Whiplash on Wall Street: From Breakdown to Possible Breakout in 48 Hours!!

Find out what happened inside the most explosive days on Wall Street in years!!🤑

Hey, MFG!!🤘🐼

YES!! YES!! YES!!🙌👏

"Someone once observed that the difference between the rich and the poor is that the rich invest their money and spend what’s left, while the poor spend their money and invest what’s left."

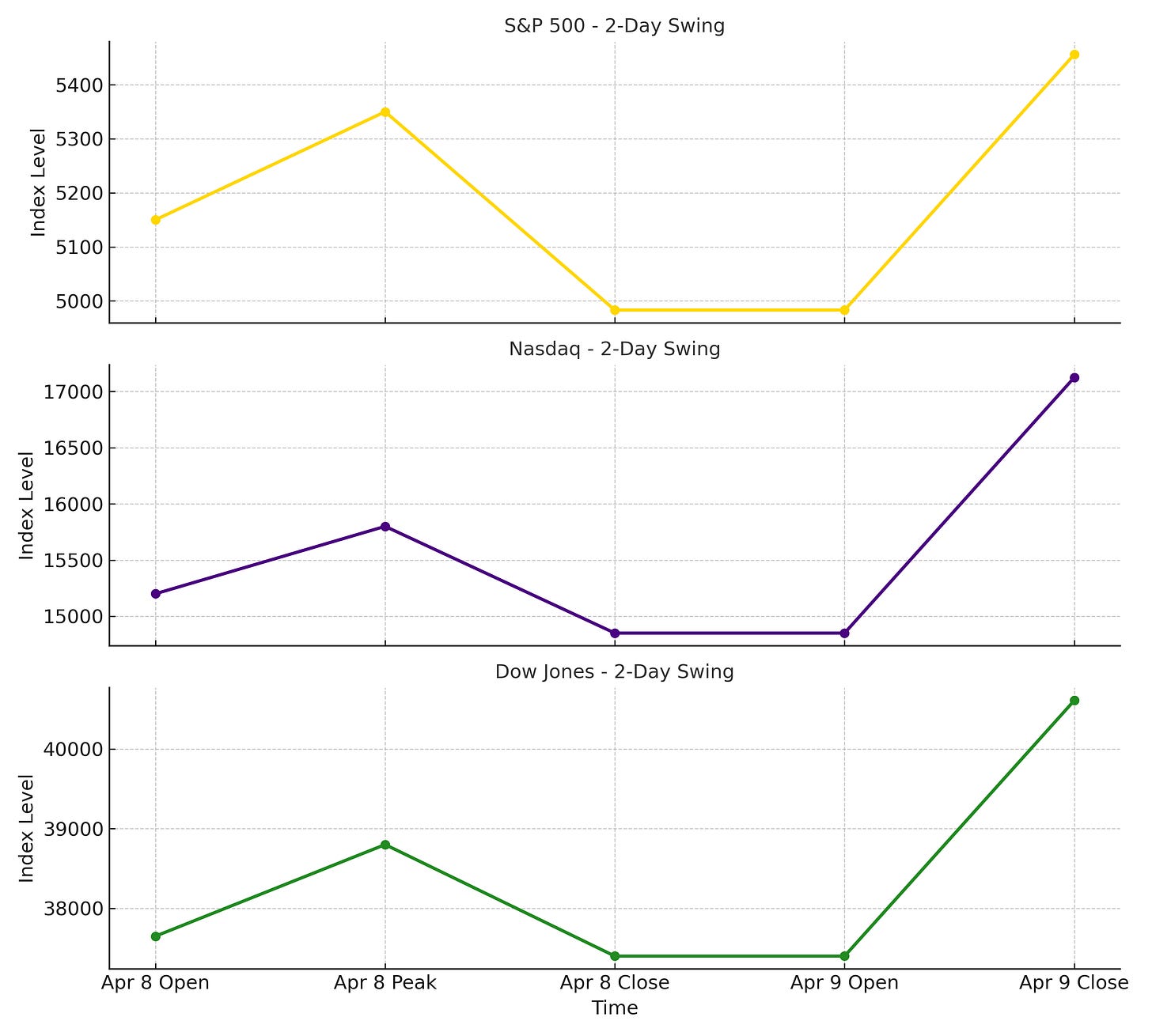

What we just witnessed was one of the most volatile two-day stretches in market history—back-to-back extremes that flipped the script faster than most traders and investors could react.

Let’s break what happened yesterday and today.

Day 1: The Panic & Breakdown - 4/8/25

Tuesday’s trading session looked like it might offer a much-needed rebound. The Nasdaq Composite ($COMPQ) surged as much as 4.6% shortly after the open—exactly the kind of bounce you’d expect in a volatile bear market cycle.

But it didn’t last.

By 10:27 a.m., the rally had peaked.

By early afternoon, the Nasdaq had turned negative, and by the close, it was down 2.2%—marking the largest intraday reversal for the index since at least 1982, according to Dow Jones Market Data.

The S&P 500 ($SPX) joined in on the wreckage, recording a first-of-its-kind collapse: up over 4% intraday, but closing down more than 1%.

That kind of whipsaw move hasn’t been seen in data going back to 1978.

Markets were already on edge after last week’s tariff announcement, and by Tuesday’s close, the damage was historic:

S&P 500: -12% since Wednesday.

The Nasdaq was up 4.6% early in the session, only to reverse course and finish the day down 2.2%.

$7.7 trillion in market cap erased across U.S. equities—the worst 4-day stretch ever recorded.

Investors hoping for a pause in tariff escalation were disappointed.

The White House confirmed that a 104% tariff on Chinese imports would take effect at midnight.

China responded with a firm 34% retaliatory tariff of its own.

The S&P 500 briefly slipped below the 4,915 level—officially on the edge of bear market territory—before closing just above it at 4,983.

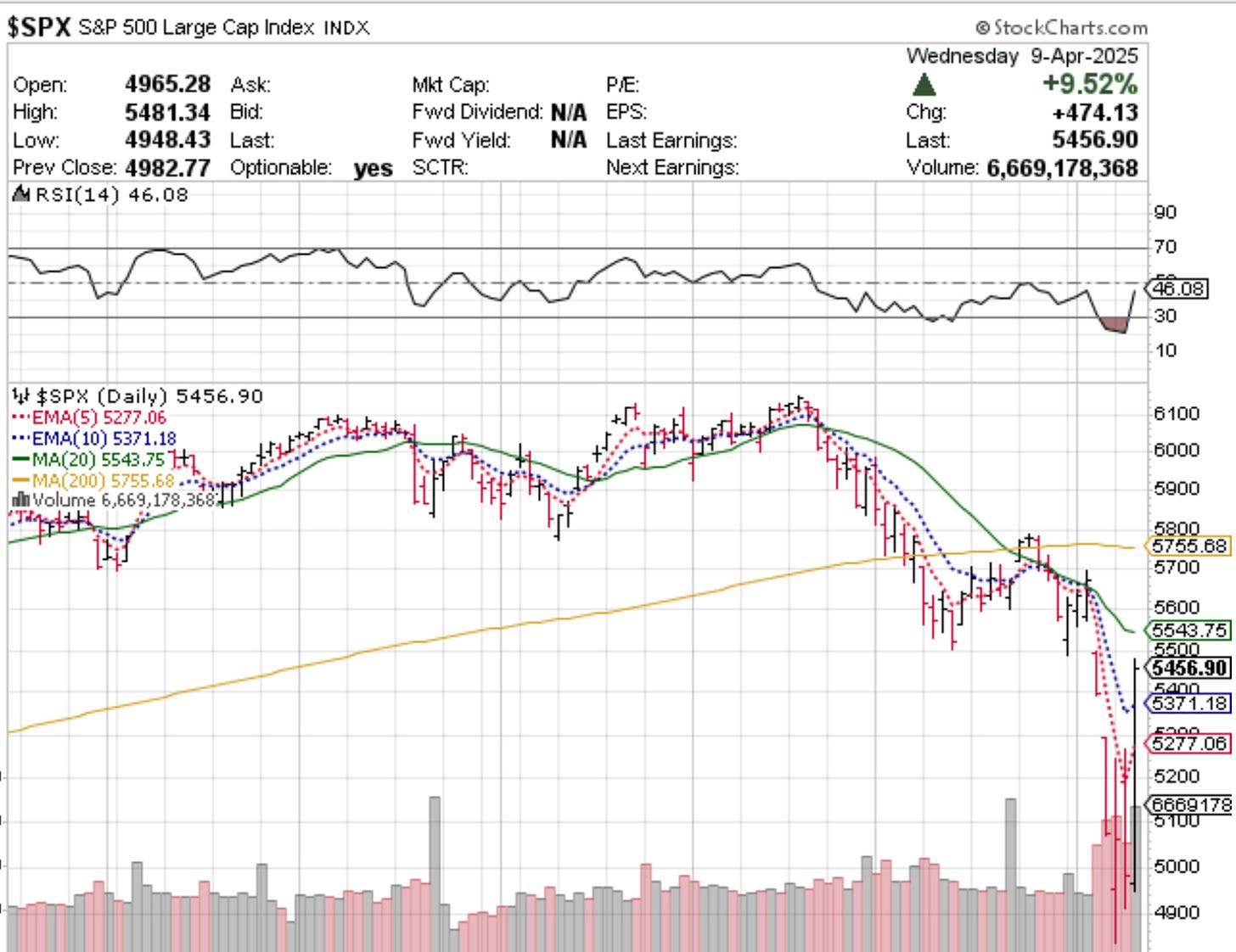

Day 2: The Recovery & Profit 4/9/25

Then came Wednesday.

What began as fear of a full-blown financial crisis turned into one of the greatest single-day rallies ever, after President Trump reversed course and suspended most of his new tariffs for 90 days.

The result?

Nasdaq Composite: +12.2% (second-largest gain on record)

S&P 500: +9.5% (largest one-day jump since 2008)

Dow Jones: +2,963 points (+7.9%)

U.S. stocks reclaimed $5.1 trillion in market value in a single day, nearly wiping out the $7.7 trillion lost over the prior four sessions.

China, notably, was not included in the tariff pause.

The administration doubled down, announcing that tariffs on Chinese imports would rise to 125%, further escalating what is now clearly a two-player trade war.

“At some point, hopefully in the near future, China will realize that the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable.”–President Trump

The policy whiplash caught everyone off guard—including institutional investors.

This morning, S&P 500 futures were pointing to a bear market, but by the close, the index was nearly 10% off its lows.

The Bigger Picture

Volatility like this isn't just noise—it’s the signal.

When stocks drop hard, and then rally harder, it tells us one thing: markets are on edge, and policy is driving price.

We also saw signs of deeper stress under the surface:

The 30-year Treasury yield spiked above 5%

The dollar, bonds, and equities all sold off simultaneously on Monday—signaling that global investors were fleeing U.S. assets, not rotating into safety

Former Treasury Secretary Larry Summers wrote on X that markets were treating the U.S. “like a problematic emerging market”

“Developments in the last 24 hours suggest we may be headed for a serious financial crisis wholly induced by U.S. government tariff policy.” –Larry Summers

Even with today’s rebound, uncertainty remains high.

Policy is shifting daily, and Wall Street is reacting in real-time.

That’s exactly why The Peters Report exists—to help you see through the fog and navigate the waves of the market with The Money Flow Trading System.

G’s Wrap-Up

In The Peters Report & The MFG, we don’t panic—we prepare.

Today’s wild rally is a reminder that markets can turn on a dime, and volatility cuts both ways.

This is exactly why we stay focused on price action, The Wind, and position sizing, not headlines or the news!!

Whether it’s a blown out trading account or a $5 trillion rebound, our strategy remains the same: always stay bullish and follow The Money Flow to stay one step ahead of the market.

Keep watching the market and sector rotations.

Stay nimble and be ready.

And most of all—keep the faith, MFG!!

Always remember, whatever you think about comes about, whatever you focus on grows. - GP 🐼🧙🤘

The Peters Report - Stock & Crypto Trader’s Resource

Always remain bullish and follow The Money Flow.

Join The MFG Trading Community & Text Alerts🐼🚨

Looking for a group of likeminded people to trade with? Text alerts and the MFG Discord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

CLICK HERE to access GP’s Trade Ideas chart pack for FREE on StockCharts!!

Stay Up To Date 👇🌊

Mastering The Trade The Money Flow Way Podcast with Gerald Peters on Spotify

The Science of Getting Rich Podcast with Gerald Peters on Spotify

NEW to trading and investing in stocks? Want a crash course? 12 videos and a 50 page manual- Getting Started with Stock Charts- The Money Flow Way: The Swing & Position Trading and Investment Blueprint. CLICK HERE

LFG!! Complete insanity but it’s been fun. 🤘

the world belongs to those who have courage