

Unlock exclusive insights and advanced strategies by becoming a paid subscriber to The Peters Report. Stay one step ahead of the market with in-depth analysis and actionable tips designed to help you succeed as a trader and investor. Support the work that keeps you informed and ahead of the curve.

The Fed’s Decision on Interest Rates

The Federal Reserve cut its benchmark interest rate by 0.5%, marking a pivotal move in the next phase of monetary policy.

With inflation decreasing closer to the 2% target, the Fed remains focused on a weakening labor market. The new target range for the federal funds rate is 4.75% to 5%, after holding steady since July 2023.

The larger reduction signals the Fed's effort to stay ahead of labor market slowdowns.

The latest projections suggest rates could fall to 4.25% to 4.5% by the end of 2024—less easing than expected, but lower than previous forecasts.

The Peters Report: Quick Market Update 9-19-24

After the Federal Reserve’s decision to lower interest rates by half a percentage point, the major 3 indexes including The Dow Jones (DIA), the S&P 500 (SPY), and the Nasdaq (QQQ) closed down; however, they are in still in stage 2 uptrends.

The Russell 2000 (IWM) is also in stage 2 uptrend, but climbed higher today after the Fed’s announcement to lower interest rates.

After hitting a new all-time high last week, Gold (GLD) looks like it possibly may rollover here. Bonds (TLT) declined and are now trading below $100 for the first time in two weeks most likely due to profit taking and market uncertainty.

Grab a free copy of Gerald’s life-changing ebook You Don’t Have To Die Broke! CLICK HERE!

Bitcoin (BTC) is in a beautiful state 2 uptrend and looks like it’s running straight for its 200-day SMA. Bitcoin Cash (BCH) recently broke out.

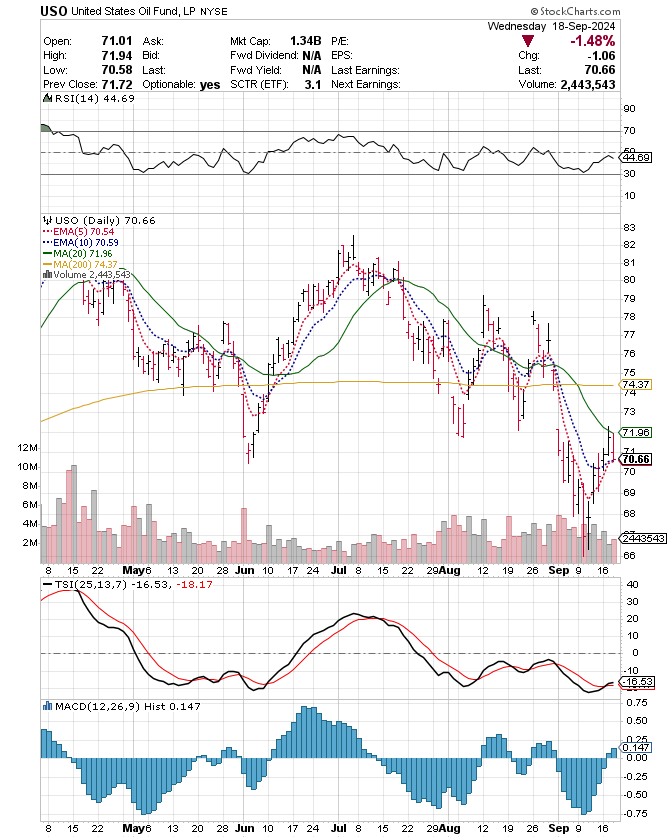

Oil (USO) and oil stocks (XLE) are in a stage 1 accumulation zones below their 200-day SMA with possible stage 2 breakouts underway.

Energy XLE 0.00%↑ was the best performing sector of the S&P 500, while Technology XLK 0.00%↑ was the worst.

There may be a possible market rotation here from tech stocks into Bitcoin, oil stocks, and small-cap companies most likely due to interest rate cuts.

Ranking The Wind everyday is what keeps me in flow and one step ahead of the markets.

👉👉So far this week, I’ve added to BORR 0.00%↑ , QQQY 0.00%↑ , and USOY 0.00%↑ .

👉👉Let’s dig into how I viewed The Wind tonight.

Quick Daily Ranking of The Wind

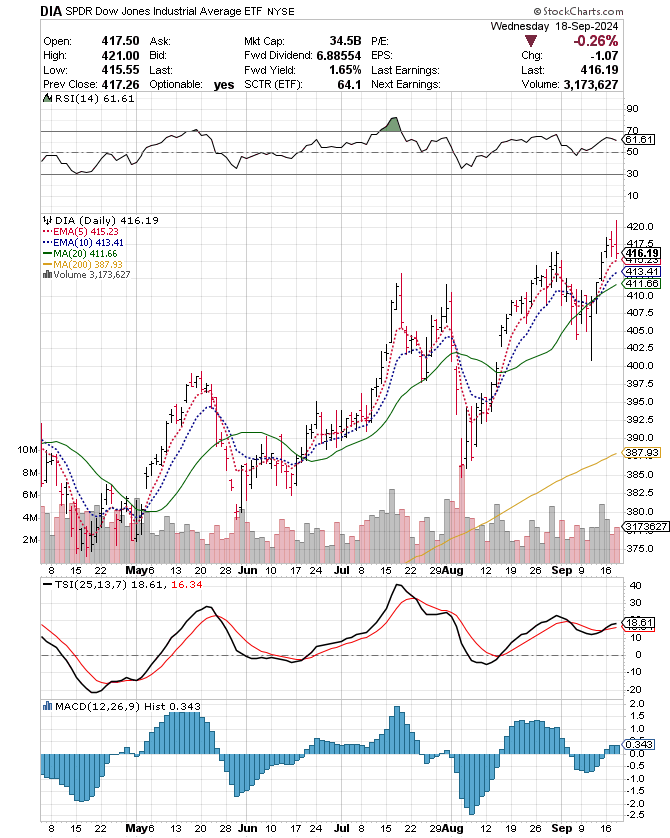

DIA DIA 0.00%↑

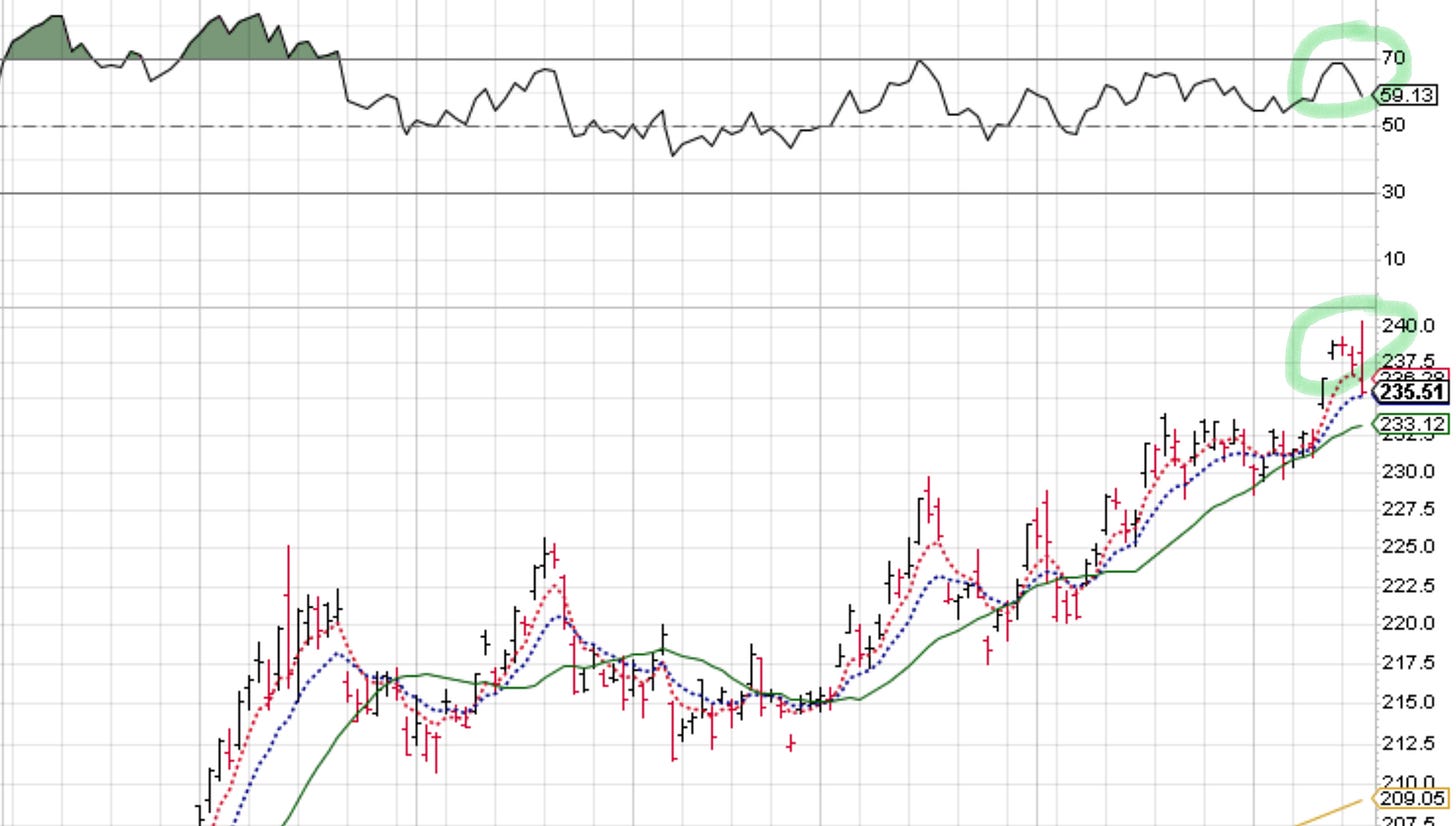

GLD GLD 0.00%↑

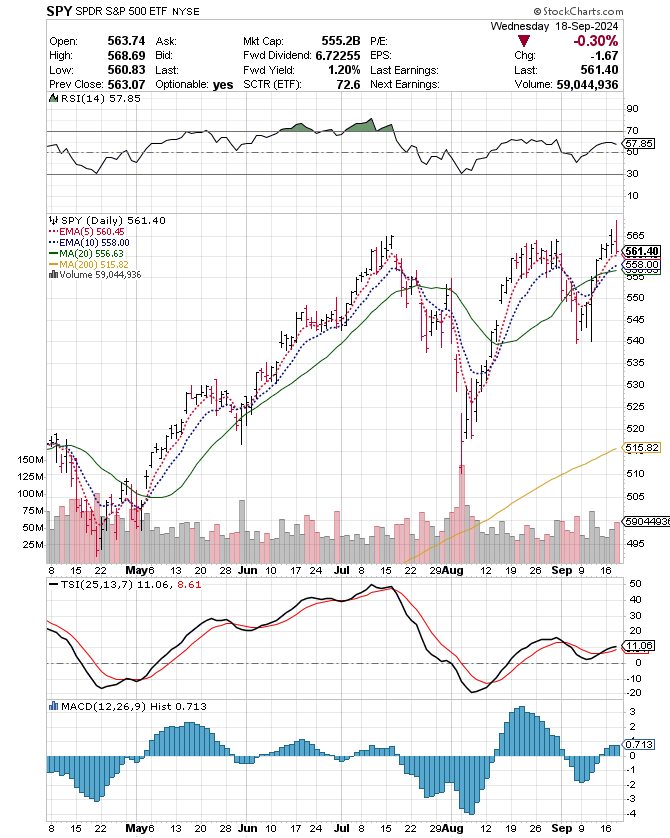

SPY SPY 0.00%↑

TLT TLT 0.00%↑

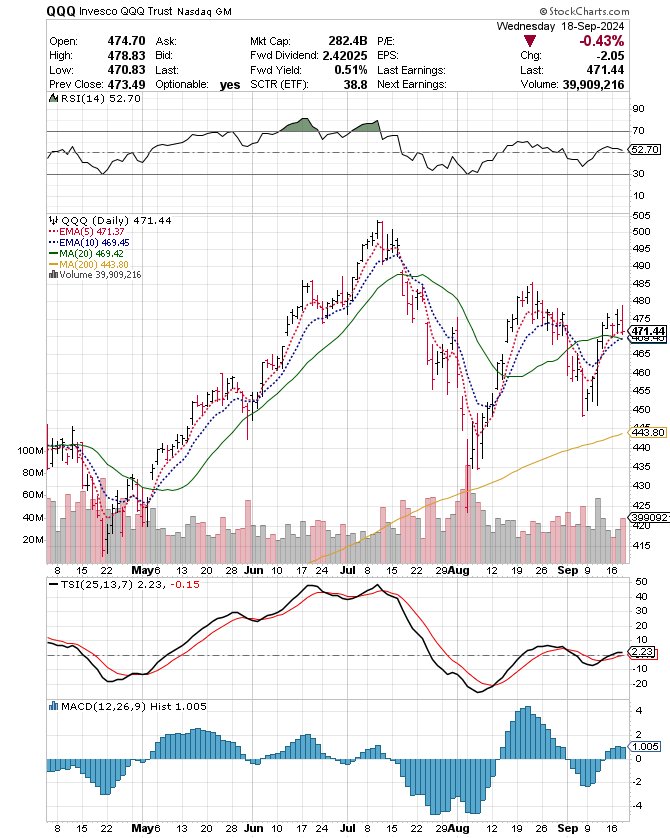

QQQ QQQ 0.00%↑

BTC ($BTCUSD)

USO USO 0.00%↑

[See 1. DIA chart below.]

The Dow Jones (DIA) was the leading asset class today. The Dow surpassed Gold (GLD) for the number one spot in The Wind so far this week. Although price fell lower, it still has closed above its 5-day EMA and trading at a 61 RSI. This is a stage 2 uptrend that has lost some momentum after the Fed’s interest rate cut announcement.

[See 2. GLD chart below.]

Gold (GLD) dropped even further than the Dow Jones (DIA) today, closing below its 5-day EMA while its RSI fell to 59. It seems poised for a potential rollover. If you look at the chart, two bars back, there's a bearish doji pattern forming at near extreme-high RSI, indicating a possible reversal. The price has declined in the two days following that signal.

[ See 3. SPY chart below.]

The S&P 500 (SPY) is still in a solid stage 2 uptrend despite falling lower today and closing its lowest all week. Price closed right above its 5-day EMA. The decline is most likely due to tech stocks dropping. Technology (XLK) was the worst performing sector of the SPY today.

[See 4. TLT chart below.]

Bonds (TLT) has been building out a stage 3 consolidation zone here, but also declined significantly today. Price banged a 70 RSI a couple of times and now looks to be rolling over into a possible stage 4 decline. Price is still above its 20-day SMA, but all Money Flow indicators are pointing down.

TLT is trading below $100 for the first time in two weeks. This drop comes despite the Fed’s recent rate cut of half a percentage point. Investors seem to be taking profits amid concerns about the future economic outlook. Although a rate cut generally signals economic support, the reaction in the bond markets suggests uncertainty remains high.

[See 5. QQQ chart below.]

The breakout in the Nasdaq (QQQ) has lost some momentum. Price closed right above its 20-day SMA. Let’s see how tech stocks perform and if QQQ climbs higher or comes back into a stage 1 accumulation zone this week.

I’m going to be honest, the breakouts in the SPY and QQQ don’t look great here. I like the stage 2 uptrend in BTC better. Again, due to the Fed lowering interest rates we could see a possible market rotation here from tech stocks into BTC and small-caps.

[See 6. BTC chart below.]

Bitcoin (BTC) is pumping and running for its 200-day SMA. I would love to see price break out of this downward-sloping channel it’s been in. BTC is in a beautiful stage 2 uptrend.

I like this breakout in BTC much better than the QQQ and SPY. BTC is also trading at a higher RSI reading than these indexes. The reason I ranked BTC lower is because price is still below its 200-day SMA.

I would not be surprised to see BTC tag or break through its 200-day SMA and outperform the QQQ due to lower interest rates.

[See 7. USO chart below.]

Oil (USO) is in a stage 1 accumulation zone with a possible stage 2 breakout underway right below its 200-day SMA along with oil stocks (XLE).

Notice after price dropped an anchor point, price put in a bullish doji reversal bar at a near extreme-low RSI reading. Also notice, how the RSI never dips below 30 on the chart.

Also, price jumped above the 5-day EMA giving you your trigger to enter the trade. This is called confluence of the Money Flow indicators.

GP’s Wrap Up 🌊

With the Fed's recent rate cut and market signals pointing to potential reversals in key assets like Gold (GLD) and the markets (SPY, QQQ, & DIA), it's crucial to stay vigilant.

I think we see a rotation out of gold and tech stocks into bitcoin, small-caps, and oil stocks. But what do I know?

No one knows where the markets are going!

Keep a close eye on technical indicators and market movements as we head into the next phase of this economic cycle.

As always, feel free to reach out with any questions in the comments, or text me—your engagement helps us navigate the markets together!!

Where two or more are gathered, there is power!!

Always remember, whatever you think about comes about, whatever you focus on grows. - GP 🐼

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

Purchase GP’s Trading Book: The Money Flow Trading System CLICK HERE!!

Book a 1:1 with GP to Discuss Your Trading CLICK HERE!!

NEW to trading and investing in stocks? Want a crash course? 12 videos and a 50 page manual- Getting Started with Stock Charts- The Money Flow Way: The Swing & Position Trading and Investment Blueprint. CLICK HERE

🎯🎯🎯

Thanks Gerald always on point